After Losing 99% of its Value in 5 Years, Is There Any Hope Left for Beyond Meat Stock to Turn Things Around in 2026?

Key Points

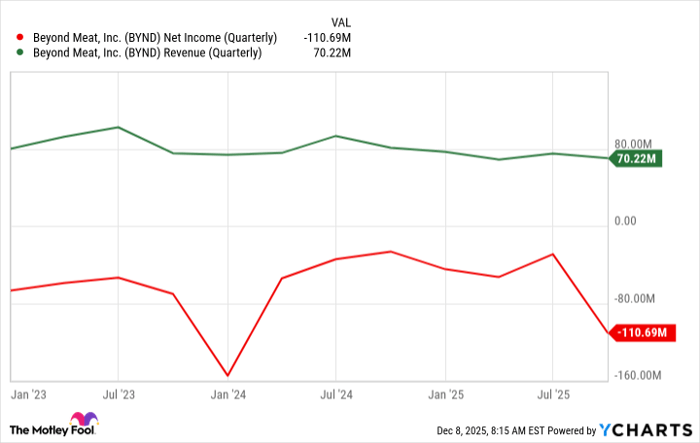

Beyond Meat is facing numerous issues, including a lack of profitability and revenue growth.

Its margins are light at less than 10% of revenue.

The stock surged earlier this year in a rally fueled by speculation.

- 10 stocks we like better than Beyond Meat ›

Beyond Meat (NASDAQ: BYND) has been one of the worst stocks to own over the past five years, without a doubt. While investors were initially excited about the company's plant-based meat products as intriguing alternatives to meat, it didn't take long for that excitement to turn into pessimism.

Questions have arisen as to how healthy those highly processed plant-based products are; their prices have typically been higher, and many people simply don't love the taste; demand hasn't proven to be all that strong. There has clearly been a lot of bearishness surrounding the business as the stock has been on a massive 99% decline over the past five years.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

However, with its valuation taking such a beating, can a contrarian case be made for Beyond Meat stock in 2026, and can it simply be too cheap to pass up heading into the new year?

Image source: Getty Images.

The company has many problems to fix

The biggest issue with Beyond Meat's stock is that there is no easy solution to the company's problems. It's not making money today. Its margins are atrocious as the company has been using discounts to help stimulate demand. And even then, sales have been going in the wrong direction.

BYND Net Income (Quarterly) data by YCharts

The company's top and bottom lines have both been vastly underwhelming in recent years. Meanwhile, with affordability issues plaguing the economy these days, there's little hope that things will get better in 2026. Beyond Meat would need to raise prices to improve its gross margins (they have averaged less than 9% over the past 12 months) and have any hope of turning a profit, and that doesn't appear to be a practical move at this point.

Investing in a stock based on price alone could be troublesome

You might be tempted to look at Beyond Meat's market cap of around $550 million and think that the stock may be a steal of a deal, given that it has generated close to $300 million in sales over the past four quarters. There's risk here, but at some point it's bound to bottom out.

However, there is no guarantee the stock can't go any lower. Retail investors have been betting on the stock's recovery this year, and that led to a surge in Beyond Meat's stock price in October, but it has come down sharply since then. Without stronger fundamentals, investing in the stock today relies heavily on the hope that it becomes a hot meme stock, rising despite the business's shortcomings. And that's a dangerous reason to invest in any company.

Investors shouldn't count on a rally for Beyond Meat's stock in 2026

Beyond Meat's stock isn't on the cusp of a turnaround. It may get a boost from speculators, but such rallies are often short-lived. Without an improvement in its financials, Beyond Meat is going to remain a highly risky stock to put in any portfolio. When a stock has plunged 99% in just five years, that should raise plenty of red flags for investors. If there's no compelling reason to believe that business will be better in the near future, then you're probably better off simply avoiding it.

The company has a long way to go before it'll be able to win over investors and prove that it can be a good food business to invest in. There's also the possibility that day may never come. Next year may not necessarily be a better one for the economy or for Beyond Meat, which is why I don't think investors should count on a turnaround for the stock anytime soon.

Should you invest $1,000 in Beyond Meat right now?

Before you buy stock in Beyond Meat, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Beyond Meat wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $521,982!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,137,459!*

Now, it’s worth noting Stock Advisor’s total average return is 981% — a market-crushing outperformance compared to 194% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 8, 2025

David Jagielski, CPA has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Beyond Meat. The Motley Fool has a disclosure policy.