Hyperunit Whale Dumps $500M In Ethereum As Massive Crypto Bet Turns Sour

Ethereum continues to struggle to reclaim the $2,000 level as persistent selling pressure and elevated volatility weigh on market sentiment. Repeated attempts to push higher have met resistance, reflecting cautious positioning among traders and broader uncertainty across the crypto market. While fluctuations around key psychological levels are common during corrective phases, the current environment suggests ongoing fragility, with liquidity conditions and derivatives positioning playing a growing role in short-term price dynamics.

Adding to the pressure, recent on-chain data from Arkham indicates that a major market participant — commonly referred to as the Hyperunit whale — has reportedly sold roughly half a billion dollars worth of ETH. Large transactions of this magnitude tend to attract significant market attention, as they can influence liquidity conditions, sentiment, and short-term volatility, even when not directly triggering sustained price declines.

Such movements do not automatically signal a broader market reversal, but they often reflect strategic repositioning by large holders amid uncertain conditions. Historically, similar episodes have coincided with transitional phases, where markets reassess direction following periods of strong trends.

Hyperunit Whale Rotation Adds Context To Ethereum Market Pressure

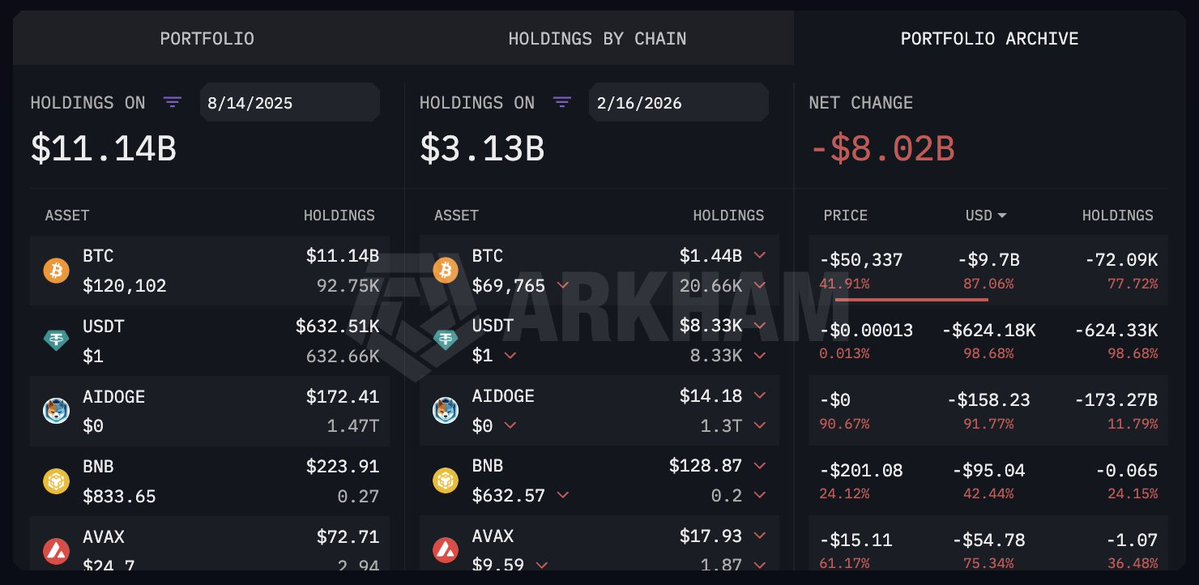

Additional data from Arkham provides further context on the large ETH transaction recently observed on-chain. The entity often referred to as the “Hyperunit whale” is believed to be a major Bitcoin holder, likely of Chinese origin, whose wallets accumulated more than 100,000 BTC during early 2018, when those holdings were valued near $650 million. For several years, the strategy appeared straightforward: accumulate Bitcoin and maintain a long-term holding position, with over 90% of those coins reportedly untouched for roughly seven years.

At the peak of its on-chain exposure, Arkham estimates the whale controlled approximately $11.14 billion worth of BTC. However, in August 2025, around 39,738 BTC — valued near $4.49 billion at the time — were reportedly transferred in a move interpreted as a rotation into Ethereum. Subsequent accumulation brought total ETH holdings to roughly 886,000 coins, valued at over $4 billion during that period.

Since that shift, performance appears to have weakened. Estimates suggest approximately $3.7 billion in losses tied to leveraged ETH exposure and combined BTC/ETH spot holdings, alongside roughly $1.2 billion in unrealized losses on staked ETH. In aggregate, Arkham data indicate a drawdown approaching $5 billion from peak portfolio levels.

Ethereum Price Holds As Downtrend Pressure Persists

Ethereum price action continues to reflect sustained weakness, with the chart showing a clear sequence of lower highs since the late-2025 peak above the $4,000 region. The recent decline toward the $2,000 psychological level highlights persistent selling pressure, while the inability to generate a strong rebound suggests buyers remain cautious despite oversold conditions.

Technically, ETH is trading below its key moving averages, which are now trending downward — a configuration typically associated with bearish momentum rather than a temporary correction. The breakdown below the mid-range consolidation seen late last year accelerated downside volatility, accompanied by a noticeable spike in trading volume. Such volume expansions often signal capitulation or forced deleveraging, rather than routine profit-taking.

The current stabilization around the $1,900–$2,000 zone may represent an early attempt to form a short-term base, but confirmation would require sustained closes above nearby resistance levels, particularly the $2,200–$2,400 range, where prior support has turned into resistance. Until that occurs, upside attempts risk being corrective bounces within a broader downtrend.

From a structural perspective, maintaining the $2,000 area is important for sentiment, while a decisive break lower could open the door to deeper retracement toward historical support zones.

Featured image from ChatGPT, chart from TradingView.com