Should You Buy Eli Lilly Before It Reaches $1 Trillion in Market Value?

Key Points

Eli Lilly briefly reached $1 trillion in market cap last year before retreating.

The company has seen revenue soar in recent quarters thanks to its weight loss portfolio.

- 10 stocks we like better than Eli Lilly ›

Eli Lilly (NYSE: LLY) is close to doing something no other pharmaceutical company has ever done: reaching $1 trillion in market value. The company briefly touched that level in November but has since returned to about $960 billion.

Why has the company been such a mover and shaker in recent times? Lilly sells one of the world's most sought-after drugs: those that help patients lose weight. The pharma giant is the maker of tirzepatide, sold as Zepbound for weight loss and as Mounjaro for type 2 diabetes -- doctors have prescribed either for weight loss. And each of these names has been bringing in billions of dollars in annual revenue.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

This means that Lilly offers the safety of a pharmaceutical stock along with the growth more often found in other sectors, such as technology. Investors clearly love this combination as Lilly stock has climbed nearly 200% in three years, and as mentioned, market capitalization is approaching $1 trillion. Should you buy Lilly before it reaches that major milestone?

Image source: Getty Images.

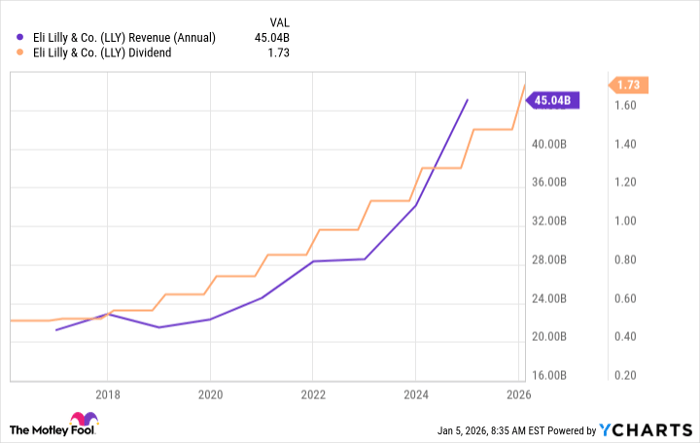

Revenue growth and dividends

First, a quick reminder of the Lilly story so far. This pharma giant sells a variety of drugs across treatment areas, from neurology to dermatology. And this has helped the company offer investors what they like most about those in this industry: revenue growth you can rely on and dividend payments.

LLY Revenue (Annual) data by YCharts

Investors view pharma companies as safe investments because people need their medicines regardless of the economic backdrop -- this ensures a certain level of revenue growth over time. And this stability often allows pharma companies to share the wealth with investors by offering them passive income.

But, after Lilly won approval for Mounjaro in 2022 and for Zepbound in 2023, the company found itself in high-growth territory. Sales of these drugs took off as doctors prescribed them for weight loss, and they've been driving revenue higher ever since. For example, in the recent quarter, these blockbusters together brought in more than $10 billion and helped generate a 54% increase in Lilly's overall revenue.

All of this has driven interest in Lilly's stock -- and has pushed the company's market value higher as investors rushed into the shares.

Investors are interested

Now, let's consider our question: Should you buy Lilly before the company's market value reaches $1 trillion? First, it's important to note that, while it's great to see market value climbing as it shows investors are interested in a particular stock, this alone isn't a reason to invest. Just because a company boasts a $1 trillion value doesn't mean that it will perform better than a company with a $500 billion market value.

Instead, it's more important to consider a company's earnings performance over time and what may drive growth in the years to come. And here, things are looking bright for this pharma player. As mentioned, Lilly's track record over time due to its entire selection of products, as well as its recent growth driven by the weight loss portfolio, is positive. But what truly makes the stock one to consider today is the company's potential in the weight loss market in the years to come. This is a market that analysts expect to reach almost $100 billion by the end of the decade.

Sharing leadership

Today, Lilly shares leadership with Novo Nordisk -- the seller of Ozempic and Wegovy. The Lilly and Novo drugs operate in similar ways, acting on hormones involved in digestion in order to control appetite and blood sugar levels.

But there are signs that Lilly may pull ahead of its rival. Efficacy of Zepbound surpassed that of Wegovy in a head-to-head trial. And though Novo recently became the first to win approval for a weight loss drug in pill form, Lilly could have an edge here too: Lilly's oral candidate, recently submitted to regulators for review, would be the only one that doesn't involve dietary restrictions.

An approval of Lilly's pill, along with its current strength in the weight loss market, could equal revenue growth well into the future. And Lilly has promising candidates in the pipeline, too.

All of this makes Lilly a solid buy -- before or after it reaches $1 trillion in market value.

Should you buy stock in Eli Lilly right now?

Before you buy stock in Eli Lilly, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Eli Lilly wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $493,290!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,153,214!*

Now, it’s worth noting Stock Advisor’s total average return is 973% — a market-crushing outperformance compared to 195% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of January 6, 2026.

Adria Cimino has no position in any of the stocks mentioned. The Motley Fool recommends Novo Nordisk. The Motley Fool has a disclosure policy.