Think You Know Beyond Meat? Here's 1 Little-Known Fact You Can't Overlook.

Key Points

Beyond Meat makes plant-based meat alternatives.

When the company first introduced its "hamburger," everybody wanted to try it.

That excitement around Beyond Meat's products has been waning for years.

- 10 stocks we like better than Beyond Meat ›

Beyond Meat (NASDAQ: BYND) held its initial public offering (IPO) in 2019 to much fanfare. At the time, the company's plant-based meat alternatives were a hot commodity, captivating consumers and drawing strong demand from restaurants that wanted in on the alternative meat trend. Things are very different today, and investors buying this struggling consumer staples maker need to understand one very important, and troubling, fact.

What does Beyond Meat do?

Beyond Meat is a food company. It makes burgers, sausages, nuggets, and "meat" balls, among other things. All of these products, however, are meat-free and are produced with only plant matter. The company claims that its products are both good for you and for the environment. Unfortunately, for consumers, the bigger question around food products is usually how good they taste.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

When Beyond Meat's burgers were introduced, they were greeted with excitement because they were a novelty. For the full year 2019, the company's first as a public company, sales in the consumer segment increased by a massive 185% over 2018. The sales growth in the food service segment was even larger, increasing 312%. Not surprisingly, the IPO was well received by investors.

Fads don't end overnight, but problems were already starting to show up in Beyond Meat's business by 2020. While retail sales continued to grow rapidly, foodservice sales fell both domestically and internationally. In 2021, retail sales were weak in the U.S. while foodservice and foreign retail sales were strong.

Things became even more troubling in 2022. Sales were mixed, with some categories up slightly and others down slightly. The big picture was that sales across the entire business rose just 0.4%. That came after double and even triple-digit sales growth in prior years. In hindsight, it appears that 2022 was the year that the Beyond Meat fad died.

Beyond Meat's business has only gotten worse

In 2023, the company's business plummeted, with sales declining by 18%. It was still pushing more volume into the foreign markets, but that wasn't nearly enough to offset the declines in its more important domestic market. In 2024, the income statement shows that sales were down across every division, with lower volumes, as well.

That highly troubling trend has continued through the first nine months of 2025. This is terrible for a consumer staples company. And yet the company has regained the attention of investors, with the shares briefing entering the ranks of meme stocks.

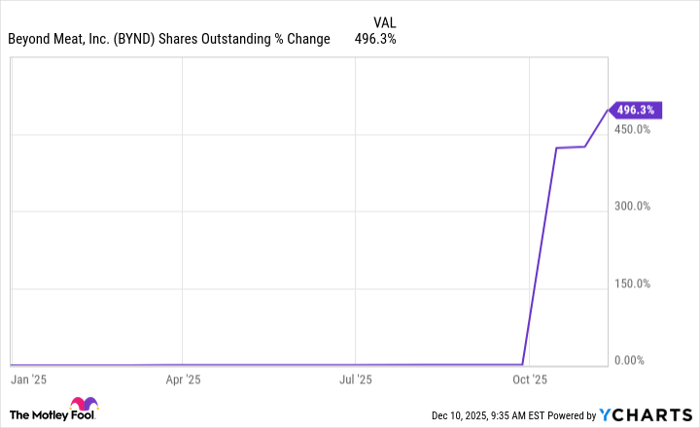

The impetus for Beyond Meat's rapid, though short-lived, stock advance boiled down to a glass-half-full view of a business overhaul the company was undertaking. Only that overhaul included troubling debt swaps and asset write-downs, which quickly chilled the excitement of many investors as all of the news slowly trickled out. The stock has resumed its downward course toward penny stock land.

Data by YCharts.

Beyond Meat is not worth the risk

Here's the ugly little secret that investors need to know before they hit the buy button. The company's business is so weak that it was forced to do a debt deal with its bondholders to "reset" its balance sheet. Bankruptcy could have been in the cards if it hadn't gone down this troubling route. The true depth of the problem was highlighted by that deal's inclusion of the issuance of stock to bondholders, massively diluting current shareholders.

Without improved demand for Beyond Meat's products, even this "reset" is unlikely to be enough to support the company's ability to remain a standalone business. In fact, the massive dilution of stockholders via the stock-for-debt swap was, effectively, a transfer of control of the company from its equity holders to bondholders without the messy process of bankruptcy. This is not a company operating from a position of strength, and most investors should probably avoid it.

Should you invest $1,000 in Beyond Meat right now?

Before you buy stock in Beyond Meat, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Beyond Meat wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $513,353!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,072,908!*

Now, it’s worth noting Stock Advisor’s total average return is 965% — a market-crushing outperformance compared to 195% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 8, 2025

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Beyond Meat. The Motley Fool has a disclosure policy.