My Top 10 Stocks to Buy for 2026

Key Points

Together, these stocks offer you a balanced mix of growth and safety.

These companies span a number of industries, and many are leaders in their markets.

- 10 stocks we like better than Nvidia ›

Overall, the past three years have been positive for investors, with the S&P 500 bull market going strong. The famous benchmark advanced more than 20% in each of the past two years, and today it's heading for yet another double-digit annual gain. Technology stocks have fueled this movement as artificial intelligence (AI) emerged as the next major game changer, and investors also piled into growth stocks across industries on optimism about lower interest rates.

It's impossible to predict with 100% certainty which direction the S&P 500 will take next year, but there's reason to be optimistic about its performance then and over time; history shows us that bull markets usually last much longer than bear markets.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

With all of this in mind, let's check out my top 10 stocks to buy for 2026. They offer you a balanced blend of characteristics, from growth and innovation to safety and passive income.

Image source: Getty Images.

1. Nvidia

Let's start with a company that has significantly driven market gains during this AI boom: Nvidia (NASDAQ: NVDA), the world's leading AI chip designer. This tech giant has seen earnings soar, and this movement may have much farther to go, as this technology is in the early chapters of its story.

Nvidia's positioned to benefit greatly from AI infrastructure spending, which may reach into the trillions of dollars over the next five years. And, over time, AI models will continue to rely on chips to power them through their job of applying AI to real-world problems. All of this suggests many bright days ahead for Nvidia and its shareholders.

2. Eli Lilly

Eli Lilly (NYSE: LLY) already has seen earnings take off thanks to its weight loss drug portfolio. Tirzepatide, sold as Mounjaro for type 2 diabetes and as Zepbound for weight loss, has delivered blockbuster revenue -- and has helped Lilly's total revenue climb in the double-digits.

Recently, Lilly delivered solid phase 3 results for its oral weight loss candidate -- orforglipron -- and regulatory review of that candidate is the next step. All of this means orforglipron soon may reach commercialization and boost Lilly's already booming weight loss portfolio.

This makes right now an excellent time to get in on this pharma player that offers you safety and growth.

3. American Express

American Express (NYSE: AXP) is a giant in the payment card market, generally serving high-income customers. Its membership base makes the company a solid investment during any economic environment, because high-income individuals continue spending regardless of the economic situation -- and this has resulted in steady earnings growth for American Express over time.

In recent quarters, American Express has spoken of growth in younger customers -- Millennials and Gen-Z made up 64% of new accounts in the latest quarter. This suggests the payments powerhouse is well-positioned for more growth in the years to come.

Image source: Getty Images.

4. CoreWeave

CoreWeave (NASDAQ: CRWV) exploded onto the scene this year, climbing more than 300% from its market launch in March through June. The stock has since dropped from that high -- and it now has plenty of room to run.

This company offers AI customers what they need most today, and likely into the future, and that's capacity for workloads. CoreWeave rents out its fleet of high-powered chips, and this could drive the company's already surging revenue higher in 2026 -- and beyond. So, now is a great time to get in on this AI growth player.

5. Viking Therapeutics

Viking Therapeutics (NASDAQ: VKTX) aims to enter the billion-dollar weight loss drug market, and so far, the company is marching steadily toward that goal. Viking's injectable candidate is involved in phase 3 trials, and its oral candidate is involved in phase 2 -- both have delivered promising results so far.

Though Eli Lilly and Novo Nordisk dominate the market right now, demand is high, suggesting there's room for others to carve out share here. Viking, with candidates that function in the same way as the Lilly and Novo drugs, could emerge as a new winner in this market in a few years -- so it's a wise idea to get in on this story early.

6. Meta Platforms

Meta Platforms (NASDAQ: META), trading for 26x forward earnings estimates, is the cheapest of the Magnificent Seven tech stocks that have led market gains. That's one reason to buy the stock now.

And I have two more reasons: Meta is a well-established company with earnings growth you can count on, and it also offers you a top AI bet. Meta is committed to investing in AI and using it to supercharge revenue in the years to come. The company already has gotten started, building its own large language model and virtual assistant, for example. But much more should be on the horizon, making this an exciting and cheap growth stock to buy now.

