You Can Outperform Around 90% of Professional Fund Managers by Using This Simple Investment Strategy

Key Points

In a recent 30-year study, nine out of 10 funds underperformed the S&P 500 index.

These funds traded positions frequently, and that clue can lead investors to discover the secret to outperforming professional money managers.

- 10 stocks we like better than Vanguard S&P 500 ETF ›

Can amateur investors outperform professionals? As unlikely as it may sound, the data is in the amateurs' favor.

S&P Global is a top company tracking the performance of professional investors. In September, the company published its biannual SPIVA (S&P Indices vs. Active) report. It showed that over the last 20 years, only 9% of actively-managed large-cap funds outperformed the S&P 500.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

In other words, there are professionals who spend their days buying and selling stocks for their funds. But over the long haul, the investors in roughly 91% of these funds would have been better off just passively investing in an S&P 500 index fund like the Vanguard S&P 500 ETF (NYSEMKT: VOO) and calling it a day.

But if the professionals can't beat the S&P 500, what hope is there for the average retail investor? Well, they have one simple investing strategy at their disposal that can lift their returns.

Doing the opposite of the professionals

From 1991 through 2020, the average annual turnover rate for U.S. large-cap mutual funds was 73%, according to a 2021 study by Gene Hochachka of Frontier Financial. This means large-cap funds saw significant buying and selling activity each year. Based on the average turnover rate, a fund with $100 million in assets would make $73 million worth of trades in a single year.

With many funds changing their positions frequently and the large majority of funds also underperforming the S&P 500, the takeaway is clear: Increased trading frequency is associated with weaker long-term returns. This is true even for people who make investing their profession.

Therefore, "amateur" investors can outperform the professionals by doing just the opposite: buy stocks and hold them.

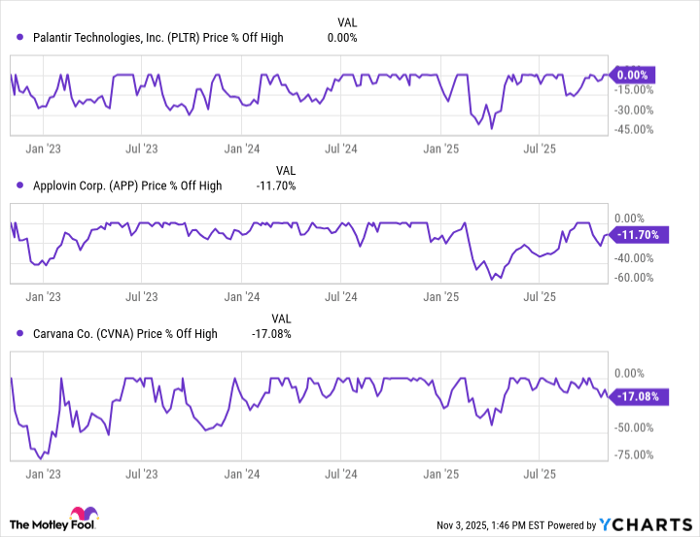

Can it really be this simple? Take three of the best-performing stocks over the last three years as an example: Palantir, AppLovin, and Carvana. All three are up 2,000% or more in just the last three years, leading to outstanding returns for those who bought and held through significant volatility.

As the chart below shows, Palantir stock has dropped 15% or more about half a dozen times since late 2022. For its part, AppLovin stock has dropped 40% or more twice. Carvana stock has done this three times.

Data by YCharts.

Logically, buying the dips and selling the highs would lead to better returns, but successfully timing such entries and exits is incredibly difficult as demonstrated by the weak track record of professional fund managers.

Why do professionals have high turnover rates?

If buying and holding is a better strategy than actively trading, then why don't professional fund managers do it? Aren't they smart enough to know this is a better strategy?

The most likely answer is yes. But as winners become large parts of a fund, managers will often trim these positions to rebalance the overall portfolio -- they want to avoid concentration. And this constant rebalancing contributes to the underperformance.

It may be how professionals manage funds, but regular investors don't have to play by those rules. They can and should hold onto their winners.

As investing great Charlie Munger said, "Life is not just bathing you in unlimited opportunities, even if you work at being able to find them and seize them." His point is that the relatively few life-changing investment opportunities are extremely consequential to lifetime returns.

Fellow investing great Peter Lynch had this to say: "Some people automatically sell the 'winners' -- stocks that go up -- and hold on to their 'losers' -- stocks that go down -- which is about as sensible as pulling out the flowers and watering the weeds."

This is why the Motley Fool Investment Philosophy suggests holding stocks for at least five years and suggests letting winners run. The stocks that offer life-changing returns will be relatively rare, so it's important not to sell them prematurely -- they lift overall portfolio performance dramatically and offset many losing investments.

It doesn't need to be complicated. Investors can outperform Wall Street professionals by buying shares of high-quality companies and then simply holding on. Not every position will be profitable, but this philosophy of holding winners long term can lead to returns that are better than many of the top actively-managed investment funds out there.

Should you invest $1,000 in Vanguard S&P 500 ETF right now?

Before you buy stock in Vanguard S&P 500 ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard S&P 500 ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $595,194!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,153,334!*

Now, it’s worth noting Stock Advisor’s total average return is 1,036% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 3, 2025

Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Palantir Technologies, S&P Global, and Vanguard S&P 500 ETF. The Motley Fool has a disclosure policy.