Is AGNC Investment Stock a Buy Now?

Key Points

AGNC Investment is a mortgage real estate investment trust (mREIT).

The stock has a huge 12% dividend yield.

To get the most out of AGNC Investment, you need to reinvest the dividend.

- 10 stocks we like better than AGNC Investment Corp. ›

When I see a stock with a 10%-plus dividend yield, the first question I ask is, why? Normally, the reason is that the company is dealing with a material business headwind.

However, AGNC Investment's (NASDAQ: AGNC) yield has been above 10% for the vast majority of its public existence. That, however, doesn't make this mortgage real estate investment trust (mREIT) a buy for dividend lovers. But another type of investor would probably find it very appealing. Here's what you need to know.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

What does AGNC Investment do?

As a mortgage REIT, AGNC Investment buys mortgages that have been pooled together into bond-like securities. This is a very different business model from a property-owning REIT, which basically does the same thing you would do if you owned a rental property, just on a much larger scale. AGNC is really managing a portfolio of bonds and, notably, uses leverage to enhance returns.

Image source: Getty Images.

In many ways, AGNC is similar to a mutual fund. The company even reports its tangible net book value per share every quarter, which is kind of like the net asset value per share that a mutual fund reports every day. If you plan to buy an mREIT like AGNC Investment, you need to be willing to dig a little deeper into what you own to ensure you really understand the investment.

That's particularly true for dividend investors. AGNC's huge 12.1% yield is alluring, but it may not meet your expectations.

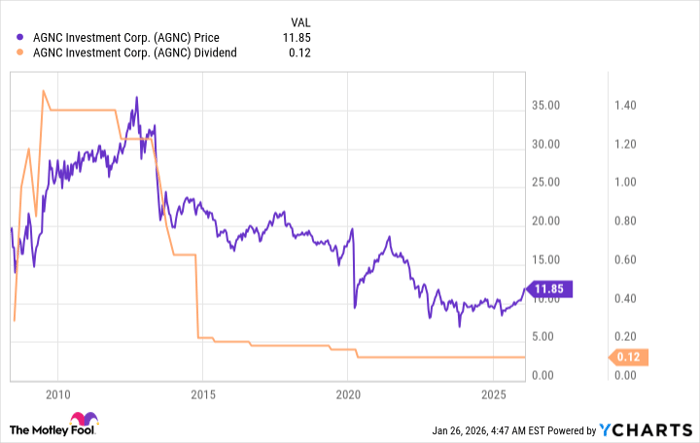

As the chart shows, the dividend backing the yield has been highly volatile, and the dividend has been trending lower for more than a decade. The share price has generally tracked the dividend, keeping the dividend yield high.

Data by YCharts.

Who is AGNC right for?

Less income and less capital are not what most dividend investors are generally looking for. So if you are attempting to live off the income your portfolio generates, you should probably avoid AGNC Investment.

However, that doesn't mean it is a bad investment. It just means that the stock isn't a good fit for income seekers. It could, however, be a good fit for another type of investor.

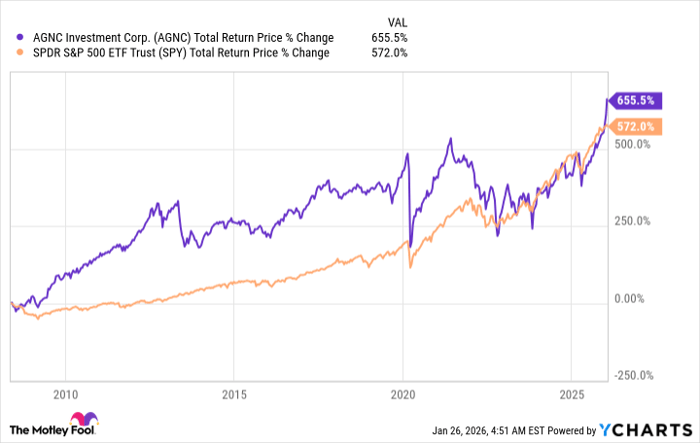

The proof is in the stock's total return. As the chart highlights, AGNC's total return since its inception is actually better than that of an S&P 500 exchange-traded fund (ETF). Note, too, that the performance graph differs significantly from that of the ETF. This means that AGNC could be a powerful diversification tool.

Data by YCharts.

The problem for dividend investors in all of this is that total return requires reinvesting dividends. If you spend your dividends to cover living expenses, you simply don't get the returns shown in the graph. What you do get is less income and less capital over time. This is why most dividend investors will probably be better off avoiding AGNC Investment.

Know what you own when you buy AGNC Investment

However, as the total return graph highlights, AGNC Investment can have a place in the right portfolio. If your goal is total return and you focus a lot of attention on diversification, AGNC Investment could be worth adding to your portfolio. Given that the returns from the stock differ from those of the broader market, including it in a portfolio would likely smooth out the portfolio's return over time.

This is an example of a business that needs more attention before purchase, as your first impression may not give you the full picture of what the company is really offering shareholders. While dividend investors need to be cautious, total return investors might want to buy it right now.

Should you buy stock in AGNC Investment Corp. right now?

Before you buy stock in AGNC Investment Corp., consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and AGNC Investment Corp. wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $456,457!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,174,057!*

Now, it’s worth noting Stock Advisor’s total average return is 950% — a market-crushing outperformance compared to 197% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of January 29, 2026.

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.