Nike Welcomes 'Stock Price Reversal Point'? Cook Makes Huge Investment To Increase Holdings, Can It Save The Downturn In The Chinese Market?

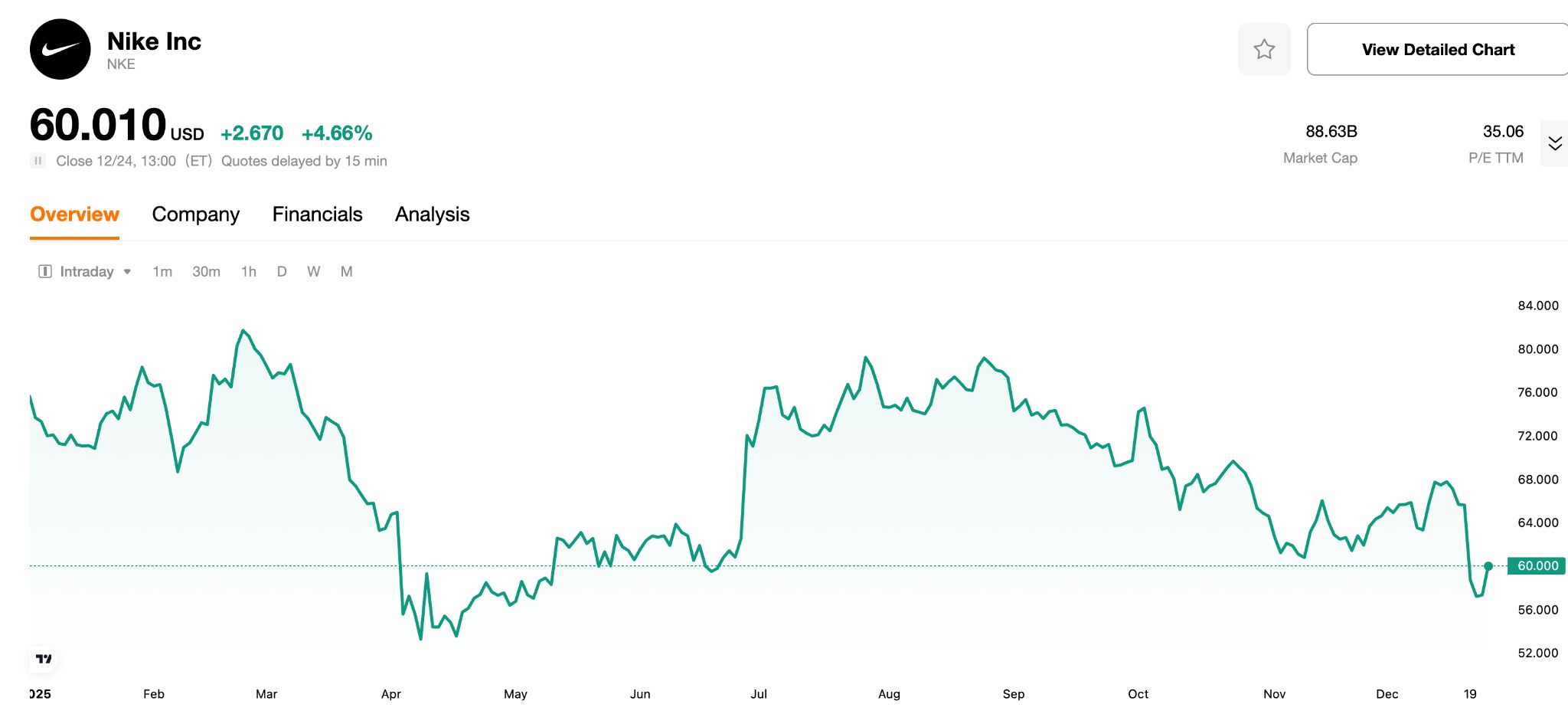

TradingKey - On December 24, local time, driven by Apple CEO and Nike board member Tim Cook's significant purchase of Nike shares news, Nike's share price significantly surged in early U.S. trading, at one point rising over 5% intraday and ultimately closing up approximately 4.64%.

