Why Serve Robotics Stock Climbed 14% in October

Key Points

Serve Robotics expanded into Chicago.

The company signed a strategic partnership with DoorDash, launching first in LA.

However, a $100 million stock offering pushed shares lower.

- 10 stocks we like better than Serve Robotics ›

Shares of Serve Robotics (NASDAQ: SERV) were moving higher last month after the maker of restaurant-delivery robots passed a milestone, deployed its 1,000th delivery robot, launched its robots in Chicago, and announced a multiyear partnership with DoorDash.

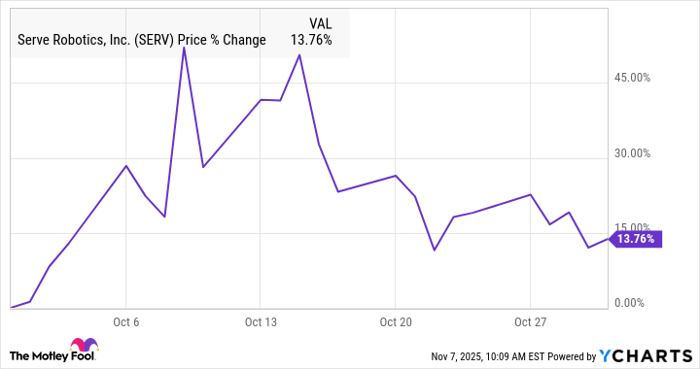

According to data from S&P Global Market Intelligence, the stock finished the month up 14% on the news. As you can see from the chart, it was another volatile month for Serve Robotics, but the gains in the first half of the month, led by those news items, were enough to push the stock up double digits in October.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

SERV data by YCharts

Serve Robotics gets a boost

On the last day of September, Serve Robotics launched its service in the Chicago metro area, marking its first entry into the Midwest.

Chicago marked the fifth market that Serve has entered, and it launched in 14 neighborhoods in Chicago.

The development-stage company, which is still earning minimal revenue, gave investors more good news on Oct. 6, saying it had deployed its 1,000th third-generation robot, and it said it was on track to have 2,000 active robots by the end of the year.

Finally, the biggest news for the company came on Oct. 9, as it announced a new partnership with DoorDash. The partnership will start in Los Angeles and will expand to other cities over time. DoorDash joins Uber Eats as a partner of Serve Robotics, showing that the company is working closely with the top two restaurant delivery apps in the country.

The stock jumped 29% on that news; however, it gave back much of those gains when it announced a $100 million direct stock offering the next day. Shares fell 16% on the news, as investors tend to dislike share dilutions. Serve said it would use the money for general corporate purposes, including working capital.

Over the rest of the month, the stock remained volatile, though there was no major news on Serve. Northland raised its price target on the stock from $23 to $26 and reiterated its outperform rating, noting the new partnership with DoorDash as well as multiple expansion in physical AI. The stock gained on that report on Oct. 13.

Image source: Serve Robotics.

What's next for Serve Robotics?

Serve is still bringing in less than $1 million in revenue a quarter, and it finished the second quarter with $116.7 million, showing why the company decided to raise another $100 million last month.

The company is growing quickly, with delivery volume growth up 80% quarter over quarter, but it's still a long way from generating material revenue.

The DoorDash partnership is certainly a step in the right direction toward that goal.

Should you invest $1,000 in Serve Robotics right now?

Before you buy stock in Serve Robotics, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Serve Robotics wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $591,613!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,152,905!*

Now, it’s worth noting Stock Advisor’s total average return is 1,034% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 3, 2025

Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends DoorDash, Serve Robotics, and Uber Technologies. The Motley Fool has a disclosure policy.