What Is the Dividend Payout for Oracle Stock?

Oracle (NYSE: ORCL) is one of the best-performing technology stocks in the S&P 500 index for 2024, returning a fantastic 65% this year. Demand for its cloud services, a critical component of artificial intelligence (AI) infrastructure, is driving a strong growth outlook.

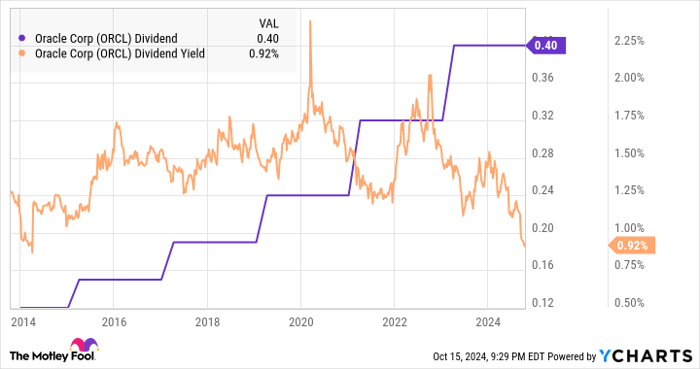

There's a lot to like about this cloud computing giant, including the company's impressive 15-year history of increasing its annual dividend payout. While Oracle's current dividend yield is only a modest 0.9%, the recent earnings momentum provides room for continued dividend growth.

Let's explore how Oracle's dividend has evolved and what investors can expect ahead.

ORCL Dividend data by YCharts

Oracle's dividend rate

Oracle's current quarterly dividend payout is $0.40 per share, with the next distribution set for Oct. 24. If you owned 100 shares of Oracle stock as of the record date on Oct. 10, you will receive a $40 dividend payment. The company last increased the dividend by 25% in the second quarter of 2023 from the prior quarterly rate of $0.32, staying consistent with the annual payout growth record on a trailing-12-month basis.

Oracle has experienced steady growth over the last several years after successfully transitioning away from server hardware and toward services. This has supported its capital-return policy. In the last reported fiscal 2025 first quarter, ended Aug. 31, revenue increased by 7% while earnings per share (EPS) of $1.03 climbed by an even stronger 20% from the prior-year quarter.

Room for future dividend hikes

Management has set a goal for sales to double over the next five years with EPS accelerating over the period, citing AI as a major opportunity. Ultimately, Oracle has the financial flexibility to continue increasing its payout annually alongside the earnings trend. While an announcement has not been made, there's a good chance that Oracle will declare a double-digit dividend rate hike in early 2025.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,121!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,917!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $370,844!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 14, 2024

Dan Victor has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Oracle. The Motley Fool has a disclosure policy.