Top Stocks to Double Up on Right Now

Key Points

The S&P 500 is expected to head higher in 2026, and these two names can benefit from the broader market's rally.

These companies see solid growth in revenue and earnings thanks to favorable end-market dynamics.

Moreover, these two stocks trade at attractive valuations, making them no-brainer buys right now.

- 10 stocks we like better than Micron Technology ›

The stock market has been in fine form for more than three years now. The S&P 500 (SNPINDEX: ^GSPC) began its current bull run in October 2022, rising an impressive 93% during this period, and the good news is that the market could jump higher in 2026.

Various estimates from Wall Street analysts suggest that the S&P 500 index's bull run will continue in the new year. Deutsche Bank, for instance, is expecting a 14% jump in the benchmark index by the end of the year to 8,000 points. A majority of the estimates predict a healthy increase in the S&P 500 in 2026, including the likes of Wells Fargo and Morgan Stanley, among others.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

That's why it would be a good time to take a closer look at a couple of fast-growing companies trading at attractive valuations, before they skyrocket in the new year.

Image source: Micron Technology.

This cheap semiconductor stock is a no-brainer buy right now

Micron Technology (NASDAQ: MU) has been one of the hottest stocks on the market in the past year, rising an incredible 220% as of this writing. What's worth noting is that Micron stock trades at extremely attractive valuations even after this phenomenal surge.

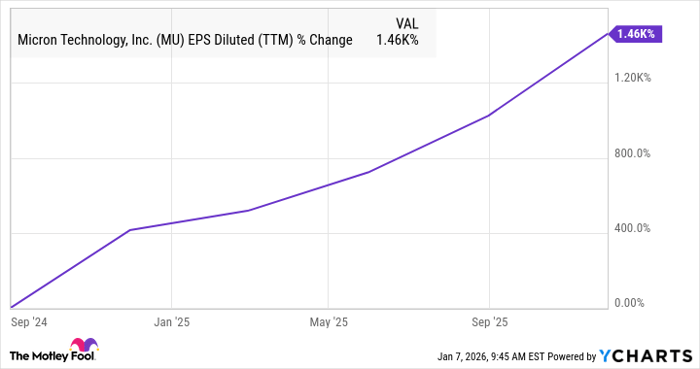

A forward earnings multiple of just 11 and a sales multiple of 9 are reasons why you should be buying this top stock hand over fist right now. That's because Micron's earnings are growing at a breathtaking pace due to the huge demand for data center memory chips. This is evident from the chart.

Data by YCharts.

Micron's bottom-line growth took off in the past couple of years, as demand for the memory chips it manufactures outpaces supply. Artificial intelligence (AI) is the biggest reason behind the favorable market dynamics powering Micron's earnings. The high-bandwidth memory (HBM) used in AI accelerators such as graphics processing units (GPUs) and application-specific integrated circuits (ASICs) is experiencing stunning demand.

Micron management has been completely selling out its quota of HBM chips for the past three years. For instance, it reported a couple of years ago that its 2024 HBM supply was sold out, and something similar happened last year. And now, Micron CEO Sanjay Mehrotra remarked on the company's December 2025 earnings call that "our HBM for 2026 is sold out in terms of volume and our negotiations with customers have been completed for calendar year 2026 for volume as well as pricing."

Mehrotra added that HBM chips enjoy stronger profitability compared to the non-HBM chips that go into other applications, such as smartphones and personal computers. So it won't be surprising to see Micron's bottom line surge higher in 2026, and in the long run, as the global HBM market is estimated to clock a compound annual growth rate (CAGR) of 30% through 2030.

