3 Bold Stock Market Predictions for 2026

Key Points

Defense companies continue to face pressure on margins.

This AI investment theme will evolve in 2026.

It's time for interest rate-sensitive stocks to outperform.

- 10 stocks we like better than Lockheed Martin ›

It's time to reflect on 2025 and prepare for the new year, potentially bringing new ideas for your portfolio. With that in mind, here's a look at three investment themes that you might want to prepare for in the new year.

1. Defense stocks will continue to underperform

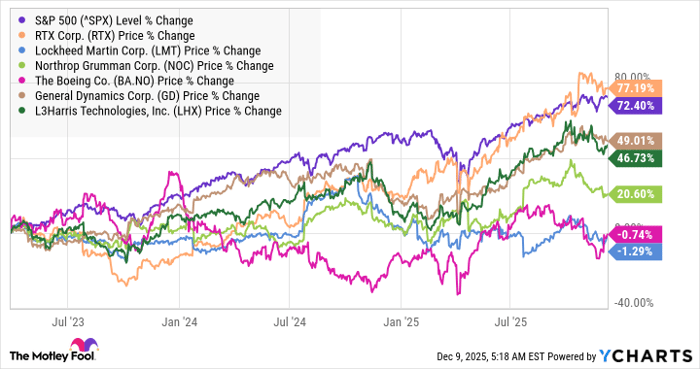

A quick look at the chart below shows that the major defense companies, including Lockheed Martin (NYSE: LMT), have underperformed the market in recent years. RTX has slightly outperformed, but that's arguably due to its large commercial aerospace businesses enjoying a recovery in flight departures.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

The general underperformance might surprise investors, given that wars and geopolitical conflict have encouraged military spending, NATO members have committed to raising spending to 5% of GDP by 2035 , and defense companies (including Lockheed) currently hold record backlogs.

Data by YCharts.

The reason comes down to profit margin pressures at defense businesses, most notably on fixed-price development programs. For example, Boeing, Lockheed Martin, and RTX have reported multibillion-dollar losses and charges on assorted programs due to cost overruns. I've covered these issues in more detail elsewhere. However, the gist of the argument is that governments are using their monopsonistic power (the single buyer in a market with many sellers) over defense contracts to bargain more aggressively for contracts, while at the same time, defense technology is becoming increasingly complex and costly to develop.

It's far from clear that these pincer-like pressures on margins aren't long-term rather than temporary issues. In addition, a resolution to various conflicts in 2026, combined with the realization that government debt levels may curtail future defense spending, could turn sentiment negative toward defense stocks in 2026.

Image source: Getty Images.

2. AI focus will shift to companies using AI rather than infrastructure

It's no secret that artificial intelligence (AI) technology and infrastructure companies like Nvidia and Vertiv have delivered market-busting returns over the last year, but when even stocks like Caterpillar have surged higher to questionable valuations due to AI exposure (Caterpillar's power generation equipment used to power and backup data centers), then it might be time to broaden exposure to the AI theme.

If you follow the argument that it's more of a question of valuation than a bubble in AI spending, then it makes sense to look at software companies that are embedding AI into their solutions so as to increase their value to customers. PTC (NASDAQ: PTC) and its suite of software solutions are ideally positioned in this respect, not least because its existing solutions focus on enabling industrial companies to work smarter by adopting digital technology.

Through the use of AI, PTC's software can more effectively analyze the vast amount of data created by integrating the physical and digital worlds, ultimately generating actionable insights to continually improve the design and production processes. That should result in improved sales over time.

Image source: Getty Images.

3. The interest rate trade will work in 2026

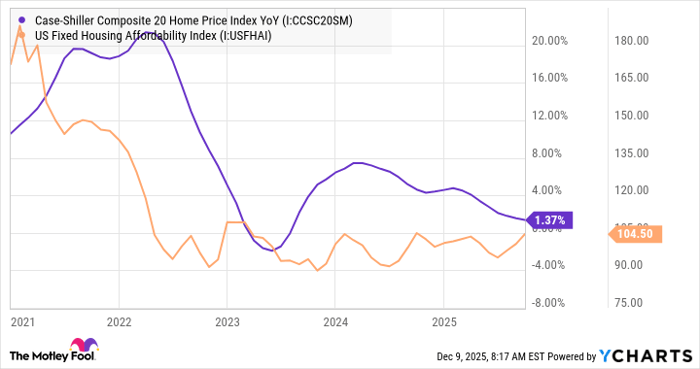

Investors seeking to profit from buying beaten-down stocks that would thrive in a lower-rate environment, such as Whirlpool and Stanley Black & Decker, were disappointed in 2025. While market interest rates and mortgage rates decreased through 2025, this wasn't enough to have a significant impact on housing affordability, as house prices remained stubbornly high.

However, as shown in the chart below, the rate of growth in house prices has slowed. With the potential for lower interest rates in 2026, housing affordability is expected to improve.

Data by YCharts.

The Trump administration's tariffs likely stoked the fires of inflation in 2025, but as the economy recovers, many of the price increases are expected to subside, allowing inflation to ease and potentially enabling the Federal Reserve to lower rates next year.

If that occurs, the housing market will receive support, which will help companies like Whirlpool remain attractive in 2026.

Should you invest $1,000 in Lockheed Martin right now?

Before you buy stock in Lockheed Martin, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Lockheed Martin wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $513,353!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,072,908!*

Now, it’s worth noting Stock Advisor’s total average return is 965% — a market-crushing outperformance compared to 195% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 8, 2025

Lee Samaha has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Boeing, L3Harris Technologies, Nvidia, and PTC. The Motley Fool recommends Lockheed Martin, RTX, and Whirlpool. The Motley Fool has a disclosure policy.