7. Abbott Laboratories

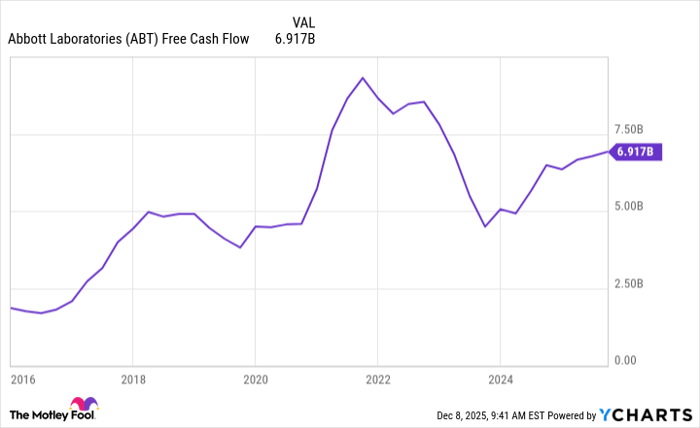

Abbott Laboratories (NYSE: ABT) is a Dividend King, meaning it's raised its dividend payments for more than 50 consecutive years. This shows the company's commitment to dividend growth, and Abbott's strong free cash flow suggests it has what it takes to keep this on track, too.

ABT Free Cash Flow data by YCharts

I also like Abbott because of its diversification across businesses -- medical devices, diagnostics, nutrition, and established pharmaceuticals. This broad range of operations is positive because, if and when one faces headwinds, others may compensate. On top of this, Abbott sells industry-leading products, such as the FreeStyle Libre continuous glucose monitor and Ensure nutrition drinks. All of this makes it a solid healthcare stock to buy and hold.

8. UnitedHealth

UnitedHealth Group (NYSE: UNH), the biggest U.S. health insurer, has faced various headwinds in recent quarters -- including the rising costs of healthcare. But the company has taken note of the issues that have weighed on earnings and is addressing them.

The efforts -- such as cutting certain plans and using AI to gain in efficiency -- already are bearing fruit, with the company recently increasing its guidance for full-year earnings. Meanwhile, the stock, considering UnitedHealth's industry leadership and long-term prospects, looks cheap at 20x forward earnings estimates. So if you're looking for a promising recovery story for 2026, UnitedHealth may be it.

Image source: Getty Images.

9. Chewy

Chewy (NYSE: CHWY) is the best friend of cats, dogs, and goldfish -- and you might take a liking to this company too. That's because this e-commerce player selling pet food, toys, healthcare, and more has a loyal following of customers, and this has led to steady growth.

The key number I always point out is Chewy's AutoShip sales -- this program allows for the automatic reordering of your favorite products according to a schedule you choose. AutoShip sales account for more than 80% of Chewy's net sales, offering us visibility on sales to come. Chewy also is profitable and debt-free, two other reasons to like this consumer goods stock.

10. Amazon

Finally, if you aim to invest in an established market giant that also offers you outstanding growth potential, consider Amazon (NASDAQ: AMZN). The e-commerce and cloud computing titan has an established track record of growth and billion-dollar profit – but it's not stopping there and instead is set to win in the high-potential area of AI.

AI already has helped Amazon Web Services (AWS) reach a $132 billion annual revenue run rate, and AI has been favoring efficiency across Amazon's e-commerce business. Moving forward, AI could continue to supercharge growth in both of these businesses, making the stock look reasonably priced now at 32x forward earnings estimates.

And that's why Amazon is a top tech stock to buy and hold for 2026 and beyond.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $507,421!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,109,138!*

Now, it’s worth noting Stock Advisor’s total average return is 972% — a market-crushing outperformance compared to 195% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 8, 2025

American Express is an advertising partner of Motley Fool Money. Adria Cimino has positions in Amazon and American Express. The Motley Fool has positions in and recommends Abbott Laboratories, Amazon, Chewy, Meta Platforms, and Nvidia. The Motley Fool recommends Novo Nordisk, UnitedHealth Group, and Viking Therapeutics. The Motley Fool has a disclosure policy.