Is Sandisk the Next Nvidia?

Key Points

Sandisk is benefiting from surging demand for AI memory and storage solutions.

Despite the stock's meteoric rise over the past year, Sandisk remains attractively valued compared to other AI chip stocks.

The momentum in Sandisk stock could just be getting started as hyperscalers double down on their AI capital expenditures.

- 10 stocks we like better than Sandisk ›

One year ago, Sandisk (NASDAQ: SNDK) was spun off from Western Digital (which had bought it in 2016) and once again became an independent, publicly traded company. Since making its second debut on the Nasdaq, Sandisk stock has skyrocketed by more than 1,500%.

Let's dive into the tailwinds that have fueled Sandisk's parabolic price action and consider whether it's still a good time for smart investors to buy the stock.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Getty Images.

Why is Sandisk outperforming Nvidia in 2026?

Before examining Sandisk's ascent, investors may find it helpful to understand how Nvidia (NASDAQ: NVDA) became the leader of the AI processor realm. While Nvidia is a diversified business, its bread and butter is designing graphics processing units (GPUs) -- the hardware that provides the key computing power required to develop and deploy AI models.

Over the last few years, hyperscalers like Meta Platforms, Alphabet, Microsoft, Amazon, and OpenAI have collectively spent hundreds of billions of dollars procuring GPUs from Nvidia. As companies accelerate the pace at which they invest in AI, the data workloads involved are scaling at an unprecedented rate.

This is leading to capacity constraints -- and as demand for additional cloud infrastructure is on the rise, demand for GPUs and other AI processors is outpacing supply. But as the data center buildout continues, another big bottleneck is forming in the high-bandwidth memory (HBM) market.

Big tech is no longer solely focused on securing as many GPUs as possible. Increasing shares of infrastructure budgets are now flowing toward another pocket of the AI chip value chain: dynamic random access memory (DRAM) and NAND solutions. This is where Sandisk enters the picture.

Next-generation products in agentic AI, autonomous systems, and robotics are far more complex than chatbots. These systems must process massive volumes of data, which means they need rapid access to that data from storage in close proximity to the processors. So as AI workloads expand, servers with more robust memory and storage solutions are becoming mission-critical necessities. For this reason, capital expenditures are swiftly rotating toward solid state drives, DRAM, and NAND flash storage -- precisely what Sandisk offers.

How much higher can Sandisk stock go?

As of this writing (Feb. 11), Sandisk stock is hovering right around $600 per share. Given the price tag, you might think you've missed out on the opportunity to invest in it profitably. However, share price alone doesn't reveal much about a company's underlying valuation.

According to analysts' consensus estimates, Sandisk will report earnings per share (EPS) of $39.45 in 2026 and $76.34 in 2027. Despite this robust outlook, it currently trades at a modest forward price-to-earnings multiple of 15.

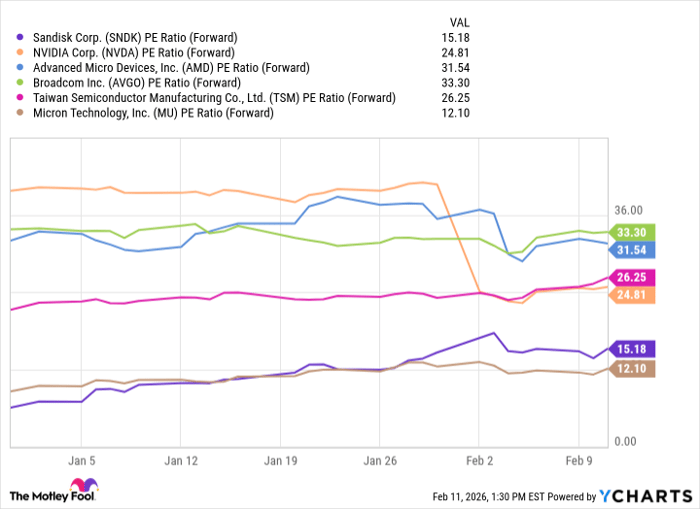

SNDK PE Ratio (Forward) data by YCharts. PE = price-to-earnings.

As the chart above illustrates, other category leaders in the AI chip landscape all boast forward earnings multiples in the mid-20s to low-30s. The next closest comparable valuation to Sandisk is Micron Technology -- another major player in the high-bandwidth memory space.

To me, these trends hint at something interesting: Growth investors have yet to fully price the upside of rising AI infrastructure spending into the shares of the leaders in the memory and storage market. In other words, despite the jaw-dropping gains it has already made, Sandisk stock is still dirt cheap. Should its valuation profile become more aligned with other AI chip leaders, Sandisk could reasonably soar to $1,000 per share or more by the end of the year.

While calling Sandisk the "next Nvidia" may be a tad overzealous, I am optimistic that the company will continue rising in a similar fashion to what Nvidia witnessed during the early days of the AI revolution -- making it a compelling buy-and-hold opportunity right now.

Should you buy stock in Sandisk right now?

Before you buy stock in Sandisk, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Sandisk wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $414,554!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,120,663!*

Now, it’s worth noting Stock Advisor’s total average return is 884% — a market-crushing outperformance compared to 193% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of February 16, 2026.

Adam Spatacco has positions in Alphabet, Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Meta Platforms, Micron Technology, Microsoft, Nvidia, Taiwan Semiconductor Manufacturing, and Western Digital. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.