Zcash Price Forecast: ZEC extends gains as derivatives turn decisively bullish

- Zcash price extends its gains on Wednesday after rallying nearly 30% so far this week.

- Derivatives data paint a bullish picture as ZEC's open interest climbs, bullish bets reach their highest monthly level, and funding rates turn positive.

- The technical outlook suggests the rally may continue, with ZEC targeting a move above $485.

Zcash (ZEC) price extends gains, trading above $440 on Wednesday after rallying nearly 30% so far this week. ZEC’s rising open interest, elevated bullish bets, and a shift to positive funding rates all point to stronger demand. On the technical side, suggest further gains, with bulls targeting levels above $485.

ZEC’s derivatives data shows bullish bias

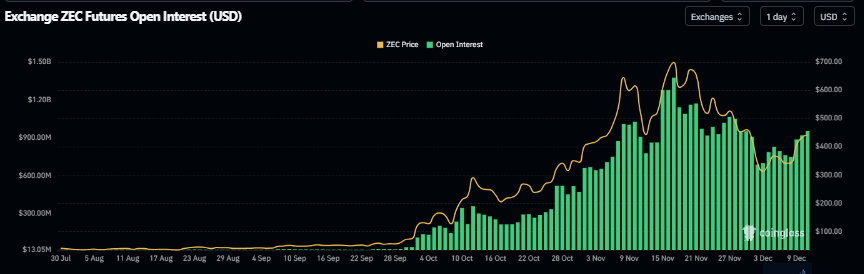

CoinGlass’ data shows that ZEC futures OI at exchanges rose from $701.11 million on December 3 to $954.87 million on Wednesday, the highest level since November 29. Rising OI represents new or additional money entering the market and new buying, which could fuel the current ZEC price rally.

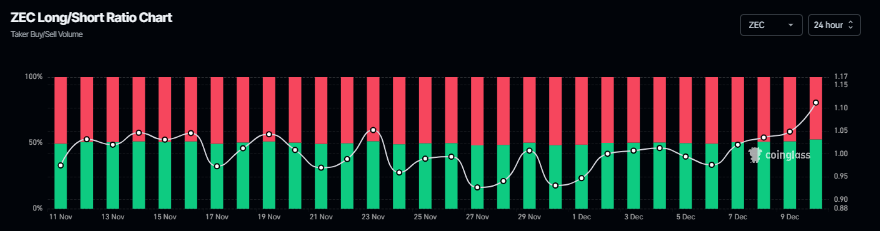

Additionally, Coinglass’s long-to-short ratio for ZEC reads 1.08, the highest level over a month. The ratio above one suggests that more traders are betting on Zcash’s price to rally.

Beyond rising open interest and bullish bets, Coinglass’s OI-Weighted Funding Rate data show that the number of traders betting that ZEC's price will slide further is lower than those anticipating a price increase.

The metric flipped to a positive level on Saturday and stood at 0.0059% on Wednesday, indicating that longs are paying shorts. Historically, as shown in the chart below, when funding rates have flipped from negative to positive, Zcash's price has rallied sharply.

Zcash Price Forecast: ZEC bulls aiming for level above $485

Zcash price broke above the descending trendline (drawn by connecting multiple highs since November 20) on December 5. Still, it failed to sustain the upward momentum and declined the next day, finding support around the trendline. On Monday, at the start of the week, ZEC rose by over 19% and continued to climb through Tuesday. At the time of writing on Wednesday, ZEC continues its gains, trading above $440.

If ZEC continues its upward trend, it could extend the rally toward the next key resistance at $485.18.

The Relative Strength Index (RSI) on the daily chart is moving above the neutral level of 50, indicating fading bearish strength and early signs of bullish momentum. Moreover, the Moving Average Convergence Divergence (MACD) is on the verge of completing a bullish crossover. If confirmed, it would further strengthen the bullish thesis.

On the other hand, if ZEC faces a correction, it could extend the decline toward the daily support at $415.