Social Security Is Headed for Major Changes Within the Next 7 Years -- What Everyone Needs to Know

Key Points

Social Security is on track to deplete its trust fund before the end of 2032.

Congress can act to preserve benefits for existing retirees while ensuring the long-term health of the program.

Everyone needs to be prepared for major Social Security reform within the next seven years.

- The $23,760 Social Security bonus most retirees completely overlook ›

Congress passed the Social Security Act over 90 years ago, and the program has undergone significant changes since then. But some of the biggest changes in the program's history, which millions of Americans rely on, could be yet to come.

Within the next few years, Congress will have to act to reform Social Security to ensure its longevity. If it doesn't, the trust fund used to pay out benefits will run out of money, and the program will be legally required to cut its monthly payments across the board.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

As of the most recent update, Social Security Chief Actuary Karen P. Glenn expects the program to deplete its trust fund before the end of 2032. That gives Congress less than seven years to make the necessary changes, or the Social Security Administration (SSA) will have to cut benefits.

Here's how we got here and how the program could change over the next few years.

Image source: Getty Images.

Why is Social Security in need of major reform?

Before we dive into potential changes Congress could make to extend Social Security's health, it's important to understand exactly what is causing Social Security's trust fund to deplete.

When Social Security first started collecting taxes from every American worker's paycheck in 1937, it placed those funds into a trust to pay out future benefits. Those funds were invested in safe government bonds to earn a bit of interest while the SSA waited for the program to start paying out monthly benefits in 1940.

Over the years, the program generally brought in more revenue from payroll taxes than it paid out in benefits. That was helped by a growing economy in most years and the baby boomer generation entering the workforce. As a result, the United States had more people earning higher incomes, with relatively few collecting Social Security retirement benefits.

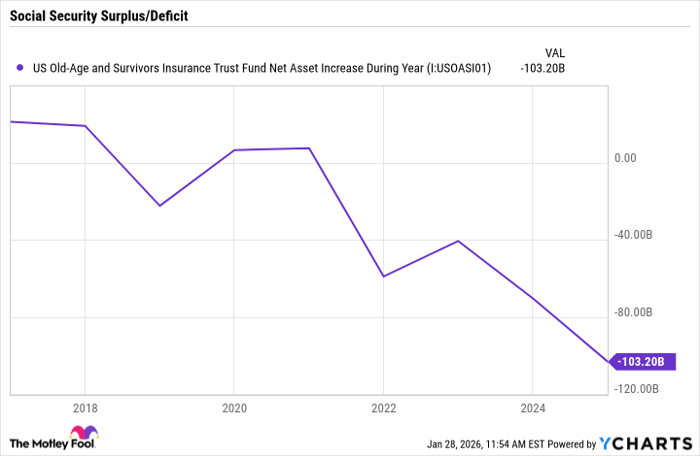

But as the baby boomers started to retire, the demographic trend shifted. The number of retirees per worker is growing, straining Social Security's finances. As a result, the Social Security Old-Age and Survivors Insurance Trust ran a deficit in each of the last four years, and that deficit is growing each year.

US Old-Age and Survivors Insurance Trust Fund Net Asset Increase During Year data by YCharts.

While the trust fund still has about $2.4 trillion left as of the end of 2025, that amount could fall to zero before the end of 2032 due to slower growth in payroll taxes and faster growth in benefits due over the next seven years. Congress needs to act before then to prevent seniors from seeing a sudden drop in their monthly payments.

How Congress could reform Social Security

There are dozens of proposals from individual members of Congress to reform Social Security and ensure benefits are paid as scheduled. The Office of the Chief Actuary reviews each of them and assesses how each individual provision could impact the trust fund over the next 75 years.

Proposals often include multiple provisions. The most effective provisions include changing how the annual COLA is calculated, changing the formula for calculating benefits, increasing the full retirement age, and increasing taxes on wages. And it will likely take a combination of reforms that impact everyone from current retirees to brand-new entrants into the workforce to improve the health of the retirement program.

One way or another, younger workers will have to pay more into the system or expect to receive less in the future. That could take the form of higher payroll taxes and an increase in the wages subject to Social Security taxes. Any wages above $184,500 in 2026 don't incur Social Security taxes. That number increases each year. Some proposals suggest taxing wages above that level or any additional wages above a set threshold, such as $400,000.

Younger workers may also see benefit cuts in the form of an increase in the full retirement age. That could decrease the amount younger people are eligible to collect at age 62 and cap the increase in benefits they could see for waiting until age 70, as those amounts are all pegged to the full retirement age.

Lastly, younger workers could see cuts in the form of changes to the Social Security benefits formula. Doing so could more precisely target high earners while maintaining a similar level of benefits for low earners.

Older Americans could be affected by proposals to change the COLA calculation, reducing the inflation adjustment each year, or to increase the amount of Social Security benefits subject to federal income taxes.

It's worth noting that this isn't the first time Congress has overhauled Social Security. The 1983 Social Security Reform Act used a combination of all of the above types of provisions to save the trust fund from the brink of bankruptcy 43 years ago. But the longer Congress waits, the more severe the changes will have to be.

The $23,760 Social Security bonus most retirees completely overlook

If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.

One easy trick could pay you as much as $23,760 more... each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we're all after. Join Stock Advisor to learn more about these strategies.

View the "Social Security secrets" »

The Motley Fool has a disclosure policy.