Is This ETF the Best Way to Invest in the S&P 500 in 2026?

Key Points

The S&P 500 is at its most expensive level since the dot-com bubble.

Nvidia, Apple, and Microsoft account for nearly 22% of this index.

An equal-weight S&P 500 ETF avoids this heavy concentration in tech.

- 10 stocks we like better than Invesco S&P 500 Equal Weight ETF ›

The S&P 500 (SNPINDEX: ^GSPC) is arguably the stock market's most important index. Tracking around 500 of the largest American companies on the market, it has long been a way that people get a peek into the health of the U.S. economy (though the two are not directly tied).

After slipping into a brief correction amid the Trump administration's tariff plan in April, the S&P 500 has bounced back impressively. Through Dec. 12, the index is up over 17% year to date.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

On one hand, I'm sure investors appreciate the run the S&P 500 is on. On the other hand, it has brought on new risks related to the index's valuation and the composition of its holdings. Given those risks, is now the time to consider an alternate way to invest in the S&P 500? Let's take a look.

Image source: Getty Images.

Just how expensive is the current S&P 500?

The S&P 500's level alone isn't a way to gauge how expensive or inexpensive it is. A common approach is to look at the Shiller price-to-earnings (P/E) ratio, sometimes known as the CAPE ratio. This metric examines the S&P 500's inflation-adjusted earnings per share (EPS) over the past 10 years, aiming to provide insight into the index's valuation without being influenced by one-off events that can be misleading.

At the time of this writing, the Shiller P/E ratio is 40.6, a level it has hit once before. And unfortunately, the last time resulted in the dot-com crash. Of course, past performance doesn't guarantee future performance, but it makes sense that the correlation would prompt some investors' caution.

An entire index led by a handful of companies

Another issue with the current S&P 500 is how top-heavy it has become since larger companies account for more of the index than smaller ones. That has caused large tech stocks to be heavily represented. Based on the Vanguard S&P 500 ETF, here are the index's top 10 holdings:

| Company | Percentage of the ETF |

|---|---|

| Nvidia | 8.46% |

| Apple | 6.87% |

| Microsoft | 6.59% |

| Amazon | 4.06% |

| Broadcom | 2.98% |

| Alphabet (both classes) | 5.05% |

| Meta Platforms | 2.41% |

| Tesla | 2.19% |

| Berkshire Hathaway (class B) | 1.50% |

Source: Vanguard. Percentages as of Oct. 31.

The S&P 500 is supposed to represent the broader U.S. economy -- which it still does to a certain extent -- but having 10 companies account for over 40% of the index isn't ideal from a diversification standpoint. This is especially true when the top three holdings themselves account for nearly 22%.

Consider this alternative way to invest in the S&P 500

One way to get exposure to S&P 500 companies without taking on the risks of the current S&P 500 is by investing in an equal-weight S&P 500 ETF like the Invesco S&P 500 Equal Weight ETF (NYSEMKT: RSP). While the standard S&P 500 gives more weight to larger companies, RSP assigns every company roughly the same weight.

Below is how the standard S&P 500's top holdings are represented in RSP:

| Company | Percentage of the ETF |

|---|---|

| Nvidia | 0.20% |

| Apple | 0.24% |

| Microsoft | 0.19% |

| Amazon | 0.19% |

| Broadcom | 0.21% |

| Alphabet(both classes) | 0.25% |

| Meta Platforms | 0.17% |

| Tesla | 0.25% |

| Berkshire Hathaway (class B) | 0.19% |

Source: Invesco. Percentages as of Dec. 11.

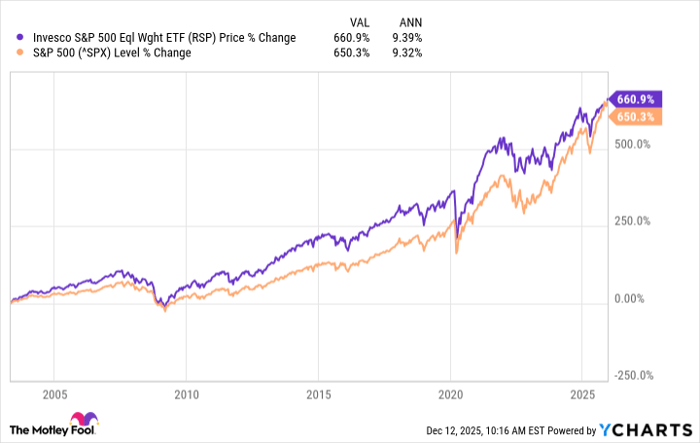

RSP gives you exposure to the same 500-ish companies without your gains relying so heavily on the "Magnificent Seven" stocks. This high concentration of the standard S&P 500 has worked out in its favor over the past decade, outperforming RSP by 242% to 157%. However, when you zoom out, RSP has slightly outperformed the standard S&P 500 since its April 2003 inception.

RSP data by YCharts

I'm still an avid standard S&P 500 investor (the Vanguard S&P 500 ETF is my top holding), but RSP stands out as a way to hedge against some of the risks the current S&P 500 presents while still giving you exposure to some of the world's top companies.

Should you buy stock in Invesco S&P 500 Equal Weight ETF right now?

Before you buy stock in Invesco S&P 500 Equal Weight ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Invesco S&P 500 Equal Weight ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $505,695!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,080,694!*

Now, it’s worth noting Stock Advisor’s total average return is 962% — a market-crushing outperformance compared to 193% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of December 16, 2025.

Stefon Walters has positions in Apple and Microsoft. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Berkshire Hathaway, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.