Has Altria Stock Been Good For Investors?

Key Points

Altria has underperformed the S&P 500 in recent years.

The stock remains a dividend powerhouse with a yield above 7%.

Its future is tied to next-gen products like Njoy and On!

- 10 stocks we like better than Altria Group ›

Tobacco stocks like Altria (NYSE: MO) were historically some of the best stocks on the market. Altria, which was joined with Philip Morris International for most of its history, delivered an annual average return of 20% for 50 years with dividends reinvested, thanks to a high-margin, addictive product, and its commitment to growing its dividend.

More recently, however, the stock has struggled as cigarette sales in the U.S. continue to decline, and its attempts to pivot to next-gen products have faced multiple setbacks.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

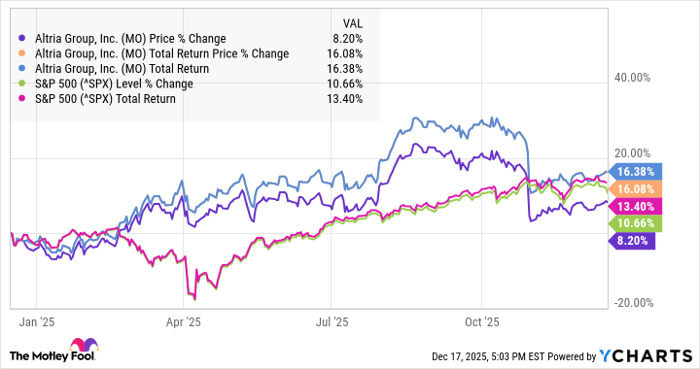

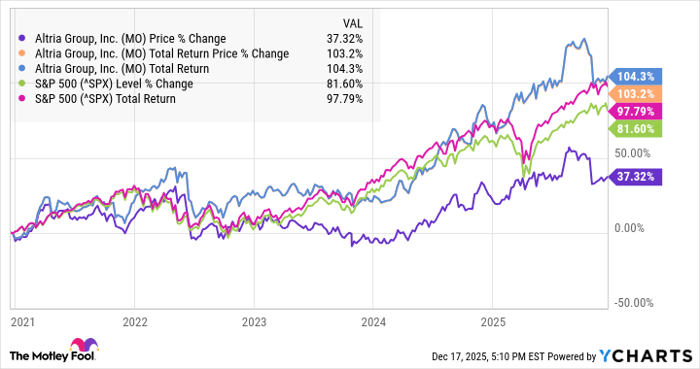

Looking back over one-year, three-year, and five-year time frames, the tobacco stock has not outperformed the S&P 500 on a price appreciation basis. However, over the last year and over a five-year time frame, it has beaten the broad-market index on a total-return basis. The charts below show how Altria compares with the S&P over those periods.

Altria vs S&P 500 1-year chart:

MO data by YCharts

Altria vs S&P 500 3-year chart:

MO data by YCharts

Altria vs. S&P 500 5-year chart:

MO data by YCharts

As you can see over a longer period of time, Altria's stock performance against the S&P 500 has been modest, but it's still delivered a solid performance thanks to its dividend. During that time, the company saw its $12.8 billion investment in Juul essentially blow up as regulators killed Juul's business, and its investment in cannabis grower Cronos Group also went south.

Image source: Getty Images.

Has Altria paid off for investors?

Most investors own Altria for its dividends. The company has historically paid a high dividend yield, and it has a history of raising its dividend every year. In fact, Altria has raised its dividend 60 times in the last 56 years, and it now offers a dividend yield of 7.2%. For dividend investors, it's hard to beat that combination of yield and reliable growth.

Looking ahead, while cigarette sales have continued to decline, the company is hoping to drive profits higher with a combination of price hikes on cigarettes and new products, including Njoy, a vaporizer brand it acquired after Juul failed, and On!, its oral nicotine pouch that's a competitor to Philip Morris's Zyn.

Altria now trades at a low price-to-earnings ratio of 11.3, and its cash flow machine continues to look reliable. If it can get some growth out of products like On! and Njoy, the stock should deliver price gains in addition to a strong dividend for investors.

Should you buy stock in Altria Group right now?

Before you buy stock in Altria Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Altria Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $511,196!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,047,897!*

Now, it’s worth noting Stock Advisor’s total average return is 954% — a market-crushing outperformance compared to 193% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of December 18, 2025.

Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Cronos Group. The Motley Fool recommends Philip Morris International. The Motley Fool has a disclosure policy.