This Under-the-Radar AI Stock Looks Primed to Skyrocket in 2026

Key Points

Nebius is providing computing power for its AI hyperscaler clients.

The company is expecting incredible growth in 2026.

- 10 stocks we like better than Nebius Group ›

There are numerous companies involved in the artificial intelligence (AI) buildout. There are obvious winners like Nvidia (NASDAQ: NVDA), but also an array of smaller players that are making their fortunes by building some of the infrastructure that an AI-first world will require. One of my favorites in this category is Nebius (NASDAQ: NBIS).

Nebius rents out space in data centers and owns some of its own to rent computing power out to AI hyperscalers. This business model is similar to cloud computing businesses that have already achieved huge success, although Nebius is focused on providing hardware specifically designed to support artificial intelligence workloads. This is a genius business model, and I think the stock is primed to skyrocket in 2026.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Getty Images.

Nebius expects monster growth in 2026

Netherlands-based Nebius was previously the parent company of Russian tech company Yandex, but it sold off its diversified Russian assets in 2024 in response to the West's sanctioning of Russian companies following the invasion of Ukraine. The new Nebius is operating largely as an AI data center business, and is clearly doing just fine.

Now, Nebius specializes in providing training clusters of graphics processing units (GPUs) for its clients. These GPUs are primarily sourced from Nvidia, so its capacity is in high demand. Originally, Nebius had planned to contract for 1 gigawatt of power for 2026. However, it has adjusted in light of high demand, and recently said it intends to contract for 2.5 gigawatts of power.

All of its anticipated growth should bring serious revenue to its income statement: The company expects its annualized revenue run rate to be $7 billion to $9 billion by the end of 2026. For comparison, as of Q3, its annual run rate was $551 million. That level of growth isn't common in any sector of the market, but it's what companies catering to the generative AI world can generate if they're in the right place at the right time. Even after the stock tripled in 2025, I think it could have another strong year in 2026.

Nebius may look expensive now, but it won't by the end of 2026

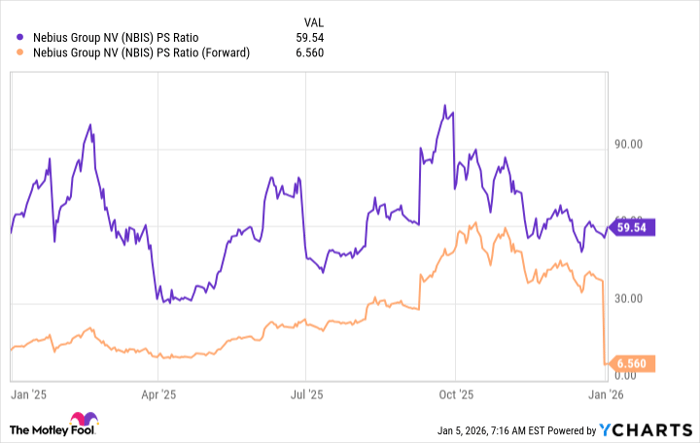

Nebius isn't profitable right now, as management is prioritizing building out its footprint. As a result, the best valuation metric for the stock is the price-to-sales ratio. Trading at 60 times sales, Nebius isn't cheap. However, the company is projected to produce massive growth throughout 2026, so a forward-looking metric would be a better choice, and on a forward P/S basis, Nebius' ratio is just 6.6.

NBIS PS Ratio data by YCharts.

Furthermore, by the end of 2026, Nebius is projecting annualized recurring revenue between $7 billion and $9 billion. If we use the midpoint of that projection, and project that the company could generate a 35% operating margin when fully mature (Amazon Web Services, a similar business, generated a 35% operating margin in Q3), then that would indicate it could generate $2.8 billion in operating profits. If we further reduce that by 30% to account for taxes and other expenses, such as depreciation, that would give Nebius a target profit margin of around 20%, giving it annual profits of nearly $2 billion.

Nebius currently has a market cap of $23 billion. That means, if all of these projections come true, it's trading at around 12 times future earnings. That's a dirt-cheap price, and there could be even more growth beyond 2026.

It's unlikely that Nebius will actually deliver those profits at the end of 2026, because it will still be investing heavily in growth and expansion, but that also increases the longer-term upside for Nebius stock. All of this could add up to a company that could make incredible returns for shareholders, making it a great stock to scoop up for 2026.

Should you buy stock in Nebius Group right now?

Before you buy stock in Nebius Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nebius Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $488,653!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,148,034!*

Now, it’s worth noting Stock Advisor’s total average return is 971% — a market-crushing outperformance compared to 196% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of January 8, 2026.

Keithen Drury has positions in Amazon and Nvidia. The Motley Fool has positions in and recommends Amazon and Nvidia. The Motley Fool has a disclosure policy.