Robinhood Stock Is Up 1,500% in Just 3 Years. Here's Why It's Still a Good Buy Heading Into 2026.

Key Points

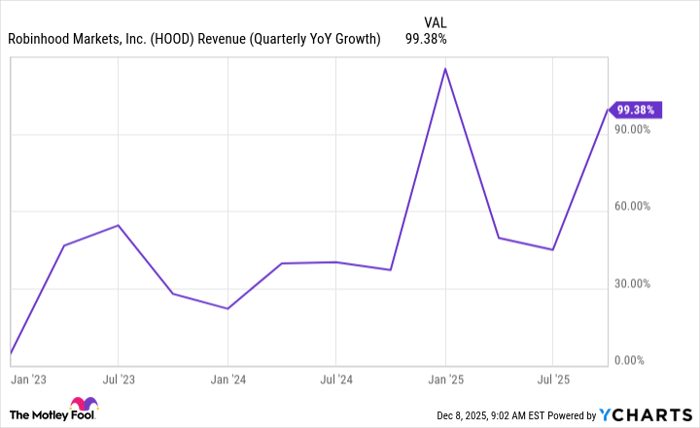

Robinhood's sales doubled last quarter as its growth rate has been accelerating.

It is expanding into prediction markets, which may be a huge opportunity for the business.

There were 2.5 billion event contracts traded in October alone, which was more than in the third quarter.

- 10 stocks we like better than Robinhood Markets ›

One of the great growth stories in recent years has been Robinhood Markets (NASDAQ: HOOD). Its popularity took off when meme stocks were surging in value during the pandemic. Over the years, it has continued to grow in size while expanding its operations.

Since 2023, the stock has skyrocketed an incredible 1,500%, making it one of the best growth stocks to own in recent years. Yet despite this massive rally, I think the stock may go even higher in the future. Here's why Robinhood stock can still be a good investment to put in your portfolio today.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

The prediction-markets business could be massive

Robinhood's platform can be used for easily trading stocks and crypto. However, one growth opportunity that's in the early innings is prediction markets, which enable people to bet on outcomes of virtually anything. In August, Robinhood announced the launch of prediction markets for the National Football League (NFL) and college football.

The growth has been explosive. In the third quarter, which ended on Sept. 30, the company said that the number of event contracts (which are bought and sold through its prediction-markets hub) totaled 2.3 billion. For the month of October alone, there were 2.5 billion contracts traded.

Robinhood has been just getting started in the prediction-markets business. To say that demand has been robust would be an understatement.

The company's growth rate remains high

In Q3, Robinhood's top line doubled, to a record of just under $1.3 billion. What's encouraging for growth investors is that not only is business not slowing down, but it has been taking off. The company says that prediction markets and Bitstamp (a cryptocurrency exchange that Robinhood acquired earlier this year) are new business lines that are generating around $100 million in annualized revenue.

HOOD Revenue (Quarterly Year-Over-Year Growth) data by YCharts.

There's a strong possibility that Robinhood's growth rate may remain strong (i.e., north of 50%) in future quarters, which would arguably justify its seemingly high valuation. The stock currently trades at a price-to-earnings multiple of 55. While that might seem high for a stock, with such terrific numbers and exciting growth prospects ahead, Robinhood's valuation may not be all that unreasonable, as a premium seems to be warranted.

Robinhood is a solid option for growth investors

Entering trading this week, shares of Robinhood have soared more than 250% since the beginning of the year. While the stock may not rally as much in 2026, it still has the potential to rise higher next year, especially as it grows its prediction-market business.

It's a huge opportunity for Robinhood to leverage its already strong user base (it has roughly 28 million investment accounts), to offer them more ways to trade. The early results have been encouraging for Robinhood, and as the prediction-market business grows, the outlook may be even better for the stock.

There is some risk with the stock, simply due to its elevated valuation and the possibility of a slowdown in the economy in the near future. Thus, there's the chance that the stock could give back some gains.

However, for long-term growth investors who are willing to hang on for multiple years, this can be an excellent stock, given Robinhood's popularity with retail investors and its relentless pursuit of growth. Although Robinhood may not be a cheap stock to own, you can still expect to earn a good return from investing in the company today.

Should you invest $1,000 in Robinhood Markets right now?

Before you buy stock in Robinhood Markets, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Robinhood Markets wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $521,550!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,133,904!*

Now, it’s worth noting Stock Advisor’s total average return is 981% — a market-crushing outperformance compared to 194% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 8, 2025

David Jagielski, CPA has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.