Is USA Rare Earth Stock a Once-in-a-Decade Rare-Earth Opportunity?

Key Points

USA Rare Earth is attempting to build a mine-to-magnet domestic supply chain for rare earth minerals.

The company just received a letter of intent from the federal government worth roughly $1.6 billion.

USA Rare Earth is pre-revenue and faces execution risks as it gets its business up and running.

- 10 stocks we like better than USA Rare Earth ›

USA Rare Earth (NASDAQ: USAR) is attempting something few Western companies have ever pulled off: a mine-to-magnet rare-earth supply chain inside the United States.

If that sounds ambitious, it is. The U.S. controls only a tiny sliver of the world's rare-earth reserves. It has relatively few rare-earth mines, and its rare-earth magnet factories can be counted on one hand. Meanwhile, China dominates the rare-earth market. It accounts for the majority of rare-earth processing and magnet production, and many of the world's largest, most concentrated rare-earth deposits are found there.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

That imbalance has, of course, made Washington uncomfortable. It's why the U.S. government recently issued a letter of intent to provide USA Rare Earth with roughly $1.6 billion -- a $1.3 billion loan and $277 million in federal funding.

USA Rare Earth has rallied hard on that development, and is currently up over 80% on the year. But whether this proves to be a once-in-a-decade opportunity will depend on execution -- and investors should be aware of the risks before taking a stake.

Image source: Getty Images.

A rare opportunity, but a narrow path from here

USA Rare Earth is a mining company that controls mining rights to the Round Top deposit in West Texas. Round Top is widely regarded as one of the most significant rare-earth deposits in the U.S., and it also contains other strategic elements like lithium and gallium.

In addition to this site, USA Rare Earth is building a manufacturing facility in Stillwater, Oklahoma, which will produce sintered neodymium magnets at scale. The facility remains under construction, but it could go live as early as the first half of 2026.

The mining site in Texas and the manufacturing facility in Oklahoma will combine to make USA Rare Earth one of the few fully integrated rare-earth companies outside of China. This end-to-end business model will not only ensure that its high-performance magnets are made entirely on U.S. soil but can also help it optimize the entire process. For example, its facilities can be designed to process ore specifically from its Round Top deposit, and it can home in on techniques that can make extraction more efficient.

To be sure, this is something the company is actually doing. At its research and development lab in Colorado, USA Rare Earth has pioneered extraction and separation practices that could end up saving it tens of millions in costs.

Saving money on extraction is crucial, especially in a capital-intensive industry like mining. Certainly, with huge financial backing from the U.S. government, the uncertainty around USA Rare Earth's future financing has now been meaningfully reduced.

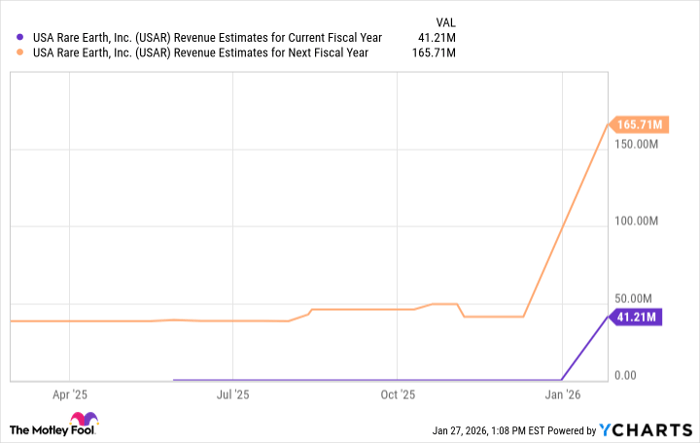

USAR Revenue Estimates for Current Fiscal Year data by YCharts

Still, USA Rare Earth is pre-revenue, and its timeline for meaningful revenue is still murky. Mining comes with execution risks, as does manufacturing, and since USA Rare Earth is trying to do both, investors should expect some hiccups as it builds its business.

That said, the stars seem to be aligning for USA Rare Earth, at least for now. If the market dynamics around rare-earth materials remain relatively unchanged over the next decade -- if, for instance, the U.S. doesn't buy or otherwise procure territory with vast reserves of rare-earth elements -- then buying USA Rare Earth stock while it's priced as an early-stage start-up could pay off over the long haul.

Should you buy stock in USA Rare Earth right now?

Before you buy stock in USA Rare Earth, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and USA Rare Earth wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $450,256!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,171,666!*

Now, it’s worth noting Stock Advisor’s total average return is 942% — a market-crushing outperformance compared to 196% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of January 31, 2026.

Steven Porrello has positions in USA Rare Earth. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.