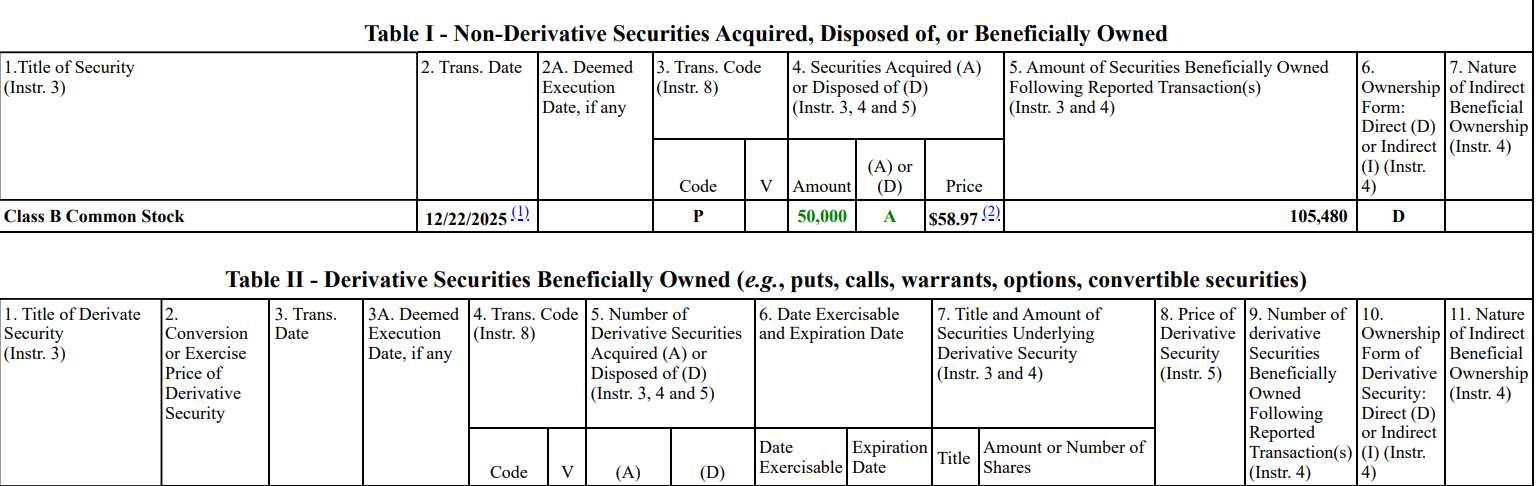

According to the FORM4 filing released on Nike's official website, Cook invested approximately $2.95 million on December 22 to acquire 50,000 Nike shares at $58.97 per share, increasing his total holdings to approximately 105,000 shares. This substantial purchase is perceived by the market as a strong vote of confidence from the executive leadership in the company's future prospects.

However, the reality of Nike's recent performance pressure should not be overlooked. The latest earnings report indicates that the company's second-quarter revenue reached $12.4 billion, a year-over-year increase of only approximately 1%, while net income declined by about 32% year-over-year, and earnings per share decreased from $0.78 in the prior year to $0.53.

Performance in Greater China was particularly weak, with revenue declining by approximately 17% year-over-year. Both digital business and wholesale channels experienced significant downturns, leading to a nearly 49% contraction in earnings before interest and taxes (EBIT). Following the earnings release, Nike's stock price briefly fell by over 10%, accumulating a year-to-date decline of over 22%, significantly underperforming the S&P 500 index.

[ Nike Stock Price Year-to-Date Trend Chart, Source: TradingKey]

The contradiction between weak overall performance and regional divergence reflects the structural challenges Nike faces in its global growth strategy.

While the North American market continues to show strong growth momentum, with revenue increasing by approximately 9% this quarter, Greater China has not only seen sustained revenue declines but also weak consumer digital engagement and online channel performance. This has raised investor concerns about the effectiveness of Nike's strategy in its second-largest global market.

Reuters previously noted that Nike has faced sales decline pressure in the Chinese market for several consecutive quarters, particularly with footwear sales dropping by double-digit percentages. This trend underscores the intensifying competitive landscape with local rivals.

Young Chinese consumers' cultural affinity for brands is shifting from traditional international labels towards more localized brands with stronger cultural resonance, such as Anta and Li-Ning. This has, to some extent, eroded Nike's market appeal and brand popularity.

In response to the current situation, Nike CEO Elliott Hill stated that the company is advancing its 'Win Now' strategy, aiming to restore growth momentum by refocusing on core categories like running, optimizing its product structure, and enhancing omnichannel marketing.

Institutional investors have begun to express divergent sentiments regarding Nike's outlook. Following the earnings release, several investment banks lowered Nike's target price; Citi, for example, cut its target from $70 to $65, while Goldman Sachs and other analytical firms also downgraded ratings or adjusted expectations.

Market analysis suggests that the executive's share purchases can, to some extent, bolster market confidence in Nike's future adjustment strategies and help alleviate investor concerns regarding current multi-faceted pressures.

However, if Nike fails to quickly reverse its decline in the Chinese market and improve the quality of its global growth, the structural divergence between its stock price and fundamentals will remain fundamentally unresolved.