Supermicro Shares Soar as It Looks to Avoid Being Delisted. Is Now a Good Time to Buy the Beaten-Down Stock?

It's been a roller-coaster ride for Super Micro Computer's (NASDAQ: SMCI) stock this year, with a lot of big moves in both directions. After a hot start to the year, the company's shares began to slide following a short report from Hindenburg Research that accused the company of accounting manipulation. That was soon followed by the company delaying the filing of its 10-K annual report.

The Wall Street Journal later reported that Supermicro was being investigated by the Department of Justice (DOJ) over potential accounting issues, addIing fuel to the fire, although the report was never confirmed by the company nor the DOJ.

The stock later shot higher after the company announced that it has been shipping more than 100,000 graphic processing units (GPUs) per quarter.

That rally, however, faded on news that its auditor, Ernst and Young, was resigning and that it would need to find a new auditor to file its annual report. This delay put the company at risk of its stock getting delisted from the Nasdaq Stock Market.

Supermicro shares took a further hit after the company announced preliminary numbers for Q4 that came up well short of expectations. However, the stock was back to rally mode after the company announced it has found a new auditor.

For the year, the stock is currently down modestly, about 7% as of this writing, although it has a tendency to make some pretty big moves in a short period of time. Against that backdrop, let's take a closer look at the company's latest news and see if investors should consider buying the stock at current levels.

A new auditor arrives

Supermicro shares soared over 30% after it named BDO its new auditor. Ernst and Young had earlier resigned, issuing a pretty harsh statement, saying it was "unwilling to be associated with the financial statements prepared by management" and that it has concerns about Supermicro's governance, transparency, and internal controls.

The firm had only been Supermicro's auditor since March 2023 after taking over from Deloitte & Touche.

Thus, getting BDO, which is one of the world's five-largest accounting firms, to take over is a big potential win for the company. In a statement, Supermicro said, "This is an important next step to bring our financial statements current, an effort we are pursuing with both diligence and urgency."

In addition to announcing a new auditor, Supermicro also said that it has submitted a compliance plan with the Nasdaq in hopes to get a filing extension and remain listed of the exchange. If the company were delisted, its shares would still trade, but it would now be on the over-the-counter (OTC) market. That could lead to its removal for the S&P 500 index, which is just joined earlier this year.

Image source: Getty Images.

Is now a good time to buy Supermicro stock?

Supermicro is a company that has been greatly benefiting from the artificial intelligence (AI) infrastructure build out, as it helps design and assemble servers and rack systems for customers. It has found a nice niche as being one of the first companies to embrace direct liquid cooling (DLC) solutions to help keep these systems cool, which can run hot and overheat.

That said, it is also in a more commoditized business, with low gross margins. The company has been having margin issues, and its latest revenue numbers were also well short of estimates. That said, its revenue still surged over 18% year over year last quarter, despite coming up short of its prior forecast.

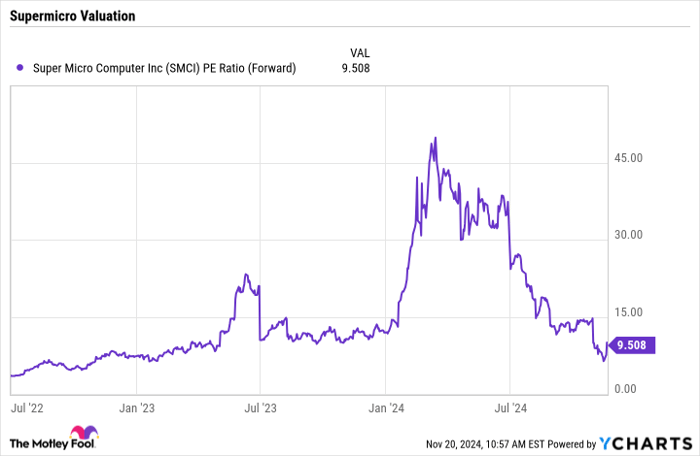

Meanwhile, from a valuation perspective, it trades a forward price-to-earnings (P/E) ratio of about 9.5 times current fiscal year analyst estimates. If those numbers hold up, that is a very inexpensive valuation for a company growing as quickly as Supermicro.

SMCI PE Ratio (Forward) data by YCharts.

The caveat is that Supermicro currently has a lot of scrutiny around its numbers. The SEC has fined the company in the past by the SEC over its accounting, while the combination of the short report, potential DOJ investigation, and resignation of its auditor don't look good.

However, this is a real business that is seeing a lot of demand, so if the company was just "smoothing over" numbers to meet forecasts, the fallout moving forward might not be that bad.

I think investors can consider taking a small position in Supermicro based on its valuation and its role in the AI infrastructure build out, but this would be a speculative position only for risk-tolerant investors.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $368,053!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,533!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $484,170!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 18, 2024

Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.