Palantir Stock for the Next 5 Years: Buy, Hold, or Avoid?

Key Points

Customers have rushed to Palantir for its AI-driven software, and that’s supercharged growth.

Investors, appreciating this story, have bought Palantir stock hand over fist in recent years.

- 10 stocks we like better than Palantir Technologies ›

Palantir Technologies (NASDAQ: PLTR) has seen its earnings and stock price soar in recent years thanks to one key thing: the company's ability to help customers immediately apply artificial intelligence (AI) to their needs. Both government and commercial customers have flocked to the software maker's Artificial Intelligence Platform (AIP) over the past several quarters.

After such enormous gains, though, investors wonder if this momentum may continue -- especially considering the valuation level of the stock today. Let's take a long-term view and consider whether Palantir stock is a buy, a hold, or a player to avoid for the next five years.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

The AI boom and revenue growth

So, first, a quick look at the Palantir story so far. The company was founded more than 20 years ago, but it only launched an initial public offering back in 2020. And the AI boom has supercharged growth in recent years. Palantir develops systems that help governments, organizations, and companies make better use of their data. The software aggregates data that, in many cases, has been inaccessible and uses the analyses of this data to make decisions, develop strategies, and more. Customers have found Palantir's AIP particularly attractive because, thanks to this system, they can quickly harness the power of AI.

As a result, in recent quarters, Palantir's government and commercial revenue have climbed in the double digits, contract value has reached records, and the company has demonstrated an incredible ability to balance growth with profitability. This is seen through its Rule of 40 score of 114% -- to put this into context, a score of 40% or a little higher is considered good.

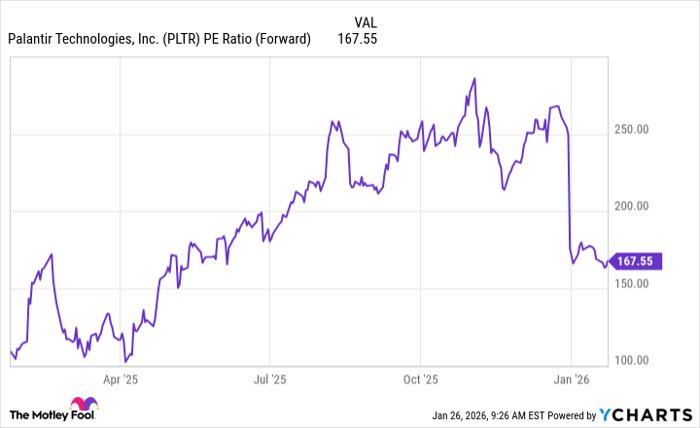

Meanwhile, Palantir's valuation, though lower than it was months ago, still remains at extremely high levels.

PLTR PE Ratio (Forward) data by YCharts

Potential headwinds for Palantir

This, as well as general concerns about the possibility of an AI bubble forming, could weigh on the stock's progress in the near term. And other factors, such as geopolitical instability or economic headwinds, also might put a halt to momentum.

But these possible stumbling blocks don't tarnish the company's long-term potential. Palantir has a long track record of winning government contracts, and the addition of AIP to its offerings should keep governments coming back to this tech giant. As for commercial customers, this business clearly is booming -- Palantir has increased its U.S. commercial customer base from about 14 a few years ago to well into the hundreds today.

So, what move should you make? This depends on your investment strategy and risk tolerance. If you're a cautious investor or focused on value stocks, Palantir probably isn't the right stock for you today. But if you don't mind some near-term risk or volatility, you might consider buying or holding Palantir as the long-term AI story unfolds.

Should you buy stock in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $464,439!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,150,455!*

Now, it’s worth noting Stock Advisor’s total average return is 949% — a market-crushing outperformance compared to 195% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of January 27, 2026.

Adria Cimino has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Palantir Technologies. The Motley Fool has a disclosure policy.