Should You Buy Broadcom Stock Before March 4? The Answer Might Surprise You

Key Points

Broadcom's artificial intelligence chips for the data center have become a popular alternative to the chips supplied by other companies like Nvidia.

Alphabet, Anthropic, and OpenAI are just a few of Broadcom's known AI customers.

Broadcom is about to release its latest quarterly operating results, but the company's blistering growth might be baked into its stock price already.

- 10 stocks we like better than Broadcom ›

The semiconductor industry is the beating heart of the artificial intelligence (AI) revolution. Without advanced chips, developers wouldn't be able to constantly improve their models, nor would they be able to serve AI software applications to their customers.

Broadcom (NASDAQ: AVGO) has become a top supplier of data center chips and networking equipment for AI workloads, and demand is through the roof. That's why Broadcom stock delivered an eye-popping 49% return last year, outperforming its main rival, Nvidia, which gained 38%.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

On March 4, Broadcom will release its operating results for its fiscal 2026 first quarter (ended Feb. 1), and Wall Street will be looking for continued momentum at the top and bottom lines, fueled by demand from AI customers. Should investors buy the stock ahead of the report? Read on for the surprising answer.

Image source: Getty Images.

Top AI companies are buying Broadcom's hardware hand over fist

Nvidia's graphics processing units (GPUs) are the best data center chips for AI development, generally speaking. But hyperscalers like Alphabet (Google) are turning to Broadcom's AI accelerators as an alternative, because they can be customized to suit specific workloads.

Alphabet enlisted Broadcom's help to design and manufacture its latest Ironwood data center chips, which it used to train its new industry-leading Gemini 3 family of AI models. Anthropic, which developed the Claude chatbot, placed two orders for Ironwood chips last year worth a combined $21 billion. Besides Alphabet and Anthropic, ChatGPT creator OpenAI is another known customer of Broadcom's AI accelerators.

Broadcom's AI strategy doesn't stop at chips alone. The company also offers some of the industry's best data center Ethernet switches, which regulate how quickly information travels between chips and devices. Its latest Tomahawk 6-Davisson switch was designed to specifically handle the large datasets used in AI workloads, featuring an industry-leading capacity of 102.4 terabits per second.

Earlier this month, Broadcom also launched its new Wi-Fi 8 enterprise networking solution for the edge (computers, tablets, and other devices), which is specifically designed to deliver enough throughput for the growing number of AI applications businesses use each day.

Broadcom's AI semiconductor revenue growth is accelerating

Broadcom's most recent guidance and Wall Street's consensus estimate (provided by Yahoo! Finance) both suggest the company brought in around $19.1 billion in total revenue during the fiscal 2026 first quarter. That would be a solid 28% increase from the year-ago period, and most of that growth was likely fueled by AI hardware sales.

According to Broadcom's own forecast, its AI semiconductor revenue likely doubled year over year to $8.2 billion during the first quarter. That would represent an acceleration from the 74% growth it produced in the fourth quarter of 2025, just three months earlier, and the 63% growth it delivered in the third quarter.

Wall Street will also be focusing on Broadcom's bottom line on March 4, because its earnings could have a major influence over the direction of its stock price (which I'll discuss further in a moment). The company generated $23.1 billion in generally accepted accounting principles (GAAP) net income during the whole of 2025, which quadrupled from the previous year.

The first-quarter result probably won't be that strong, but I would expect Broadcom turned its booming AI hardware business into rapidly growing profits yet again.

Should you buy Broadcom stock before March 4?

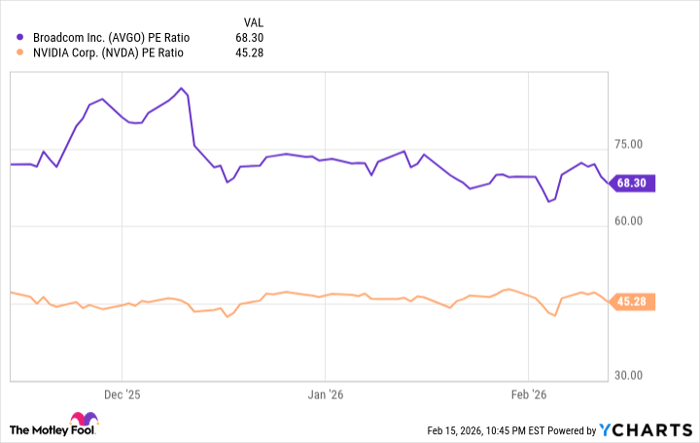

That is the big question, and the answer isn't exactly simple. Yes, this company is growing at a lightning-fast pace, but investors have already baked that into its stock price. Based on Broadcom's earnings of $4.77 per share in fiscal 2025, its stock is trading at a hefty price-to-earnings (P/E) ratio of 68, which is more than twice the P/E ratio of the Nasdaq-100 technology index (32).

Therefore, you could argue that Broadcom is overvalued relative to its big-tech peers. In fact, it's certainly a lot more expensive than Nvidia, which trades at a P/E ratio of 45.

Data by YCharts.

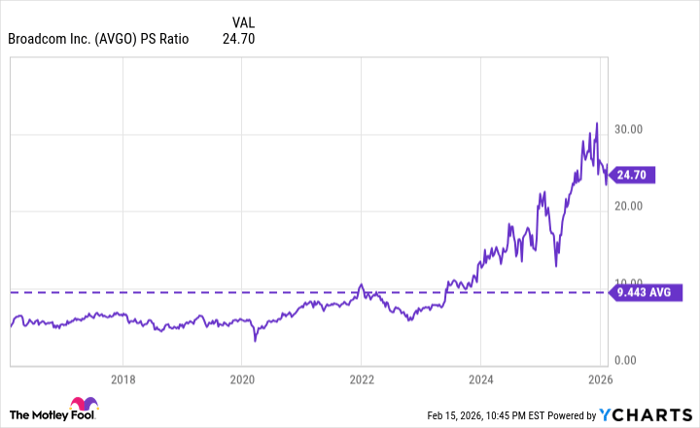

Broadcom is also trading at a whopping 24.7 times its annual revenue, which is nearly triple its 10-year average of 9.4.

Data by YCharts.

Wall Street expects Broadcom to grow its annual revenue by 50% during fiscal 2026, followed by a further 40% in fiscal 2027, so its valuation looks far more reasonable on a forward basis. However, like I just mentioned, that simply means investors have baked a lot of the company's future growth into its stock price already.

Therefore, investors who are looking for quick gains over the next 12 months or less should probably steer clear of Broadcom ahead of its upcoming earnings report. Instead, this opportunity should be reserved for investors who are willing to hold onto the stock for a period of at least three years, but preferably longer, to maximize the chances of earning a positive return.

Should you buy stock in Broadcom right now?

Before you buy stock in Broadcom, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Broadcom wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $415,256!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,133,904!*

Now, it’s worth noting Stock Advisor’s total average return is 889% — a market-crushing outperformance compared to 193% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of February 18, 2026.

Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet and Nvidia. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.