Is Rubrik Stock a Good Buy?

Key Points

The adoption trends for Rubrik are promising, with deep-pocketed customers signing up at an encouraging rate.

The business should be safe from AI, and management is providing solutions for things that could be changed by AI.

- 10 stocks we like better than Rubrik ›

People have frequently asked me about disruption from artificial intelligence (AI) in recent weeks: Which industries are safe and which are in trouble? I won't pretend to see the future perfectly. But I will say that I believe cybersecurity is mission-critical software, placing these businesses among those safe from AI replacement.

I believe cybersecurity stocks are safe. I believe cybersecurity stocks with a deep understanding of AI are even safer. And that's why I want to highlight Rubrik (NYSE: RBRK) today. The stock trades down more than 45% from its all-time high set in mid-2025. But its business is thriving, making this a compelling investment opportunity.

Will AI create the world's first trillionaire? Our team just released a report on the one little-known company, called an "Indispensable Monopoly" providing the critical technology Nvidia and Intel both need. Continue »

Image source: Getty Images.

Solving an important problem

Rubrik provides enterprises with a way to safely store their data so they can get back up and running if bad actors successfully threaten the business with a cyberattack. This focus allows Rubrik to sidestep a key risk in the space. Other cybersecurity players focus on preventing attacks and suffer reputational damage when their security software fails. By contrast, Rubrik assumes these attacks will happen and provides its service for this reality.

Rubrik's services are gaining traction. The company packages its services as a subscription, and annual recurring revenue (ARR) was up 34% year over year to $1.35 billion in the third quarter of 2025. This was driven by strong 27% growth from customers spending at least $100,000 annually.

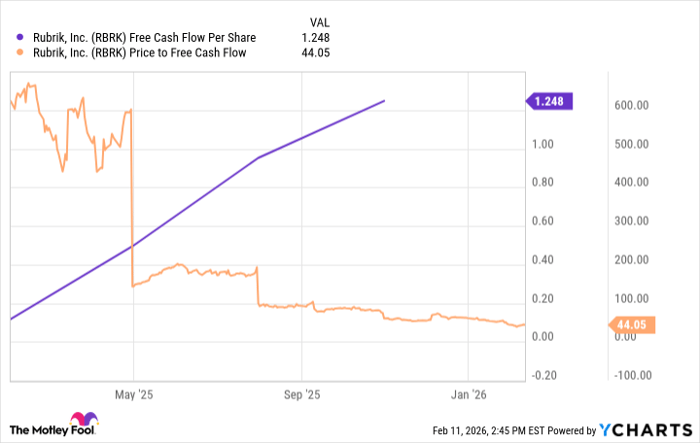

Rubrik's growth is clearly strong, and adoption is promising. But there's something else for investors to like: The company generates positive free cash flow, which is growing fast on a per-share basis. And now the stock trades at 44 times its free cash flow.

Data by YCharts.

Some might consider the valuation expensive. But I can get behind Rubrik's valuation given how fast it's growing. In short, the company is doing important work, growing quickly, and generating profits, which is why I like Rubrik stock.

But what about disruption?

As a final thought, AI agents will be the next big technological trend you'll be hearing about if you're not hearing about it already. AI agents can perform complex tasks for their creators, and this will be increasingly important for enterprises.

AI agents, however, pose a security risk because they access your data and your applications. Rubrik's cybersecurity platform already takes this into consideration. Enterprises have a simple way to approve or deny which data their AI agents access.

Moreover, Rubrik offers a software solution that enables enterprises to reverse potential mistakes made by AI agents. Based on most people's experience with AI so far, this is reassuring.

In other words, cybersecurity seems like an industry safe from AI disruption. But this doesn't mean that AI won't change things, presenting new challenges. This being the case, I'm encouraged by the proactive solutions that Rubrik offers.

As a closing thought, Rubrik guided for about 40% year-over-year revenue for the upcoming fourth quarter. That's strong enough. But on Feb. 4, management said that preliminary Q4 results were even better than guidance.

Therefore, it seems like things are still on track with the business, making Rubrik stock a good buy.

Should you buy stock in Rubrik right now?

Before you buy stock in Rubrik, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Rubrik wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $414,554!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,120,663!*

Now, it’s worth noting Stock Advisor’s total average return is 884% — a market-crushing outperformance compared to 193% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of February 15, 2026.

Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Rubrik. The Motley Fool has a disclosure policy.