SoundHound AI Stock Is Down 36% in 2025. Where Could It Be at the End of 2026?

Key Points

SoundHound AI is a leading developer of conversational artificial intelligence (AI) software.

Many of the world's top brands use its products, including Krispy Kreme, Panda Express, Hyundai, and more.

The stage might be set for a more positive year in 2026.

- 10 stocks we like better than SoundHound AI ›

SoundHound AI (NASDAQ: SOUN) develops conversational artificial intelligence (AI) applications designed to understand voice prompts and respond in kind, and it's in high demand from some of the world's biggest brands across industries like hospitality, automaking, and healthcare.

Most of SoundHound's products are still in the early stages of commercialization, but the company's revenue is growing rapidly. Nevertheless, its stock price has plummeted 36% so far in 2025 as investors weigh its sky-high valuation against the business's potential.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

However, based on Wall Street's 2026 revenue forecast for SoundHound, its stock might actually be cheap at the current level for investors who are willing to hold it for the next 12 months or longer. Read on.

Image source: Getty Images.

SoundHound's conversational AI software is in high demand

SoundHound offers several different products. For fast-food restaurants, its Dynamic Drive-Thru software can autonomously take orders from customers, and its Employee Assist stands ready to help workers prepare menu items, understand store policies, and more. Krispy Kreme, Jersey Mike's, and Panda Express are just some of the popular chains using the company's AI software in their restaurants.

SoundHound's Voice AI platform allows automakers to create an in-car assistant to suit their brand. It can help drivers understand their car's functionality, or give them information about the weather or their favorite sports team on command. Drivers can even order food from their favorite restaurants on the go. Hyundai and Stellantis (which owns Jeep, Chrysler, and Dodge) are just a couple of manufacturers tapping into these tools right now.

The company's Amelia platform allows businesses to create AI agents to make their employees more efficient and to serve customers. Resorts World Las Vegas used Amelia to create a digital concierge called RED, which handled 223,000 guest interactions in 2024 -- accounting for 59% of the company's total call volume -- without having to pass them along to human customer service operators. This could save the company a significant amount of money in the long run.

Rapid revenue growth, with a catch

SoundHound generated $42 million in revenue during the third quarter of 2025 (ended Sept. 30), a 68% increase from the year-ago period. That is a rapid increase at face value, but it was a deceleration from the 217% growth the company delivered in the second quarter three months earlier. Although that signals a loss of momentum, no company can grow by triple-digit percentages forever.

Management actually increased its full-year forecast for 2025 following the third-quarter result. The company is now expected to generate somewhere between $165 million and $180 million in total revenue, up from the previous guidance of $160 million to $178 million.

Part of the reason SoundHound's top line is growing so quickly is that it's investing heavily in addressing operating costs to attract customers and develop new products. This will probably be great for the company in the long run, but it's fueling significant losses in the near term. SoundHound generated a net loss under generally accepted accounting principles (GAAP) of $109.2 million in the third quarter alone.

The company's third-quarter loss was just $13 million on an adjusted (non-GAAP) basis, after excluding one-off expenses relating to acquisitions and noncash expenses like stock-based compensation. That number was far more palatable, but with just $269 million in cash on hand, management needs to control its costs very carefully, or else it will have to raise more money in the future, which will dilute existing shareholders.

SoundHound stock might be cheap on a forward basis

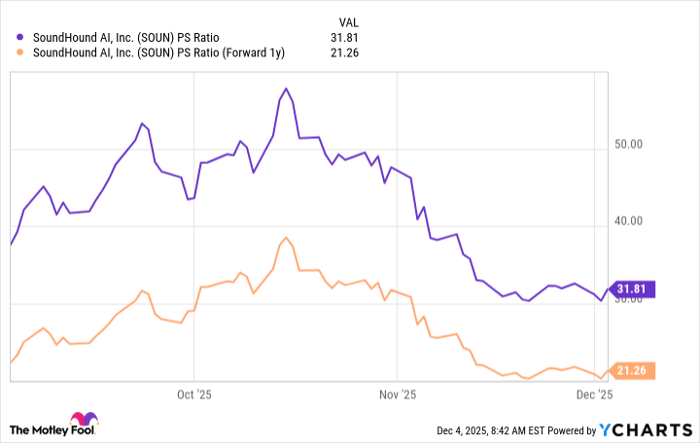

Despite the 41% slump in SoundHound stock this year, it's still trading at an elevated price-to-sales ratio (P/S) of 31.8. It's even more expensive than Nvidia stock, which trades at a P/S of 23.5. The chipmaker is one of the highest-quality companies in the world with a track record of success spanning decades, a rock-solid balance sheet, and soaring profits, so it's hard to justify SoundHound's premium valuation.

However, the benefit of SoundHound's rapidly growing revenue is that its P/S appears far more attractive when we look into the future. Wall Street's consensus estimate (provided by Yahoo! Finance) suggests the company will deliver $232.8 million in revenue during 2026, which places its stock at a forward P/S of just 21.2.

Data by YCharts.

I wouldn't call the stock a bargain based on its forward P/S, but if the company meets or exceeds Wall Street's revenue estimate next year, investors could certainly earn a nice return. It might even end 2026 with a powerful rally if Wall Street issues a bullish forecast for the company's 2027 revenue.

In summary, while it's hard to nail down an exact price for SoundHound AI stock for 2026, I think there's a good chance it leaves its 2025 losses in the rearview mirror and ends next year in the green.

Should you invest $1,000 in SoundHound AI right now?

Before you buy stock in SoundHound AI, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and SoundHound AI wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $540,587!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,118,210!*

Now, it’s worth noting Stock Advisor’s total average return is 991% — a market-crushing outperformance compared to 195% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 1, 2025

Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool recommends SoundHound AI and Stellantis. The Motley Fool has a disclosure policy.