The Smartest Growth Stock to Buy With $100 Right Now

Key Points

Marvell Technology stock has underperformed the broader market so far this year, but that's good news for investors.

Marvell's incredible growth and sunny prospects should infuse life into the stock.

The company is sitting on a huge revenue opportunity that should help it sustain impressive growth levels in the long run.

- 10 stocks we like better than Marvell Technology ›

Growth stocks give investors an opportunity to achieve market-beating returns. That isn't surprising, as fast-growing companies have the ability to increase their top and bottom lines at much faster rates when compared to the broader market.

So growth stocks provide an ideal investment avenue for investors looking to generate big capital gains. That's why we are going to take a closer look at Marvell Technology (NASDAQ: MRVL). Shares of the chip designer have lost over 17% of their value in 2025 as of this writing. As a result, each share of the company is now trading at less than $100.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

If you have $100 in investible cash and you're looking to buy a growth stock with that money, it would be a good idea to buy one share of Marvell with it. Let's look at the reasons why.

Image source: Getty Images.

Marvell Technology is growing at a breathtaking pace

Though shares of Marvell may have been underperforming this year, there is no denying that the company's growth is nothing short of incredible. Its revenue in the first six months of the ongoing fiscal year 2026 has increased by an impressive 60% from the year-ago period. Its adjusted earnings, on the other hand, have jumped nearly 1.4x during this period to $1.29 per share.

The data center business has been the driving force behind this outstanding performance, as it accounts for almost three-fourths of Marvell's top line. The company's data center business has been on fire due to artificial intelligence (AI). Marvell designs application-specific integrated circuits (ASICs) that are now gaining healthy traction in AI data centers, thanks to the advantages they enjoy over graphics processing units (GPUs).

These ASICs are custom processors designed to perform specific tasks. As a result, they can perform those tasks faster while keeping a check on power consumption. This explains why the deployment of custom AI processors by cloud service providers is expected to overtake that of GPUs next year.

According to market research firm TrendForce, the deployment of ASICs developed in-house by hyperscalers is expected to increase by almost 45%. That's well above the 16% projected increase in the deployment of GPUs by cloud service providers next year. Not surprisingly, Marvell has been witnessing solid expansion in its custom AI chip programs.

The company reportedly designs custom AI processors for Microsoft and Amazon already, which is the reason why it has been seeing remarkable growth in the data center business. The good part is that the potential opportunity for Marvell in custom AI chips is expanding at a terrific pace. The company is currently developing 18 chips for the top four hyperscalers in the U.S., along with emerging hyperscalers.

Looking ahead, Marvell now sees more than 50 opportunities in the custom AI chip market across more than 10 customers. The company estimates that these opportunities could translate into lifetime revenue of $75 billion. That's a huge number, considering that Marvell's revenue in the trailing 12 months stands at $7.2 billion.

Importantly, Marvell's management suggested on its August earnings call that it is indeed turning the potential opportunities into actual business. In the words of CEO Matt Murphy:

Since our event in June, our team has won additional sockets, adding to the 18 sockets we had already discussed.

Collectively, these new wins represent multibillion dollar lifetime revenue potential and we remain deeply engaged in advanced architectural discussions of many of the opportunities still in the funnel.

As such, don't be surprised to see Marvell sustaining its outstanding growth levels in the long run, and handily beating Wall Street's growth expectations.

A simple reason why this stock can be a long-term winner

We have already seen how rapidly Marvell has been growing. Consensus estimates are projecting the company to end fiscal 2026 with a 41% increase in revenue to $8.1 billion. Additionally, its earnings are estimated to increase by an impressive 78% to $2.80 per share. That's well above the 10% growth that the S&P 500 index companies are expected to deliver.

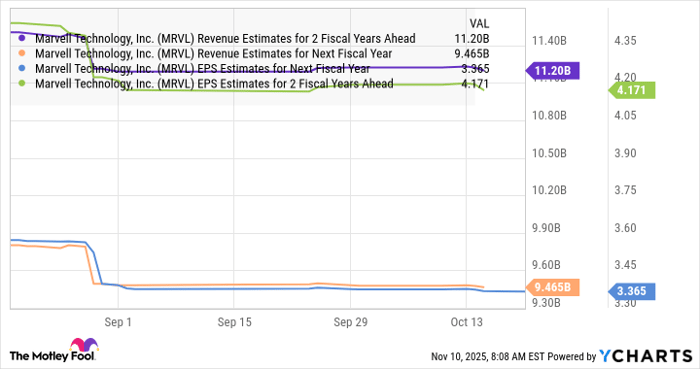

However, analysts' estimates for the next couple of years point toward a slowdown in both its revenue and earnings growth.

MRVL Revenue Estimates for 2 Fiscal Years Ahead data by YCharts. EPS = earnings per share.

But that's unlikely to be the case. Marvell is sitting on a massive opportunity in custom AI chips, and its expanding customer pipeline suggests that it has the ability to win a bigger share of this market. As a result, there is a solid chance of this semiconductor stock outperforming Wall Street expectations going forward.

That should encourage the market to reward Marvell with a richer valuation. It is trading at 22 times earnings right now, which is a discount to the S&P 500 index's average price-to-earnings ratio of 26. Since Marvell is growing at a much faster pace than the S&P 500, and it has the potential to keep up that momentum, it could eventually trade at higher multiples.

What this means is that investors are getting their hands on a solid growth stock at an attractive valuation right now. That's why, if you have $100 to spare, buying a share of Marvell Technology could turn out to be a smart move, as its impressive growth should ideally result in solid gains on the market.

Should you invest $1,000 in Marvell Technology right now?

Before you buy stock in Marvell Technology, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Marvell Technology wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $612,872!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,184,044!*

Now, it’s worth noting Stock Advisor’s total average return is 1,062% — a market-crushing outperformance compared to 194% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 10, 2025

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon and Microsoft. The Motley Fool recommends Marvell Technology and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.