Is the YieldMax MSTR Option Income Strategy ETF an Underrated Crypto Play?

Key Points

The YieldMax MSTR Option Income Strategy ETF uses a complex options strategy to generate income.

The ETF's options approach focuses on just one company: Strategy Inc.

Strategy describes itself as "the world's first and largest Bitcoin treasury company."

- 10 stocks we like better than Tidal Trust II - YieldMaxTM Mstr Option Income Strategy ETF ›

If you're a dividend investor, buying cryptocurrencies probably won't be very appealing. However, the YieldMax MSTR Option Income Strategy ETF (NYSEMKT: MSTY) offers you a way to get exposure to Bitcoin while also providing you with dividends. That sounds great, until you hear the dividend yield. But the problem isn't that the yield is too low. Read on before you make your final investment decision.

What does the YieldMax MSTR Option Income Strategy ETF do?

From a big-picture perspective, the YieldMax MSTR Option Income Strategy ETF is an option-income exchange-traded fund (ETF). Its options approach focuses on just one company: Strategy (NASDAQ: MSTR). Strategy makes AI-powered enterprise analytics software, but the real reason investors buy and sell the stock is likely the fact that it also describes itself as "the world's first and largest Bitcoin treasury company." In other words, it's a way to invest in Bitcoin without having to buy Bitcoin.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

That said, the YieldMax MSTR Option Income Strategy ETF doesn't actually own any Strategy stock. It uses a complex options strategy to generate income and provide investors with exposure to the performance of Strategy stock. However, the ETF is clear that the options strategy "will cap its potential gains if MSTR shares increase in value." So the real goal here is to generate income from a cryptocurrency-linked stock.

That sounds great until you see the yield. If you annualize the weekly dividend paid on Jan. 21, 2026, the yield comes out to 75%. That's a shockingly high number, and one that most dividend investors would treat with extreme caution.

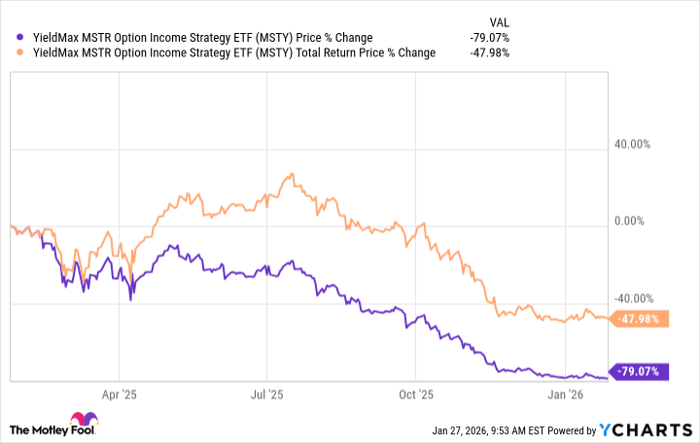

MSTY data by YCharts.

Not a great fit for most investors

That caution would be warranted. The ETF explains: "Previous distributions have included a combination of ordinary dividends, capital gain, and return of investor capital, which may decrease a fund's NAV and trading price over time. As a result, an investor may suffer significant losses to their investment." The ETF's total return over the past year was negative 42%. One year isn't a particularly long time if you are a long-term investor, but that's a truly horrible return.

It gets worse. Total return includes reinvested dividends. If you had spent the dividends, you would have watched the ETF's value decline by nearly 80%. Note, too, that the dividend can change dramatically from payment to payment. If anything, the YieldMax MSTR Option Income Strategy ETF looks like an overrated crypto play, particularly if you're trying to generate a reliable and sustainable income stream.

Should you buy stock in Tidal Trust II - YieldMaxTM Mstr Option Income Strategy ETF right now?

Before you buy stock in Tidal Trust II - YieldMaxTM Mstr Option Income Strategy ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Tidal Trust II - YieldMaxTM Mstr Option Income Strategy ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $450,256!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,171,666!*

Now, it’s worth noting Stock Advisor’s total average return is 942% — a market-crushing outperformance compared to 196% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of February 1, 2026.

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bitcoin. The Motley Fool has a disclosure policy.