Is 2026 the Big Payoff Carnival Cruise Investors Have Waited For?

Key Points

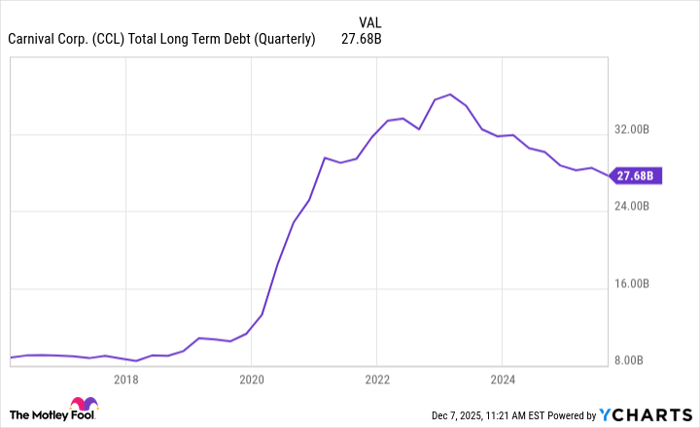

The COVID-19 pandemic ruined Carnival's balance sheet.

Carnival's credit is steadily improving and could attain investment-grade ratings next year.

It could add a boost to Carnival's tremendous business momentum.

- 10 stocks we like better than Carnival Corp. ›

Carnival Corp. (NYSE: CCL), the renowned cruise line company, has made a remarkable comeback from a disastrous 2020. The business nearly sank during the COVID-19 pandemic. Now, it's fair to say that Carnival is back and better than ever. The company touted record-breaking numbers in the third quarter, including all-time highs in revenue, bookings, and operating profits.

Despite the strong showing, Carnival stock has underperformed the broader stock market this year. The stock has returned just 2.3% in 2025, compared to the S&P 500's impressive 16.4% run. Now, the company enters 2026 with a potential catalyst on the horizon.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Here is why 2026 could be a pivotal year for Carnival's comeback, and how it could affect the stock.

Image source: Getty Images.

Carnival might attain investment-grade credit in 2026

The pandemic put Carnival in a challenging situation. It had to essentially do whatever was necessary to stay afloat when lockdowns put its entire business model on dry land. This included incurring massive amounts of debt, which severely damaged the company's credit rating.

Carnival did survive, and its business has steadily improved to the extent that management has paid down billions of dollars of its long-term debt over the past few years.

Data by YCharts.

Doing so has steadily regained the confidence of the ratings agencies. For instance, Moody's upgraded Carnival's credit to B1 in the third quarter of 2024, then to Ba3 in the first quarter of 2025, and finally, to Ba2 in Q3 2025.

This is still below investment grade, but it's just two upgrades away from achieving that milestone. Carnival is just one upgrade away from investment-grade status with the other two primary ratings agencies, so Carnival's balance sheet is clearly trending in the right direction.

It could boost a business already performing at a high level

Having better credit would allow Carnival to potentially refinance debt at more favorable terms, further releasing the financial restraints that have weighed on the business since the pandemic. It would be a welcome boost to a business that, frankly, is already performing well.

Carnival has already booked roughly half of its 2026 capacity. Again, that's as of the third quarter! It's an impressive feat considering that people across America are struggling financially, and consumer sentiment is near its lowest levels on record.

So, why is Carnival thriving? Vacations are a discretionary purchase, so people typically cut back during tough times. It could be due to young consumers prioritizing experiences amid unaffordable housing. It could also be high earners downgrading to Carnival from more expensive vacations, their version of cutting back.

Either way, Carnival's business is roaring. If the company does attain investment-grade credit next year, it could reinvigorate the stock, making 2026 a far better year for investors than 2025 has been.

Should you invest $1,000 in Carnival Corp. right now?

Before you buy stock in Carnival Corp., consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Carnival Corp. wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $521,550!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,133,904!*

Now, it’s worth noting Stock Advisor’s total average return is 981% — a market-crushing outperformance compared to 194% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 8, 2025

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Moody's. The Motley Fool recommends Carnival Corp. The Motley Fool has a disclosure policy.