Is Archer Aviation a Once-in-a-Decade Buying Opportunity in 2026? The Answer May Surprise You.

Key Points

Archer Aviation is close to debuting its electric air taxi for short-haul flights.

It's spending billions of dollars building out manufacturing and airport infrastructure.

The stock looks overvalued and risky to buy now given that it generates zero revenue today.

- 10 stocks we like better than Archer Aviation ›

Efficiencies in battery technology are enabling massive transportation innovations, and not just with electric vehicles. Start-ups such as Archer Aviation (NYSE: ACHR) have developed electric air taxis, otherwise known as electric vertical takeoff and landing vehicles (eVTOLs).

With taxis under testing and the promise to bring a new form of urban transportation to market, Archer's stock has soared, up close to 300% in the last three years alone. Today, the stock has fallen 38% from all-time highs, likely due to simple market volatility for high-growth stocks.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Does this stock price pullback make Archer Aviation a once-in-a-decade buying opportunity in 2026? The answer may surprise you.

Building the future of flight

Everyone can agree that electric air taxis like Archer Aviation's Midnight are an innovative new mode of transportation. The Midnight can fit four passengers and is targeting 50-mile or less rides that usually take a driver an hour or more in traffic. Electric air taxis can transport customers over cities to these point-to-point helipads in less than 10 minutes.

With 4.7 billion hours spent in traffic in the United States every year, there is a huge market opportunity for electric air taxis, especially for wealthier individuals willing to pay up for tickets. Even if just a small percentage of cars get pulled off the roads, it could help alleviate traffic pains for all travelers.

The problem is, Archer Aviation's Midnight vehicle has not been fully authorized by the Federal Aviation Authority (FAA) yet to operate commercial flights in the United States. Until this happens, all the company can do is build aircraft, test its vehicles, and set up its point-to-point airports for its air taxi network.

Image source: Getty Images.

Heavy upfront costs, large cash burn

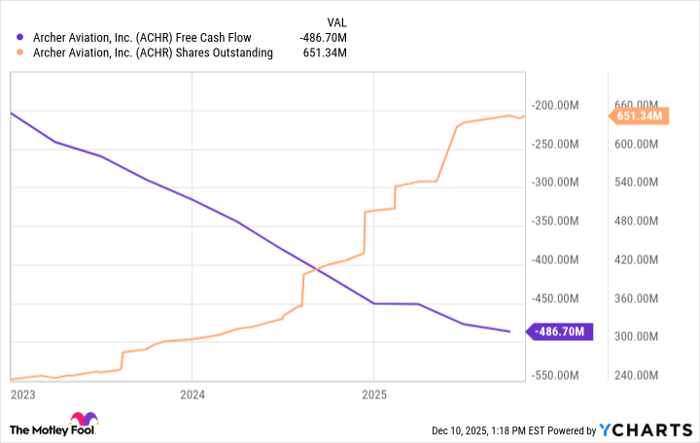

Simultaneously building out aviation infrastructure, air taxis, and going through the FAA approval process is expensive, requiring Archer Aviation to spend a lot of money up front in order to execute its business plan. The company has raised billions of dollars through common stock offerings, which have been highly dilutive to shareholders. It currently has over $1 billion in cash on the balance sheet.

Hopefully, commercial viability is near, although FAA timelines are always uncertain. Archer just bought a stake in the Hawthorne airport in Los Angeles as a hub for its taxi network, working with airline partners, the Los Angeles Rams, and other key commercial partners in the city. Plans call for networks in New York City as well as internationally in the Middle East, Japan, and South Korea.

There is a lot of potential for these taxi networks to generate revenue, which will be required to make up for all this upfront spending. Right now, Archer Aviation is losing $487 million annually in free cash flow. It is going to have to generate at least that much, or more, in order to get to profitability.

ACHR Free Cash Flow data by YCharts

Is Archer Aviation stock a buy?

With a rising share price and dilutive stock offerings, Archer Aviation now has a market cap of $5.5 billion. The company has zero revenue today, making it tough to value, although I think it is prudent for investors to always be skeptical of investing in a company that has never generated a sale, let alone proven it can generate a profit for you.

But even if Archer scales up its taxi network and starts generating $1 billion in revenue each year, its expenses are still going to be significant. It has to pay for maintenance on these air taxis, pay the pilots, and pay the electricity costs. There are also going to be maintenance costs for running the airport hubs. What this means is that at $1 billion in revenue, Archer Aviation may only make a slim profit versus its $5.5 billion market value.

Today, it generates none. For this reason, investors should avoid Archer Aviation stock in 2026. It does not look like a can't-miss stock opportunity right now.

Should you invest $1,000 in Archer Aviation right now?

Before you buy stock in Archer Aviation, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Archer Aviation wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $513,353!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,072,908!*

Now, it’s worth noting Stock Advisor’s total average return is 965% — a market-crushing outperformance compared to 195% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 8, 2025

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.