Is Constellation Energy Stock a Buy Now?

Key Points

Constellation Energy is the largest owner and operator of nuclear power plants in the United States.

Nuclear power is experiencing a renaissance today, with demand for the carbon-free power strong.

While Constellation's business looks promising, its stock already reflects a lot of the good news.

- 10 stocks we like better than Constellation Energy ›

Constellation Energy (NASDAQ: CEG) is not your typical utility company. Not only does it sell power outside of the regulated framework under which most utilities operate, but it is also the largest nuclear power provider in the United States. But is the stock worth buying?

That depends on what you think the future of nuclear power will be. Here are some things to consider before you add Constellation Energy to your portfolio.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

What does Constellation Energy do?

Regulated utilities sell power to customers within a set area. They are granted monopolies in those areas, but they are subject to government approval of their rates and capital investment plans. Given the cost of building a utility business, this is a fair trade-off for all parties involved, including the utility, its customers, and its investors. Slow and steady growth is the norm for regulated utilities.

Image source: Getty Images.

Constellation Energy isn't a regulated utility. It sells power to customers under long-term contracts and must compete on the open market. If demand for electricity is high, leading to high power prices, that can be a very positive position to be in. However, if demand is low, resulting in low power prices, being an independent power producer can be challenging. If you are looking for a boring dividend stock, Constellation Energy will be a bad fit for your portfolio. A regulated utility would be a better choice.

One thing that sets Constellation Energy apart from the broader utility sector is its large portfolio of nuclear power plants. Nuclear power is always-on (base-load power, in industry jargon) clean energy, since it doesn't emit greenhouse gases. That makes it a very good complement to intermittent renewable power options, such as solar and wind. With electricity demand rising thanks to data centers and the power-hungry artificial intelligence (AI) computers they increasingly house, nuclear power is in high demand today.

If you're looking for a "picks and shovels" play on AI infrastructure, Constellation Energy is an interesting option. Notably, it has agreements to supply the U.S. government, Meta Platforms, and Microsoft with nuclear power. But before you jump on this story, you need to consider the price you are paying to get in the door.

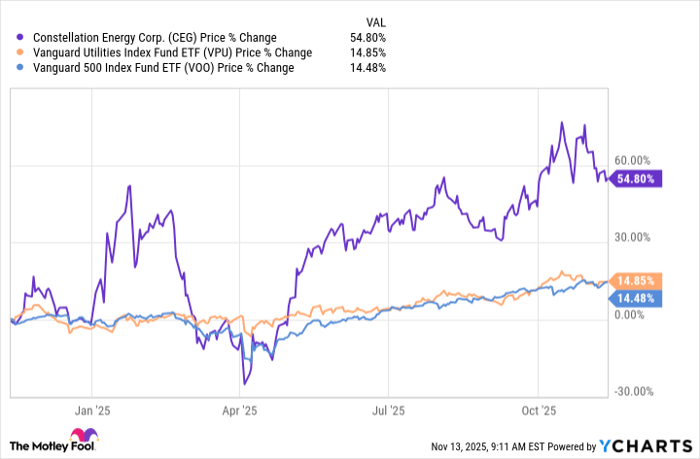

CEG data by YCharts

Constellation Energy has had a good run

The story behind Constellation Energy is exciting, but Wall Street is well aware of that story. That's evidenced by the nearly 55% price advance the stock has experienced over the past year. By comparison, the S&P 500 index is up 14% and the average utility, using Vanguard Utilities Index ETF as an industry proxy, is up about 14%, too. Constellation Energy is acquiring Calpine, which probably adds to the excitement around the stock, but the real driver right now is the nuclear power connection.

The stock's price advance has had a big impact on its valuation. There isn't much history to go on, as Constellation Energy underwent a major restructuring a few years ago. However, the current price-to-earnings ratio is 40.5, and the price-to-book value ratio is 7.7. Those are both high on an absolute basis. They are numbers you would expect from a growth stock, not a utility. The average P/E for Vanguard Utilities Index ETF is just 22, with the average P/B ratio sitting at 2.4.

Essentially, investors have factored in a substantial amount of positive news. If Constellation Energy fails to meet Wall Street's lofty expectations, it is highly likely that the stock will fall back down to Earth. To highlight the extreme valuation, Vanguard Information Technology Index ETF has an average P/E ratio of just over 41. And while the exchange-traded fund's average P/B ratio is a bit higher at 9, Constellation Energy's P/B ratio is much closer to that than to the P/B ratio of the average utility.

Constellation Energy is not a tech stock

So Constellation Energy is being priced like a technology stock, even though it is much more similar to a utility than a tech company. Sure, the nuclear power angle is exciting, but it seems as if that aspect of the story has already been factored into the stock price. Unless you strongly believe that nuclear power demand will continue to rise dramatically, Constellation Energy is probably best added to the wish list rather than the buy list.

Should you invest $1,000 in Constellation Energy right now?

Before you buy stock in Constellation Energy, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Constellation Energy wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $599,785!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,165,716!*

Now, it’s worth noting Stock Advisor’s total average return is 1,035% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 17, 2025

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Constellation Energy, Meta Platforms, and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.