How Google Used AI to Break a Seven-Year Deadlock and Overtake Apple as the World’s Second Most Valuable Company

TradingKey - Since 2019, Google's parent company Alphabet has consistently had a market capitalization lower than Apple, but this multi-year market cap ranking is now being disrupted.

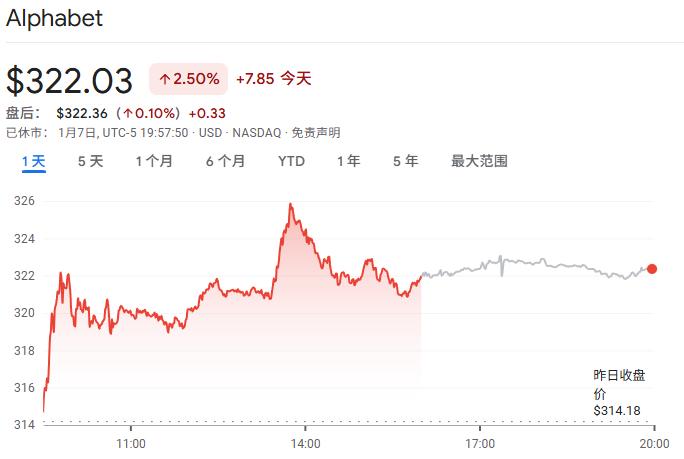

The latest data shows that the company's stock price rose by over 2% this Wednesday, with its market capitalization climbing to approximately $3.89 trillion, surpassing Apple for the first time in seven years.

At Wednesday's close, Google's stock price rose to $322.03, while Apple's stock continued to face pressure, declining slightly, bringing its total market capitalization down to approximately $3.85 trillion. This positioned Google as the second most valuable company in the U.S., trailing only Nvidia, which holds the top spot.

Alphabet Aggressively Pursues AI Ecosystem

Market observers note that Google's market cap surpassing Apple stems from the increasingly apparent divergence in the two companies' artificial intelligence strategies .

Following OpenAI's launch of ChatGPT, which garnered significant industry attention, some voices questioned the sustainability of Google's long-standing reliance on its search advertising model, suggesting that generative AI could disrupt traditional search logic. However, Google effectively countered competitive pressures by accelerating the release of its proprietary large language models, algorithm platforms, and custom chip systems, simultaneously enhancing market performance across multiple product lines.

Last November, the company unveiled its seventh-generation Tensor Processing Unit (TPU), Ironwood, designed to benchmark against mainstream GPU solutions and provide foundational computing power for training large models. This custom AI chip has emerged as a potential alternative to Nvidia's products.

Gemini 3, released in December, is the new generation core model following the PaLM series, and its launch garnered significant attention. Industry feedback indicates that the model demonstrates improved information processing speed, multimodal interaction capabilities, and long-text generation efficiency, possessing a competitive edge across various evaluation metrics.

Concurrently, its autonomous driving company Waymo has established a stable operating structure and is endeavoring to expand its commercial service scope. According to informed disclosures, the project is seeking a new funding round, with the total amount expected to exceed $15 billion, potentially pushing its overall valuation past $110 billion

Nick Jones, an equity research analyst at BNP Paribas, stated in a report on Tuesday evening that Google "could be poised to become the dominant AI platform."

Within the first three quarters of 2025 alone, Google signed more large client contracts exceeding $1 billion than the total combined for the preceding two years. Sundar Pichai, CEO of Alphabet and Google, emphasized that the company is actively addressing growing market demand.

Apple Absent from the Core Battlefield

In comparison, Apple has yet to formulate a unified and comprehensive generative artificial intelligence strategic framework, and is noticeably lagging in this new wave of technological innovation driven by generative AI.

The next-generation Siri AI assistant, originally scheduled for release last year, was postponed due to various reasons, with the company promising a more personalized version in 2026, though its specific functional roadmap remains unclear, raising investor concerns.

Many analysts believe that innovation in hardware products like the iPhone has been overly anticipated. Coupled with extended upgrade cycles, without new highlights or groundbreaking software applications, it will be challenging to continue attracting substantial capital inflows.

The technological transformation brought about by artificial intelligence differs from previous mobile internet waves. Apple previously had time to observe competitors and then catch up. However, the pace of development in the AI sector is much faster, and leaders can leverage data advantages, talent accumulation, and technological foundations to continuously widen their lead. Every quarter of delay exacerbates the risk of falling behind.

Furthermore, AI possesses a significant characteristic: "economies of scale." This means companies with vast user bases and powerful computing resources can more effectively amortize high research and development costs.

This explains why companies like Nvidia, AMD, Microsoft, and Google dare to continuously increase their investments and have garnered investor support.

Apple, on the other hand, has always insisted on releasing new products only when they are fully mature. This cautious rather than swift approach might limit its competitiveness in an era that prioritizes speed and scale of expansion.

Google Leads "Magnificent Seven" in 2025

Google's stock price continued its upward trend throughout 2025, with a cumulative annual gain of 65%, ranking first among the "Magnificent Seven" tech giants. Analysts point out that after facing early market uncertainties, the company achieved a dual recovery in performance and valuation, driven by advancements in its AI business and the launch of multiple products.

In the early part of the year, Google (GOOGL) experienced pressure due to ongoing antitrust lawsuits, transformation challenges in its search advertising business, and expanding AI-related expenditures. Its stock price hit a 52-week closing low of $144.70 on April 8th, sparking external concerns about the stability of its growth trajectory.

However, starting from the second quarter, the company rapidly regained investor confidence. Google appointed a senior management executive to oversee the Gemini product line, centralizing resources to strengthen the integration and deployment of generative AI models in practical applications.

In August of the same year, its team released the image generation feature "Nano Banana," enabling users to create AI-styled images and produce personalized digital avatars. This feature quickly gained traction on social platforms; by the end of September, the Gemini platform had cumulatively generated over 5 billion images and topped the Apple App Store's free chart, surpassing the ChatGPT application in downloads.

In the third quarter, Google completed the acquisition of talent from AI startup Windsurf, with key R&D leaders, including its co-founder and CEO Varun Mohan, joining the team.

In response to competitors continually enhancing their proprietary search experiences—such as OpenAI launching the Perplexity chat feature and Microsoft integrating Bing AI assistant tools—Google simultaneously updated its interface.

For example, "AI Overviews" can directly generate summary content displayed at the top of the search homepage, while "AI Mode" provides longer, more contextually relevant responses to queries. These new features, improving interactive details, significantly enhanced user stickiness, boosted service activity, and supported the stable value of key advertising placements.

Although there are voices within the broader tech sector cautioning that rising industry capital expenditures could prolong return cycles, Google, as a crucial infrastructure provider, maintained positive feedback on actual capital utilization efficiency.

Nancy Tengler, CEO and CIO of Laffer Tengler Investments, noted that rapid growth in capital expenditures is further strengthening AI demand transactions. As Gemini applications continue to expand and AI productivity becomes evident across various business lines, Google is converting its scale advantage into long-term competitiveness.

Wall Street institutions generally maintain positive ratings. As of the publication date, according to TradingKey Stock Rating, most analysts have issued a "Buy" rating for the stock, with an average target price of $317.85, exceeding the current closing price.