3 Stocks to Double Up on Right Now

Key Points

Microsoft has reached lows not seen in some time.

Alphabet has given back some of its gains.

Amazon is executing at a high level.

- 10 stocks we like better than Microsoft ›

Right now is the perfect time to deploy some cash into some beaten-down stocks. The market has been poorly receiving most fourth-quarter earnings reports, and several stocks that rarely go on sale are cheap as a result.

This opens up a great buying opportunity for many stocks on the market, and three at the top of my list are Microsoft (NASDAQ: MSFT), Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL), and Amazon (NASDAQ: AMZN).

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

If you've got some cash waiting on the sidelines, I can think of few better stocks to buy than this trio.

Image source: Getty Images.

1. Microsoft

Microsoft is a stock that rarely goes on sale. It always carries a premium valuation due to the company's top-notch execution, yet it has lost that premium recently. It's not anything that Microsoft did; it's crushing it. In Q2 FY 2026 (ended Dec. 31, 2025), its revenue rose 17% year over year, with non-GAAP (adjusted) net income rising 23% (GAAP net income was heavily skewed by a gain in value of its OpenAI investment).

Microsoft's most important segment, Azure, its cloud computing platform, also crushed it, delivering 39% growth in Q2. Still, the market didn't like what it saw and sold the stock off anyway.

I don't see anything changing in the long-term investing thesis for Microsoft stock, and taking advantage of its unbelievably cheap 24 times forward earnings stock price is the genius thing to do.

2. Alphabet

Alphabet used to trade for a huge discount, but that was eliminated throughout 2025 as Alphabet solved all the problems overhanging it. Now, Alphabet is recognized as an AI leader and no longer has a discount, although it has fallen a bit from recent highs.

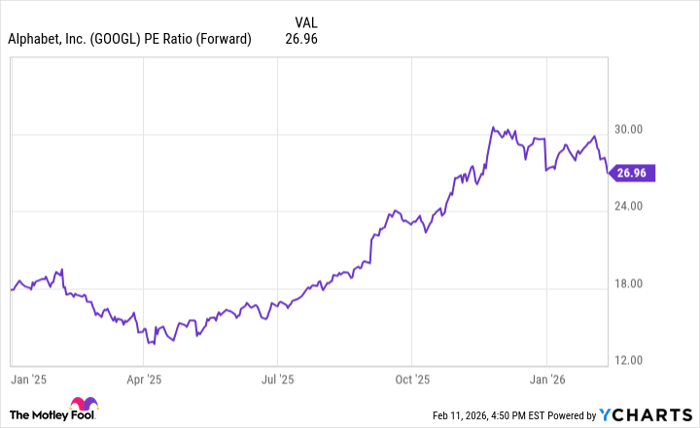

GOOGL PE Ratio (Forward) data by YCharts

Still, at 27 times forward earnings, I think Alphabet is an excellent stock to consider buying. There's still massive upside in the AI realm, and it also has a thriving cloud computing segment like Microsoft.

Alphabet blew all expectations away when it reported 48% year over year growth for Google Cloud, which stacked on top of an impressive 17% performance from its legacy Google Search business. While the market may be concerned about Alphabet's aggressive spending plans for AI computing power, it's clear that there's still demand there for how quickly Alphabet is growing.

Alphabet looks like a great buy at these prices, and now is the time to scoop up shares.

3. Amazon

Rounding out the trio, Amazon is also a great stock to double up on now. It's had a rough start to 2026, falling more than 10%, mostly thanks to its poorly received earnings report. Once again, Amazon's results really weren't anything to be disappointed in. Revenue rose companywide at a 14% pace. Strength came from (you guessed it) its cloud computing division, Amazon Web Services (AWS). Another strong area for Amazon was its advertising wing, which rose 23% year over year.

Amazon is truly doing great, yet thanks to the sell-off, the stock now trades for 26 times forward earnings. Most of this can be traced back to the same reason why Alphabet and Microsoft fell: Spending plans. In 2026, Amazon plans to spend $200 billion on capital expenditures, with most of that money going toward data centers.

Alphabet is in a similar boat, with its 2026 spending figures expected to be between $175 billion and $185 billion. While Microsoft didn't offer any new capex guidance during Q2, it's also spending big, with $37.5 billion in capital expenditures during Q2 FY 2025.

Investors are growing concerned that these companies won't see a return on investment, which is why the market is reacting negatively to their spending plans. However, AI spending is nearly table stakes in the tech world, and these companies can't afford not to build out AI computing capacity. I think they will be alright in the long run, and today is a solid opportunity to add more.

Should you buy stock in Microsoft right now?

Before you buy stock in Microsoft, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Microsoft wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $414,554!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,120,663!*

Now, it’s worth noting Stock Advisor’s total average return is 884% — a market-crushing outperformance compared to 193% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of February 17, 2026.

Keithen Drury has positions in Alphabet, Amazon, and Microsoft. The Motley Fool has positions in and recommends Alphabet, Amazon, and Microsoft. The Motley Fool has a disclosure policy.