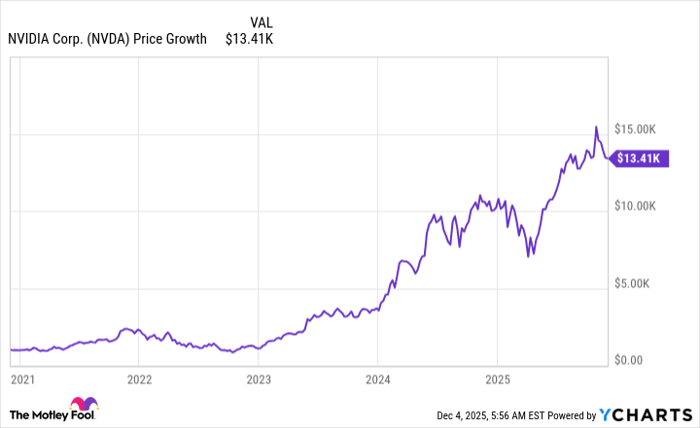

If You'd Invested $1,000 in Nvidia 5 Years Ago, Here's How Much You'd Have Today

Key Points

Nvidia's stock is up by over 1,200% in the past five years.

Its revenue has increased by over 1,000% in the past five years.

The artificial intelligence infrastructure buildout should keep boosting Nvidia's growth.

- 10 stocks we like better than Nvidia ›

If you invest long enough, you'll eventually run into an "I wish I had invested in that earlier" situation. They are par for the course. For me, one such missed opportunity is Nvidia (NASDAQ: NVDA), a stock I noticed but glossed over years ago.

From where it traded five years ago, Nvidia's stock is up by around 1,240%, meaning a $1,000 investment then would be worth around $13,400 today.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

NVDA data by YCharts.

An AI must-have

There's no doubt that Nvidia's role in the artificial intelligence (AI) ecosystem -- as the main supplier of high-end graphics processing units (GPUs) and other key data center hardware and software -- has played a huge role in its recent success. In the past five years, its revenue has increased by more than 1,000% (to $57 billion in its last fiscal quarter), and it's now the world's most valuable public company.

As the use of AI continues to grow and companies continue to invest in AI infrastructure, Nvidia will undoubtedly be one of the biggest beneficiaries. It won't always have the level of dominance in the AI accelerator market that it does now, but it has solidified itself as a cornerstone of the industry.

I wouldn't expect it to repeat its stock performance of the last five years over the next five, but the signs still point to it being a good long-term play.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $540,587!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,118,210!*

Now, it’s worth noting Stock Advisor’s total average return is 991% — a market-crushing outperformance compared to 195% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 8, 2025

Stefon Walters has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.