Big Tech's AI Bets Are Paying Off, but Which Stock Has the Most Upside?

Key Points

Meta, Amazon, and Alphabet are integrating AI into their operations, thanks to the benefits the technology delivers.

All these companies rely on Nvidia's chips to help train AI models and run inference applications.

It is easy to see why analysts expect Nvidia to clock outstanding growth (and stock performance) going forward.

- 10 stocks we like better than Nvidia ›

The latest earnings season turned out to be a terrific one for technology giants, as several reap the rewards for their investment in artificial intelligence (AI) technology.

Of course, there have been concerns whether the massive amount of money big tech companies are pouring into AI is justified, with investors questioning the potential returns that they can generate from their investments. Not surprisingly, big tech stocks have been under pressure this earnings season despite their impressive performance.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

However, the latest results from semiconductor bellwether Nvidia (NASDAQ: NVDA) clearly indicate that tech companies continue to spend on AI infrastructure. Let's see why that's the case, and check what the best way is to benefit from the huge bets that big tech is placing on AI.

Image source: Nvidia.

AI has started moving the needle for big tech companies

A big reason why companies and governments invest in AI is that it can help enhance productivity and efficiency, reduce redundancy, and enhance returns on investment. Market research firm IDC, for example, points out that each dollar spent on AI services is expected to generate $4.60 in value.

Tech giants such as Meta Platforms, Alphabet, Amazon, and others reported tangible gains driven by AI. Meta Platforms, for instance, notes stronger user engagement across its social media properties. The AI-recommended content on its sites encourages users to spend more time on these platforms, which boosts its ad business.

Similarly, Amazon's deployment of AI-powered robots in warehouses helps reduce repetitive tasks and improve productivity, but it also leads to an improvement in worker safety. Meanwhile, Alphabet's AI-powered search features, cloud offerings, and large language models (LLMs) all gained solid traction, as the company recently pointed out.

So, it is not surprising to see all these companies pledging to boost their capital expenditures as they are looking to build more AI data center infrastructure and features. According to one estimate, big tech capital expenditure spending could jump by 62% this year to $405 billion. That number is likely to head higher in 2026 as many companies are looking to accelerate their outlay to quickly build more AI infrastructure.

Now, you may be wondering which company can make the most of its huge outlay on AI. Will it be Meta, Amazon, Alphabet, or someone else? The answer isn't going to surprise you.

This company stands to win the most from big tech's AI bets

I pointed out earlier that Nvidia's results have given us an indication that big tech companies are set to sustain their huge spending on AI infrastructure. The reason I said that is because Nvidia provides critical tech that helps make AI a reality.

That's because all the big tech companies discussed in this article rely on AI models to bring various features into production. Amazon, for example, is using AI models to power its robots in warehouses, while Alphabet's Gemini LLM is witnessing strong customer demand. Meta, meanwhile, is focusing on the development of the next generation of AI models.

Nvidia's chips power these AI models and inference applications. The company leads the AI chip market by a big distance, and that explains why its growth remains solid quarter after quarter. Its revenue shot up by 62% year over year in the third quarter of fiscal 2026 to a record $57 billion, driven by a 66% jump in data center revenue to $51.2 billion.

Even better, the company points out that the demand for its graphics processing units (GPUs) that are used for AI model training and inferencing is so strong that it has sold out those chips. Nvidia management acknowledged on the earnings call that it has indeed received orders totaling $500 billion for 2025 and 2026, around $150 billion of which has already been fulfilled.

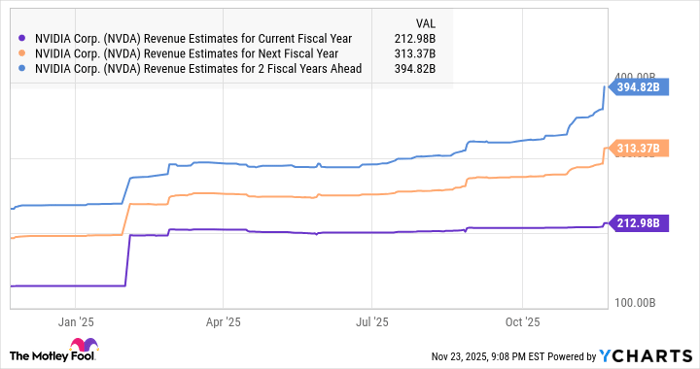

CFO Colette Kress is confident of receiving more orders, which is why the company is busy securing more components so that it can build more GPUs to satisfy the huge order backlog. Not surprisingly, Nvidia's revenue estimates have moved up significantly.

Data by YCharts

Even better, the company's earnings growth rate is expected to accelerate by a couple of points in the next fiscal year to 58%, with the bottom line expected to hit $7.42 per share in fiscal 2027 (which begins in January 2026). Assuming Nvidia trades at 33 times earnings at that time (in line with the tech-laden Nasdaq-100 index's earnings multiple), its stock price could hit $238.

That points toward a potential upside of 33% from current levels, though don't be surprised to see the company delivering bigger gains as it is capable of delivering a stronger increase in earnings, thanks to its backlog. Given that Nvidia is trading at an attractive 23 times forward earnings right now, buying this AI stock looks like a no-brainer considering the potential upside on offer.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $563,022!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,090,012!*

Now, it’s worth noting Stock Advisor’s total average return is 991% — a market-crushing outperformance compared to 192% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 24, 2025

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Meta Platforms, and Nvidia. The Motley Fool has a disclosure policy.