This Aviation Stock Could Turn $1,000 Into $100,000

Key Points

Archer Aviation is designing eVTOLs.

If successful, Archer's aircraft could offer passengers an alternative to traffic and gridlock.

The low altitude economy could be worth $9 trillion, according to analysts at Morgan Stanley.

- 10 stocks we like better than Archer Aviation ›

At the heart of every great innovation is a desire for betterment, like longer lives, faster learning, cleaner energy, or less wasted time. Sometimes, the results disappoint -- they can greatly exacerbate inequalities or worsen health -- but the pitch usually starts the same: make a thorny problem smaller.

Few problems today feel as stubborn, or as universal, as city traffic. That's exactly the problem that start-up Archer Aviation (NYSE: ACHR) is hoping to reduce.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Archer is designing an electric vertical takeoff and landing (eVTOL) aircraft called Midnight.

As the name suggests, the aircraft can take off and land vertically. It doesn't need a runway. While that might sound like a helicopter, the aircraft uses multiple rotors, instead of a single main rotor. That could make it quieter, simpler to maintain, and better equipped for short hops around the city.

Image source: Archer Aviation.

The biggest hurdle for Archer Aviation in 2026 is Federal Aviation Administration (FAA) type certification. Until it has that approval, the company can't carry paying passengers. Archer is making progress through the certification process, but investors still don't have a firm timeline for when the FAA will sign off, if ever.

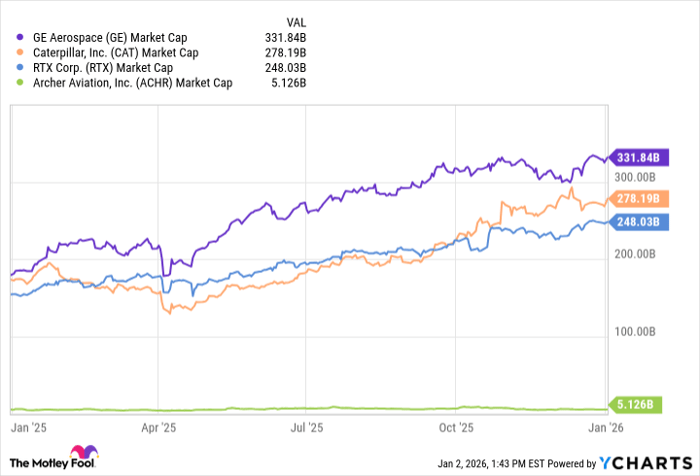

The stock currently trades under $8, and its market cap is about $5 billion. If the stock gained a hundredfold, turning $1,000 into $100,000, its market value would exceed $500 billion. That would make it one of the most valuable industrial companies, as the chart below implies.

GE Market Cap data by YCharts.

It's unlikely Archer will ever reach a half-trillion-dollar valuation, but it's not impossible. In 2021, Morgan Stanley argued that the low altitude economy could reach $9 trillion by 2050. If Archer captured even 6% of that, that's more than $500 billion in potential value.

Still, it's a dream scenario. The reality is that Archer lacks FAA type certification. For now, treat Archer as a speculative stock. Aggressive investors may want to drop $1,000, but avoid putting the retirement plan at risk.

Should you buy stock in Archer Aviation right now?

Before you buy stock in Archer Aviation, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Archer Aviation wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $490,703!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,157,689!*

Now, it’s worth noting Stock Advisor’s total average return is 966% — a market-crushing outperformance compared to 194% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of January 5, 2026.

Steven Porrello has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends GE Aerospace and RTX. The Motley Fool has a disclosure policy.