Should You Buy Occidental Petroleum Stock Before Feb. 18?

Key Points

Occidental Petroleum reports its fourth-quarter financial results on Feb. 18.

The oil company has a knack for delivering better-than-expected financial results.

Oil prices have had a meaningful impact on its stock price over the past few months.

- 10 stocks we like better than Occidental Petroleum ›

Investors interested in Occidental Petroleum (NYSE: OXY) should circle Feb. 18 on their calendar. That's the date the oil and gas giant will report its fourth-quarter and full-year earnings. It could serve as a catalyst for the company's stock price.

Here's a look at what transpired the last time Occidental Petroleum reported earnings and what to expect this time around. That should help you decide whether to buy the oil stock before its next earnings report or wait until after.

Will AI create the world's first trillionaire? Our team just released a report on the one little-known company, called an "Indispensable Monopoly" providing the critical technology Nvidia and Intel both need. Continue »

Image source: Getty Images.

A strong third quarter

Occidental Petroleum reported its third-quarter financial results on Nov. 10. The energy producer had a strong quarter. Its oil and gas output exceeded the high end of its guidance range, reaching nearly 1.5 million barrels of oil equivalent per day. Its midstream and marketing segment also delivered results that exceeded the high end of its guidance range. This strong showing enabled the company to report $0.64 per share of adjusted net income, which beat the analysts' consensus estimate by $0.12 per share.

The company benefited from higher oil and gas prices. It sold its oil for an average of $64.78 per barrel during the period, a 2% increase from the prior quarter. Meanwhile, the average price it sold its natural gas was 11% higher than the previous quarter.

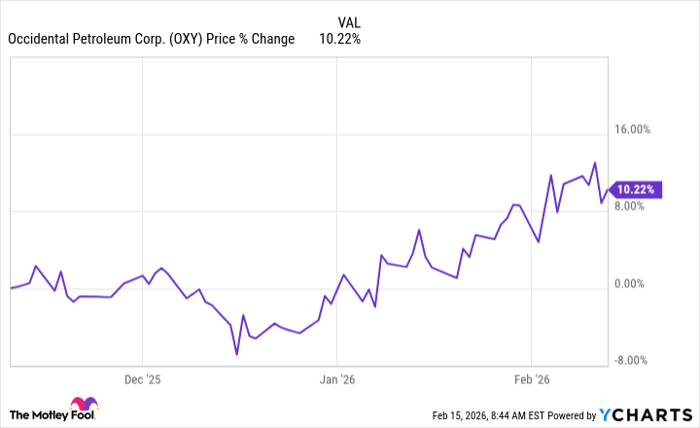

Despite its strong quarterly results, Occidental Petroleum's stock barely budged after it reported earnings:

OXY data by YCharts

As that chart shows, shares dipped in the weeks following its earnings before rocketing more than 10% in January. The company got a boost from oil prices and forward progress on its strategic plan to enhance shareholder value.

What to expect on Feb. 18

Occidental Petroleum likely faced some headwinds in the fourth quarter. Oil prices declined by about 10% during the period, which likely pressured its earnings. That reflects in the analysts' consensus estimate, which is only $0.19 per share for the fourth quarter.

While analysts aren't optimistic about Occidental's fourth-quarter earnings, they tend to underestimate the oil company. It beat the consensus estimate for three straight quarters last year, largely due to its strong operations. Given that history, it wouldn't be surprising to see Occidental beat the analysts' consensus earnings estimate again during the fourth quarter.

However, that doesn't necessarily mean the stock will pop after earnings. Changes in oil prices are a much more meaningful catalyst for Occidental these days. Crude prices have been on the rise this year, fueled by the potential for supply disruptions related to Iran amid growing tensions with the U.S. If the U.S. takes military action against Iran, crude prices could soar, taking Occidental Petroleum's stock up with them.

Buy on oil prices, not on earnings

While Occidental Petroleum will undoubtedly report lower fourth-quarter earnings on Feb. 18 due to weaker oil prices during the quarter, it wouldn't be a surprise to see it beat analysts' expectations again. However, that might not cause the stock price to pop. What could cause shares to surge is military action in Iran. Given that, you might want to buy the energy stock before it reports earnings if you think oil prices might spike soon.

Should you buy stock in Occidental Petroleum right now?

Before you buy stock in Occidental Petroleum, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Occidental Petroleum wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $414,554!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,120,663!*

Now, it’s worth noting Stock Advisor’s total average return is 884% — a market-crushing outperformance compared to 193% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of February 16, 2026.

Matt DiLallo has no position in any of the stocks mentioned. The Motley Fool recommends Occidental Petroleum. The Motley Fool has a disclosure policy.