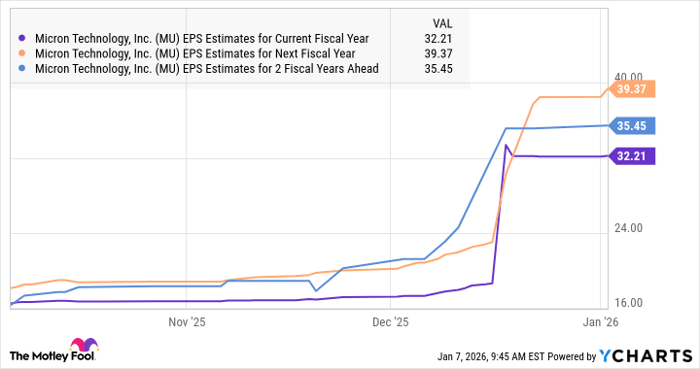

As such, it is easy to see why Micron's earnings estimates for the current and the next couple of fiscal years have witnessed significant upward revisions in the past month.

Data by YCharts.

This solid earnings growth potential puts Micron on track to maintain its red-hot rally in the future, especially considering its cheap valuation. If this growth stock is trading anywhere in line with the tech-focused Nasdaq-100 index's earnings multiple of 32 in the future (using the index as a proxy for tech stocks), its price could skyrocket.

This stock has jumped nearly 900% in less than a year, and it is still an incredible buy

Flash memory specialist Sandisk (NASDAQ: SNDK) was spun off from data storage solutions company Western Digital in February last year. The stock has shot up a remarkable 871% since its listing as an independent company.

Sandisk makes flash memory-based storage products that are deployed in a variety of applications, such as PCs, smartphones, tablets, data centers, automotive, industrial, and the Internet of Things (IoT). The company benefits from soaring storage demand across the consumer (gaming and handheld), data center, and edge (PC and smartphone) markets.

The company reported a 23% year-over-year increase in revenue in the first quarter of fiscal 2026 (which ended on Oct. 3, 2025) to $2.3 billion. There is a strong likelihood of Sandisk's growth getting stronger in the coming quarters as the company is engaged with five hyperscale customers to sell its data center storage products.

It won't be surprising to see these hyperscalers spur demand for Sandisk's products, as the proliferation of generative AI has created an enterprise solid-state drive (SSD) boom. McKinsey predicts that enterprise SSD usage could jump to 1,078 exabytes in 2030 from just 181 exabytes in 2024, driven mainly by AI inferencing and training applications.

This booming demand is also causing a supply shortage, leading to a jump in the prices of flash storage memory. According to market research firm TrendForce, the contract prices of flash memory rose by 20% to 60% in November 2025. That trend could continue based on the exponential growth in demand from the AI data center market.

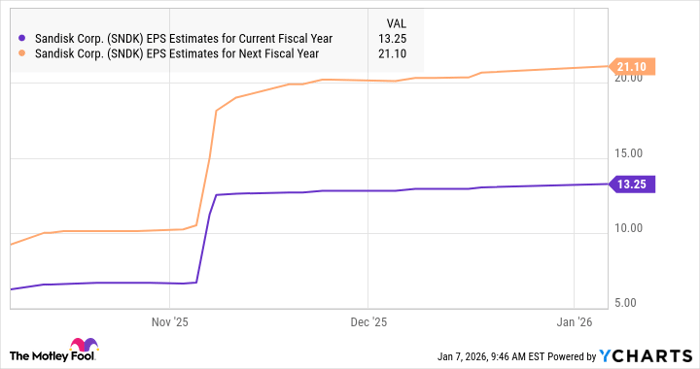

So, it is easy to see why consensus estimates predict a whopping 343% increase in Sandisk's earnings this fiscal year to $13.25 per share, followed by another impressive increase next year.

Data by YCharts.

With shares of Sandisk trading at just 26 times forward earnings right now, investors are getting a great deal on this tech stock when its earnings growth potential is considered. So, it would be a great idea to buy the stock right away, as its healthy earnings growth potential, attractive valuation, and the broader market rally could send its shares soaring in the long run.

Should you buy stock in Micron Technology right now?

Before you buy stock in Micron Technology, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Micron Technology wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $488,222!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,134,333!*

Now, it’s worth noting Stock Advisor’s total average return is 969% — a market-crushing outperformance compared to 196% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of January 9, 2026.

Wells Fargo is an advertising partner of Motley Fool Money. Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.