The Safest Dividend ETF for a Recession -- Based on 30 Years of Market Data

Key Points

If you're preparing for a recession, it's a good idea to think defensively about your portfolio.

Consumer staple products tend to sell regardless of economic conditions.

The Consumer Staples Select Sector SPDR Fund has routinely outperformed the market during recessions and bear markets.

- 10 stocks we like better than Select Sector SPDR Trust - State Street Consumer Staples Select Sector SPDR ETF ›

One piece of advice that I always carry with me is that it's much better to be overprepared than underprepared. This applies to many aspects of life, including your finances. Some areas of finance are out of your control -- especially when it comes to the broader economy -- but how prepared you are to handle it tends to fall on you.

There may not currently be any glaring signs of a recession on the way, but there is some uncertainty that could make it smart to prepare your portfolio for a potential downturn. This doesn't mean jumping ship on your current investments or strategies; it just means potentially adding pieces that could play defense if conditions turn.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Getty Images.

A sector built for defense

The most important point to note is that recessions and stock market volatility are inevitable parts of the investing journey. Some are more severe and last longer than others, but overall, you can count on them eventually happening.

There is no stock that's completely immune to recessions, but there are sectors that have historically performed strongly during them. One of those is consumer staples. Companies in this sector sell products and services that are in demand regardless of economic conditions.

Think about it like this: When money is tight and people need to prioritize their spending, chances are that they will cook at home instead of eating out, delay upgrading to the newest electronics, decide they don't actually need new clothes, and cut back on streaming subscriptions well before they skip buying things like groceries, toothpaste, deodorant, medicine, and similar items.

When the economy is growing, the consumer staples sector generally doesn't produce returns like those in tech and consumer discretionary. However, when the economy is in a rough spot, it typically doesn't perform as badly because investors are looking for safer places to park their funds.

A good way to invest in the consumer staples sector

The Consumer Staples Select Sector SPDR Fund (NYSEMKT: XLP) is a good way to get exposure to consumer staples stocks in the S&P 500. The exchange-traded fund (ETF) contains 36 companies dealing with distribution and retail (32.97% of the ETF), beverages (19.9%), food products (16.73%), household products (16.72%), tobacco (9.72%), and personal care products (3.97%).

When you invest in this ETF, you know your investment is going to household names like Walmart (11.97%), Costco Wholesale (9.17%), Procter & Gamble (7.82%), Coca-Cola (6.38%), and Kroger (2.57%). These companies all sell products that hold up during recessions and when consumer money is tight.

How the ETF has performed compared to the market during rough patches

This isn't an ETF I'd expect to deliver tech-like returns, but it fits the definition of defensive by most accounts. One example is the Great Recession.

From October 2007 to March 2009, the S&P 500 declined by about 55%. The Consumer Staples fund also experienced a huge decline, but it was much less than the broader stock market, down close to 30%.

^SPX data by YCharts

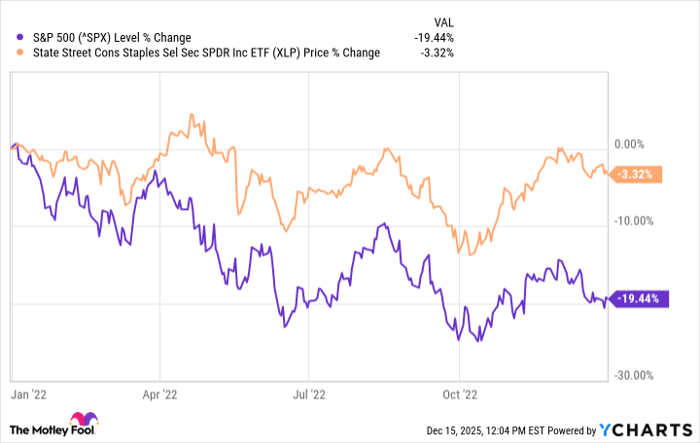

Another example is the most recent bear market. When the S&P 500 hit its bottom during the COVID-19 pandemic in March 2020, it bounced back and surged by nearly 98% up until the beginning of 2022. During that same run-up, the ETF only increased by 43%.

However, when the S&P 500 entered a bear market in 2022 and declined by more than 19% that year, the Consumer Staples fund declined by only about 3%.

^SPX data by YCharts

This shows that it's not always about making money during recessions or bear markets (though that's welcomed). Sometimes, it's about not losing as much money as you could've.

A healthy dividend to help cushion any blows

Although stock price growth is always appreciated, it's nice to be invested in stocks and ETFs that pay attractive dividends. This is a way to ensure you receive value from your investments without solely relying on stock price growth.

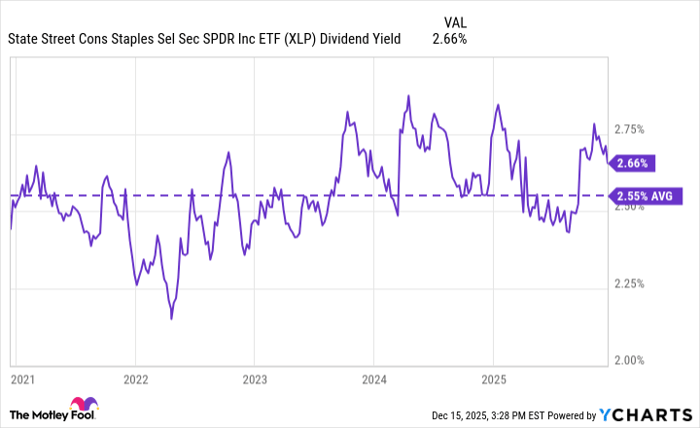

At the time of this writing, the Consumer Staples' dividend yield was about 2.7%, which is slightly above its average during the past five years.

XLP Dividend Yield data by YCharts

It's not life-changing money (unless you just own a ton of shares), but it's enough to help cushion the blow in a downturn. I wouldn't invest much of my portfolio in this fund, but it can be a complementary addition if you want to hedge against a potential recession or market pullback.

Should you buy stock in Select Sector SPDR Trust - State Street Consumer Staples Select Sector SPDR ETF right now?

Before you buy stock in Select Sector SPDR Trust - State Street Consumer Staples Select Sector SPDR ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Select Sector SPDR Trust - State Street Consumer Staples Select Sector SPDR ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $505,695!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,080,694!*

Now, it’s worth noting Stock Advisor’s total average return is 962% — a market-crushing outperformance compared to 193% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of December 17, 2025.

Stefon Walters has positions in Coca-Cola. The Motley Fool has positions in and recommends Costco Wholesale and Walmart. The Motley Fool recommends Kroger. The Motley Fool has a disclosure policy.