After an Incredible 578% Run, Will This Artificial Intelligence (AI) Stock Dazzle in 2025?

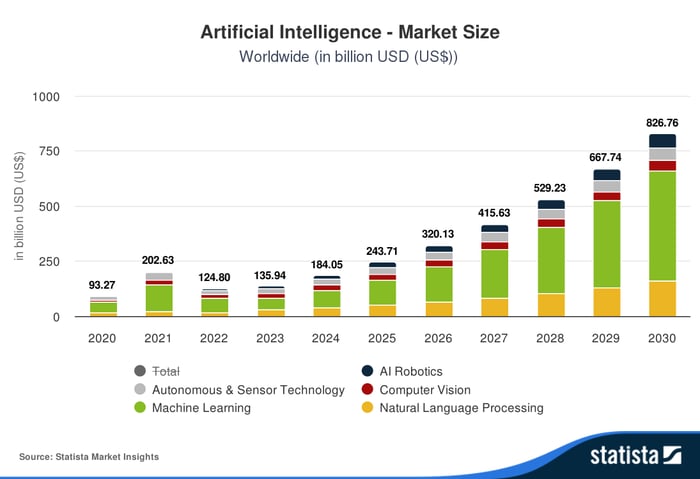

We will soon put 2024 in the history books, and what a year it was for the stock market. So far, the S&P 500 index has reached a new all-time high a whopping 50 times. There are multiple reasons for the rise, like a resilient economy and expectations that the Federal Reserve will keep lowering interest rates. However, perhaps the largest reason is artificial intelligence (AI) enthusiasm. Some believe that the stock market is in a bubble, or at least overextended, and there are definitely stocks that appear overvalued. However, the AI market is massive and expanding quickly, as shown below.

Chart by Statista.

The AI market could more than quadruple 2024 revenues by 2030, so companies (and investors) are scrambling for a piece of it.

AI covers a lot of different applications, one of which is voice recognition technology. This tech communicates with people conversationally and has many applications. One of the leading companies in the field is SoundHound AI (NASDAQ: SOUN), whose stock has rocketed 578% in 2024 as of this writing.

Will this continue in 2025?

SoundHound's market opportunity

The financial implications of conversational speech recognition are gigantic. Order-taking at drive-thru restaurants and automated customer service will save companies vast sums of money on employee costs. Well-known companies like White Castle, Papa John's, Applebee's, and many more are testing or deploying SoundHound's tech. SoundHound just reported that Torchy's Tacos rolled out the tech at their locations.

Automotive is another massive market using SoundHound. The tech accesses a vast database to answer questions like "What's the most scenic route?" "What will the weather be like in Detroit this weekend?" or "Where is a nearby Italian restaurant, and what is the fastest way to get there?" This is a significant advancement from the days of "call so and so" and "play music."

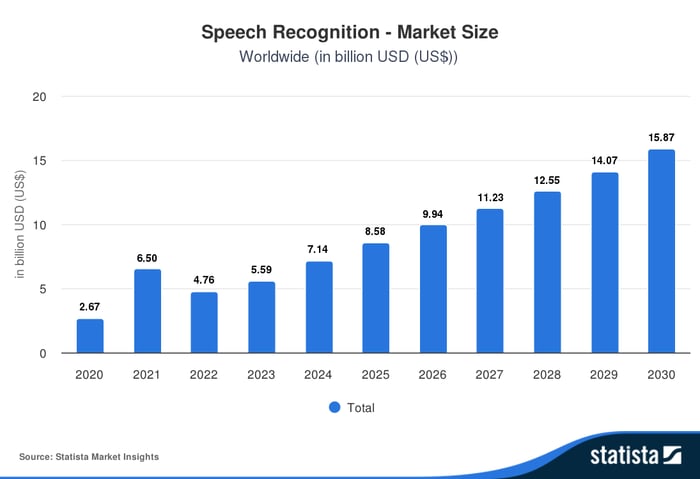

I believe that voice recognition tech like this will soon be the standard at drive-thrus and automobiles. Statista predicts the market will more than double by 2030, as you can see below.

Chart by Statista.

Revenue is growing faster than the market for SoundHound.

Is SoundHound stock a buy now?

SoundHound reported an 89% year-over-year increase in revenue to $25 million in the third quarter. It also expanded its customer base significantly in 2024. The company expects sales of $82 million to $85 million for 2024, potentially doubling sales with $165 million as the guidance midpoint of 2025. The revenue growth is incredible; however, investors should note that the company is not profitable and does not produce positive cash flow from operations. This makes the stock riskier than profitable companies.

SoundHound's valuation is in question after its recent epic run that saw the stock soar 171% over the past 30 days. The company trades for 33 times its potential $165 million in sales for 2025 based on its $5.5 billion market cap at the time of this writing. That is quite high for any company, let alone one that isn't profitable. Analysts put an average price target on SoundHound of $8.07, well below the current price of $14.62. I am enthusiastic about SoundHound's future and was recently high on the stock; however, investors should consider waiting for a pullback after this run.

Should you invest $1,000 in SoundHound AI right now?

Before you buy stock in SoundHound AI, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and SoundHound AI wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $872,947!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of December 2, 2024

Bradley Guichard has the following options: long January 2025 $2 calls on SoundHound AI. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.