2 Ways Nvidia Will Make History in 2026 (Hint: You're Going to Want to Buy Now)

Key Points

Nvidia should pass Alphabet as the world's most profitable company.

Nvidia will cross the $6 trillion market cap threshold in 2026.

- 10 stocks we like better than Nvidia ›

Nvidia (NASDAQ: NVDA) is a company like no other. It has dramatically risen to become the world's largest company by market cap and is growing at a rate that no other trillion-dollar company has ever achieved.

Furthermore, it won't be done growing anytime soon. Nvidia's stock isn't in a bubble; it's a real company generating real profits, growing at an unbelievable pace.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

I think the company is set to make history in 2026 on two fronts, and I think both are fantastic reasons to buy the stock now.

Image source: Getty Images.

1. Nvidia will become the most profitable company in the world in 2026

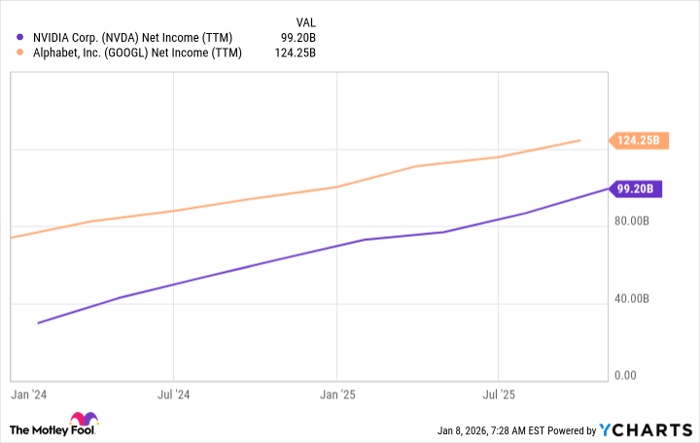

Currently, Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) is the world's most profitable company. Over the past 12 months, Alphabet generated nearly $125 billion in profits, while Nvidia was just shy of $100 billion.

NVDA Net Income (TTM) data by YCharts. TTM = trailing 12 months.

While Alphabet is growing at a solid pace, it's nothing compared to Nvidia. For 2026, Wall Street analysts expect Alphabet's revenue to rise at a 14% rate. For fiscal year 2027 (ending January 2027), these analysts expect Nvidia's revenue growth to be a jaw-dropping 50%. Assuming that no events tank either company's profit margins, and they can maintain the same level they have over the past 12 months (Alphabet's was 32%, and Nvidia's was 53%), Nvidia will pass Alphabet as the world's most profitable company.

For next year, Alphabet would generate about $146 billion in profits, while Nvidia racks up $170 billion. That's a huge milestone for Nvidia to achieve, and if future data center buildout projections are to be believed, Nvidia's profits could rocket higher in the years beyond 2026. Nvidia believes that global data center capital expenditures will reach $3 trillion to $4 trillion by 2030. With its graphics processing units (GPUs) comprising up to half of those costs, there is a huge potential market for Nvidia to grow into over the next few years.

This new profitability level will also cause Nvidia to make history in another way.

2. Nvidia will become the first $6 trillion company

Nvidia was the first $5 trillion company but has since pulled back from that level and sits at about a $4.6 trillion market cap. However, if Nvidia's projected growth pans out, it won't stay there long. Should Nvidia's market cap stay put and it deliver the $170 billion in profits investors expect, that would value Nvidia's stock at 27 times earnings. While 27 times earnings isn't necessarily cheap by itself, it fails to factor in the massive growth investors expect for the artificial intelligence market.

As a result, looking at Nvidia's forward earnings ratio is much smarter. Nvidia tends to trade around 40 times forward earnings. So, if Nvidia achieves $170 billion in revenue and is valued at 40 times forward earnings, that means the company would be worth $6.8 trillion. That's easily in the $6 trillion range and nearly to the $7 trillion level.

No other company is in contention with Nvidia to achieve these levels, so it's safe to say that it will be the first to breach these notable levels if its projections pan out. If Nvidia rises to a $6.8 trillion market cap throughout 2026, you're going to want to buy the stock now.

That would indicate the stock would rise nearly 50% for the year. Few stocks can deliver that growth level, let alone the world's largest company. I think Nvidia is assured to make history in 2026 and deliver some promising results along the way. It's one of the largest holdings in my portfolio, and I think investors would be wise to make it their largest as well.

Should you buy stock in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $482,326!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,133,015!*

Now, it’s worth noting Stock Advisor’s total average return is 968% — a market-crushing outperformance compared to 197% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of January 11, 2026.

Keithen Drury has positions in Alphabet and Nvidia. The Motley Fool has positions in and recommends Alphabet and Nvidia. The Motley Fool has a disclosure policy.