How Has DNUT Stock Done for Investors?

Key Points

Krispy Kreme is losing a lot of money, negatively impacting its stock price.

It's hard to operate a donut business, as evidenced by the company's $600 million in operating expenses year to date.

- 10 stocks we like better than Krispy Kreme ›

It could get an award for its ticker symbol because D-N-U-T appropriately belongs to Krispy Kreme (NASDAQ: DNUT). But this sweet business has delivered sour returns for investors since it went public again in 2021 at $17 per share. Now, it has been trading below $4 per share, having lost about 80% of its value during this time.

Unfortunately for Krispy Kreme investors, stock performance doesn't always match the quality of the business's products. If it did, Krispy Kreme stock may have been a winner thus far. After all, its donuts are considered among the best.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

However, it's difficult to profit from donuts, even when you have good donuts, and that's what matters from an investment perspective.

Image source: Getty Images.

Just consider Krispy Kreme's financials. Through the first three quarters of 2025, the company generated more than $1.1 billion in product sales, which is mostly donuts. But it's lost about $100 million during this time (after favorably adjusting for a $400 million non-cash impairment charge).

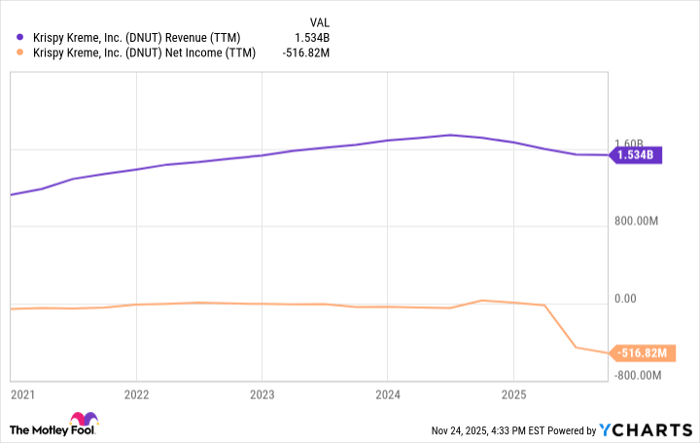

In short, it costs a lot of money to run a donut operation. This means that from a net income perspective, Krispy Kreme hasn't ever been much better than a breakeven business even during its best times, as the chart below shows.

DNUT Revenue (TTM) data by YCharts

This is the primary reason why Krispy Kreme stock has lost about 80% of its value since 2021.

Are better days possibly ahead?

Krispy Kreme needs to make major changes to its business model to have any hope of better financial results. And that's precisely what it's trying to do right now.

For starters, Krispy Kreme is attacking the largest item on its income statement: operating expenses. The company has accrued $600 million in operating expenses in 2025, which is more than half of its revenue right there. One way to lighten the operating load is by outsourcing U.S. logistics -- it delivers a lot of donuts -- which management is actively pursuing right now.

Krispy Kreme is also attempting to refranchise some of its locations and rework joint venture agreements. In short, running this business is capital-intensive. The idea is for some of these capital requirements to be picked up by franchisees and partners.

These efforts (and others) represent Krispy Kreme's attempt to improve the financials of its business model. That's what the company needs for the stock to perform better in coming years. That said, franchisees, partners, and logistic contractors want to make attractive returns as well, so some changes may be hard for Krispy Kreme to sell.

In conclusion, Krispy Kreme's management is aiming for returns that are as sweet as its donuts. But it will likely take time for it to make improvements that dramatically improve the trajectory of this business.

Should you invest $1,000 in Krispy Kreme right now?

Before you buy stock in Krispy Kreme, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Krispy Kreme wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $563,022!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,090,012!*

Now, it’s worth noting Stock Advisor’s total average return is 991% — a market-crushing outperformance compared to 192% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 24, 2025

Jon Quast has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.