Nvidia and 19 Other Stocks Now Make Up 50% of the S&P 500. Here's What It Means for Your Investment Portfolio.

Key Points

Just 4% of S&P 500 components are driving over half the index’s performance.

Many of the largest S&P 500 components are expensive but are generating rapid, high-margin earnings growth.

Hyperscalers like Apple, Microsoft, Alphabet, Amazon, and Meta Platforms can stomach AI spending thanks to rock-solid balance sheets.

- 10 stocks we like better than S&P 500 Index ›

If you regularly follow markets, chances are you've heard of the "Magnificent Seven," which is a group of mega-cap tech-focused companies that have produced monster returns in recent years. The group consists of Nvidia, Microsoft, Apple, Alphabet, Amazon, Meta Platforms, and Tesla.

You may also have heard of the "Ten Titans," which is a group I refer to as the Magnificent Seven, plus Broadcom, Oracle, and Netflix. But what you may not be aware of is just how massive these companies are compared to the rest of the S&P 500 (SNPINDEX: ^GSPC) components.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

At the time of this writing, the Magnificent Seven makes up roughly 35% of the S&P 500, the Ten Titans make up 40%, and the 20 largest S&P 500 stocks by market cap -- which would be the Ten Titans plus Berkshire Hathaway, Eli Lilly, JPMorgan Chase, Walmart, Visa, ExxonMobil, Mastercard, Johnson & Johnson, Palantir Technologies, and AbbVie -- make up a whopping 50.2% of the index.

Here's what a concentrated S&P 500 means for your investment portfolio and how to navigate markets near all-time highs.

Image source: Getty Images.

Leading from the top

Effectively, the S&P 500's structure doesn't limit concentration risk. Whereas an individual investor, an actively managed exchange-traded fund, or a mutual fund may rebalance a portfolio if a handful of stocks become overweighted.

This means that investor sentiment and earnings growth can drastically impact the index's composition. Over the last few years, Nvidia went from being worth less than half a trillion to over $5 trillion earlier this month. But it also grew earnings from a few billion to over $86 billion. In this vein, Nvidia has added the most value to the S&P 500 in terms of market cap, but it has also produced the most earnings growth.

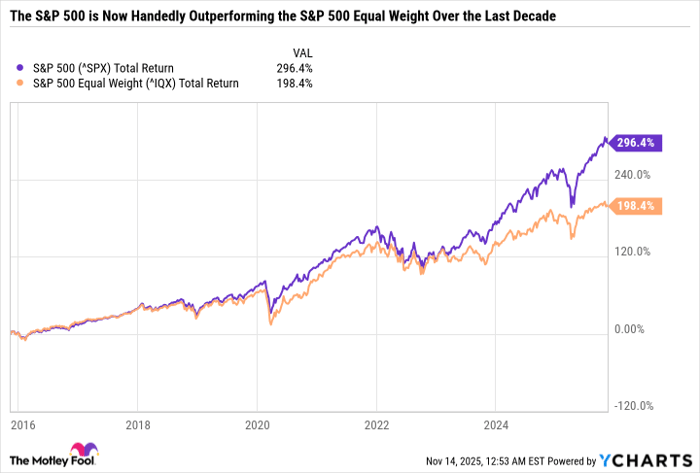

The largest companies have contributed disproportionately to S&P 500 gains. An easy way to measure that is by comparing the S&P 500's performance to the S&P 500 Equal Weight Index, which effectively weights each S&P 500 component at 0.2% of the index. So, instead of Nvidia having over 350 times more influence than a company like Clorox in the S&P 500, their stock prices would have the same impact in the S&P 500 Equal Weight Index.

The S&P 500 Equal Weight Index was roughly keeping pace with the S&P 500 leading up to 2022. But as mega-cap tech stocks recovered in late 2022 and early 2023, the S&P 500 began distancing itself -- crushing the Equal Weight over the last three or so years.

Data by YCharts.

The outperformance of the S&P 500 relative to the Equal Weight has made it far more concentrated in just a handful of stocks. The concentration is even more pronounced in the Nasdaq-100, where the five largest companies by market cap (Nvidia, Microsoft, Apple, Amazon, and Alphabet) account for a mind-numbing 55.4% of the index.

Justifiably expensive stocks

The more concentrated the broader indexes become, the more aware investors should be when buying and holding index funds. Another risk worth monitoring is duplicated holdings. If you have sizable individual stock holdings in some of the largest S&P 500 stocks, then buying an index fund is going to give you more exposure to those names and could give you less diversification than you may have intended.

As stock prices of large names have outpaced earnings growth, the S&P 500 has become a lot more expensive than its historical average valuation -- which will put pressure on those companies to deliver on expectations. The good news is that many of these stocks can support their expensive valuations with solid earnings growth, high free cash flow, and operating margins.

Nvidia, Microsoft, Apple, Amazon, and Alphabet have completely different business models. But a shared quality among all these companies is that they have more cash, cash equivalents, and marketable securities than long-term debt on their balance sheets.

All five companies are supporting their accelerated spending with cash flow rather than taking on leverage that would deteriorate their financial health. So, while the boom in artificial intelligence is leading to lofty valuations in certain pockets of the market, the run-up in mega-cap names is justified because these companies have the balance sheets and business models needed to take risks.

The same argument applies to other massive companies -- like the stability and diversification of the big banks like JPMorgan Chase, the high margins and cash flow of Visa and Mastercard, or even the high-quality oil and gas and refining portfolio of ExxonMobil that has allowed the company to boost its dividend for 42 consecutive years, regardless of gluts in the industry.

Take risks into account when navigating today's concentrated market

With a few exceptions, the top 20 S&P 500 components are going up because they are accelerating earnings growth, and investors are willing to pay higher prices for these stocks as they become higher quality. Paying an expensive price for a great company is a far more reasonable decision than betting big on unproven or unprofitable companies that need everything to go right to meet lofty expectations.

In sum, the S&P 500's concentration isn't inherently bad, but it does mean that the index is much less diversified than it used to be. So, investors should take caution when buying index-linked products and expect the index to be more volatile. Sell-offs in even a few key holdings could drag down the index, even if the vast majority of S&P 500 stocks are doing just fine.

Should you invest $1,000 in S&P 500 Index right now?

Before you buy stock in S&P 500 Index, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and S&P 500 Index wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $599,785!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,165,716!*

Now, it’s worth noting Stock Advisor’s total average return is 1,035% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 17, 2025

JPMorgan Chase is an advertising partner of Motley Fool Money. Daniel Foelber has positions in Nvidia. The Motley Fool has positions in and recommends AbbVie, Alphabet, Amazon, Apple, Berkshire Hathaway, JPMorgan Chase, Mastercard, Meta Platforms, Microsoft, Netflix, Nvidia, Oracle, Palantir Technologies, Tesla, Visa, and Walmart. The Motley Fool recommends Broadcom and Johnson & Johnson and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.