Is Palantir the Next Tesla?

Key Points

Tesla and Palantir both have low institutional ownership figures.

The rise of retail investing provides another force that can influence stocks.

- 10 stocks we like better than Palantir Technologies ›

Few stocks have been called overvalued and a scam as much as Tesla (NASDAQ: TSLA) has. However, the returns keep coming, and long-term shareholders have been rewarded, even if it hasn't been the smoothest of rides.

Part of the reason for Tesla's stock success is the loyalty of retail investors who don't think about cash flows or valuation, instead buying the stocks they feel can succeed. Part of the reason for Tesla's success is its CEO, Elon Musk. Whether you like him or not, it doesn't matter. The reality is, his leadership created a strong following in Tesla's stock, and his vision for the future captured the imagination of shareholders.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

While Tesla has faced several sell-offs and calls for it to be worth far less than it actually is (there's still an analyst who has a $120 price target on Tesla's stock, according to Yahoo! Finance), it has maintained its elevated levels for a long time and has bounced back after each sell-off. With the rise of retail investors, stocks that defy logic have become a trend, and I think it could be a similar story with Palantir (NASDAQ: PLTR).

Palantir's valuation metrics do not make any sense either, and its large individual ownership percentage could be a reason why Palantir is slated to become the next Tesla.

Image source: Getty Images.

Palantir's AI software is making a huge difference

Palantir makes artificial intelligence (AI)-powered data analytics software that was originally intended for government use. Eventually, it found a use case in the commercial markets and saw impressive growth there, too.

In recent years, the biggest reason Palantir has grown so much is its Artificial Intelligence Platform (AIP) product. AIP allows clients to integrate generative AI agents into workflows. These agents can be fully autonomous or require approval for tasks after doing work that humans normally do.

Palantir's growth has been nothing short of incredible, and its third quarter was no exception. Commercial revenue rose 73% year over year to $548 million, and government revenue increased at a 55% pace to $633 million. That led to an overall growth rate of 63% to $1.18 billion for the quarter. It also delivered an impressive profit margin of 40%, showcasing that Palantir isn't trading profitability for growth.

Both Palantir's story and growth make it look like an incredible investment pick, but there's just one problem: valuation.

Palantir's valuation is unbelievable

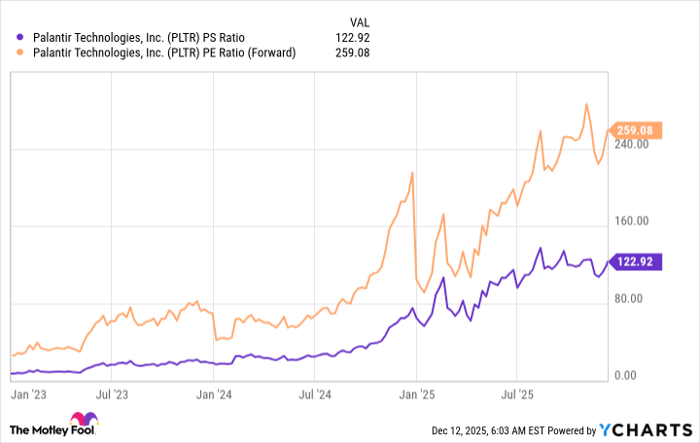

Palantir is among the most expensive stocks in the market, trading for 123 times sales and 259 times forward earnings.

PLTR PS Ratio data by YCharts

It's rare to see a company trade at that much of a premium, especially compared to some of its AI peers. Take Nvidia, for example. In its most recent quarter, revenue grew at a 62% pace (nearly the same as Palantir), and its profit margin was 56% (much higher than Palantir's). Nvidia's expected revenue growth rate for next year is 48%, while Palantir's is 41%. So, Nvidia is the better business by nearly every metric. However, its stock trades for 24 times sales and 39 times forward earnings.

That means that for Palantir to reach Nvidia's valuation level, its finances must increase by over fivefold while its stock price stays flat. That doesn't make any sense and leads many in the market to call it overvalued. That isn't far off from where Tesla has been over the past five years, as many have called its valuation unreasonable, but its stock never faded to the point where anyone would call it reasonably valued.

This can be explained by its low percentage of institutional ownership, which in turn means a high percentage of individual investor ownership. About 48.1% of Tesla shares are owned by institutional investors. Other companies similar to Tesla's size are Meta Platforms and Berkshire Hathaway. These two have institutional ownership of 77.4% and 65.7%, respectively. That's a noticeably higher percentage than Tesla, and shows that individual investors drive Tesla's stock.

Palantir is in a similar boat. Institutional investors own 56.5% of shares, and similarly sized companies like AMD and Mastercard have 65.4% and 90% ownership by institutional investors.

As a result, Palantir's stock may not be able to be valued by usual valuation metrics, which could be a problem for some investors. Additionally, shorting the stock or other actions may not work either. Instead, if you feel like Palantir is overvalued and a bubble waiting to pop, stay away from it. I'm in that boat, as the valuation doesn't make sense, but fighting the trend against individual investors in Tesla stock hasn't worked, and it may not work with Palantir's stock, either.

Should you buy stock in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $509,955!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,089,460!*

Now, it’s worth noting Stock Advisor’s total average return is 968% — a market-crushing outperformance compared to 193% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of December 18, 2025.

Keithen Drury has positions in Mastercard, Meta Platforms, Nvidia, and Tesla. The Motley Fool has positions in and recommends Advanced Micro Devices, Berkshire Hathaway, Mastercard, Meta Platforms, Nvidia, Palantir Technologies, and Tesla. The Motley Fool has a disclosure policy.