Where Will Figma Stock Be in 1 Year?

Key Points

Figma recently released a solid set of results and raised its full-year guidance.

The company's AI tools are gaining traction among its loyal customers.

Customer count is rising, and existing clients are spending more.

- 10 stocks we like better than Figma ›

Figma (NYSE: FIG), a provider of cloud-based collaborative design tools that enable its customers to create websites, applications, and other digital products, has witnessed a roller-coaster ride on the stock market since it went public on July 31.

Shares of the company shot up a remarkable 250% on the day of its initial public offering (IPO). However, investor enthusiasm has gone for a toss since then. Figma dipped below its IPO price last week. It has lost a whopping 72% of its value after July 31, driven mainly by concerns about its rich valuation and slowing growth.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

However, with the stock pulling back substantially since going public, is now a good time to consider buying it? Analysts, as it turns out, are expecting this tech stock to regain its mojo and jump impressively in the coming year. Let's see if Figma could indeed live up to such expectations.

Image source: Getty Images.

Figma is expected to step on the gas

Figma holds a 12-month median price target of $69, according to 10 analysts that cover the stock. That's just over double its current stock price.

The good part is that Figma's latest results suggest it may be able to come out of the tailspin it has witnessed since its IPO. The company's third-quarter 2025 earnings were released on Nov. 5, and there were quite a few positive takeaways. Figma not just beat Wall Street's expectations but also raised its 2025 guidance.

Figma's revenue increased by 38% from the year-ago period to $274 million, exceeding the higher end of its guidance range. This solid showing can be attributed to the new products and features launched by the company, which are helping it attract new customers and also get more business from existing ones. The company introduced over 50 new features in Q3, including an artificial intelligence (AI)-powered tool called Figma Make.

Users can convert their ideas into a functional prototype design with a written prompt. Figma Make helps users create apps and websites, and can be integrated with the company's other products. Another notable development is the integration of Figma's tools with ChatGPT. Users of the popular OpenAI chatbot can enter a prompt and ask it to be executed in Figma. Additionally, ChatGPT will suggest Figma to users when relevant.

This partnership could be a big deal for Figma, considering that ChatGPT has over 800 million monthly users, and especially considering that OpenAI CEO Sam Altman suggests there are ways to monetize such integrations. What's more, Figma's AI tools are gaining terrific traction among customers. As CEO Dylan Field remarked on the latest earnings conference call:

Figma Make is speeding up. By September, approximately 30% of customers spending $100,000 or more in ARR were creating in Figma Make on a weekly basis, and that number has continued to grow.

Management added that Figma Make helped it close the third quarter with 540,000 paid customers, up from 450,000 at the end of Q1. Additionally, there was a 27% sequential increase in the number of customers that signed multiyear deals with the company in Q3. So, it wasn't surprising to see Figma report an increase of two percentage points in its net dollar retention rate to 131%.

The growth in this metric points toward an improvement in the adoption of Figma's solutions by its existing customers. So, Figma seems to be pulling the right strings to get back on track. Higher spending by existing customers, along with the addition of new customers who could go on to secure larger contracts in the future, may lead to a solid improvement in the company's bottom line in the long run.

But what about the valuation?

While Figma's growth was healthy last quarter, investors may wonder if the stock is attractive enough to buy right now. After all, the stock's price-to-sales ratio of 17 is still at a premium when compared to the U.S. technology sector's average of 8.4. However, it may be able to justify that premium.

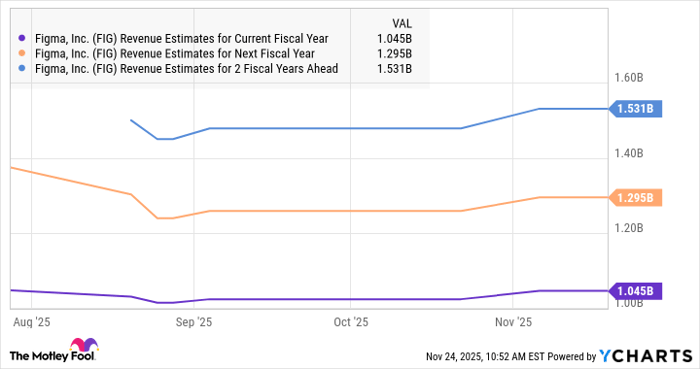

Figma's updated 2025 revenue guidance of just over $1 billion implies a 40% increase from last year. Even analysts have become a tad bullish about its prospects going forward.

FIG Revenue Estimates for Current Fiscal Year data by YCharts

If Figma continues to add new customers at a healthy clip and wins more business from existing ones, it could end up delivering better-than-expected results in the coming year. Moreover, the company estimates that it is sitting on an addressable opportunity worth $33 billion in the global software design market.

So, there is a good chance Figma stock will indeed head higher in the coming year, as analysts are projecting. That's why now may be a good time to start accumulating this tech stock following its sharp post-IPO decline.

Should you invest $1,000 in Figma right now?

Before you buy stock in Figma, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Figma wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $572,405!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,104,969!*

Now, it’s worth noting Stock Advisor’s total average return is 1,002% — a market-crushing outperformance compared to 193% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 24, 2025

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.