Could Buying Ultra-High-Yield Annaly Capital Stock Today Set You Up for Life?

Key Points

Annaly Capital is a mortgage real estate investment trust.

The stock currently offers a 12.2% yield, which is likely to be enticing to dividend investors.

A volatile history suggests that Annaly might not be the dividend stock its lofty yield suggests.

- 10 stocks we like better than Annaly Capital Management ›

Most investors expect the stock market to provide an annualized return of around 10%. That's not unreasonable, given the market's history.

But what if you could get more than that just by collecting a dividend? That's the simple view with Annaly Capital Management (NYSE: NLY) and its shockingly high 12.2% yield, which is a full 11 percentage points higher than the 1.2% yield of the S&P 500 index.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

But don't jump in just yet. Here's what you need to know before you buy Annaly Capital, thinking you are setting yourself up for a lifetime of reliable income.

Destroying the dividend dream right up front

Most dividend investors are likely seeking a reliable -- and perhaps even growing -- income stream to support their spending needs in retirement. That's a laudable goal, but it means you need to be extra careful about your stock selection. A glance at Annaly Capital's dividend history will quickly dispel the notion that this stock can provide you with that.

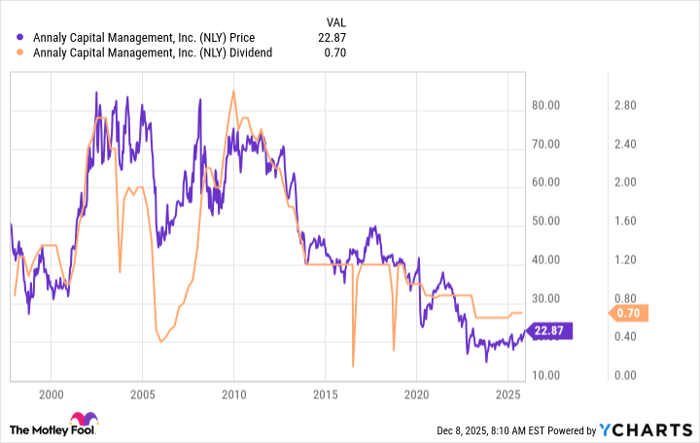

Data by YCharts.

The orange line is Annaly's dividend. Notice how volatile it is. Although the most recent change was an increase, the fluctuations over time have been remarkably wide. It would be virtually impossible to plan your spending around a dividend like that, even with the dividend yield so high today. But don't stop with the orange line; notice that the price (the purple line) is just as volatile.

At the end of the day, Annaly is just not the kind of dividend stock that most dividend investors will want to own. There's too much uncertainty, and every time there's a dividend cut, the stock price falls, too, meaning you are not only suffering a loss of income, but you are also getting hit with a loss of capital.

Image source: Getty Images.

What is Annaly really doing?

The key fact here is that Annaly isn't actually trying to be a reliable dividend stock. It aims to generate a strong total return, which assumes the reinvestment of dividends. If you spend your dividends instead of buying more shares with them, you'll be out of line with the goals of the company and, as history suggests, you'll likely end up disappointed with your investment results.

If you shift your frame of mind from dividend investing to total returns, Annaly actually comes out looking pretty good. As the chart below highlights, since its initial public offering, its total return has actually been slightly higher than that of the S&P 500 index. Even more important is the path of those returns, which has been notably different.

Data by YCharts.

All in, if you are building a diversified portfolio with a goal of total return, Annaly could provide you with valuable diversification. But what is the business actually doing?

Annaly is a mortgage real estate investment trust (mREIT). Essentially, it buys mortgages that have been pooled into bond-like securities. In some ways, it operates like a mutual fund, in that the value of the company is essentially the value of its mortgage securities portfolio. Like a mutual fund, the performance of Annaly's portfolio fluctuates over time.

Know what you are getting before you buy Annaly

The truth is, Annaly is a fairly well-respected mREIT; if you are looking to own such a REIT, you might want to consider it. The problem is that investors often focus on the yield and assume it is an income stock, which is simply not management's goal.

If you understand Annaly and buy it for total return, you'll probably be reasonably happy with your decision. If you buy it hoping to generate a lifetime of reliable income, history suggests you will end up highly disappointed.

Should you invest $1,000 in Annaly Capital Management right now?

Before you buy stock in Annaly Capital Management, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Annaly Capital Management wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $521,550!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,133,904!*

Now, it’s worth noting Stock Advisor’s total average return is 981% — a market-crushing outperformance compared to 194% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 8, 2025

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.