OpenAI CEO Sam Altman Just Delivered Fantastic News to Amazon Investors

Key Points

Over the last several months, OpenAI migrated away from a heavy reliance on Microsoft Azure.

The ChatGPT maker previously signed large-scale deals with Google Cloud and Oracle's cloud infrastructure.

With Amazon as its latest partner, OpenAI now leverages each of the major cloud hyperscalers.

- 10 stocks we like better than Amazon ›

Some people have a natural draw to the spotlight. In the investment world, personalities like JPMorgan Chase CEO Jamie Dimon can move markets based on a single comment during an interview. Tesla CEO Elon Musk can influence investor sentiment with one post on social media.

When it comes to artificial intelligence (AI), perhaps no one commands more attention than Sam Altman, the CEO of ChatGPT maker OpenAI. On Nov. 3, OpenAI announced a headline-grabbing $38 billion partnership with e-commerce and cloud titan Amazon (NASDAQ: AMZN).

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Let's unpack how this deal benefits both companies, and assess why it marks such strategic importance as investment in AI infrastructure continues to accelerate.

Amazon is leader of the cloud hyperscalers

According to data compiled by Statista, Amazon Web Services (AWS) is the largest cloud infrastructure provider -- boasting 30% market share as of the end of the second quarter. Trailing AWS are Microsoft Azure and Google Cloud Platform (GCP), which hold 20% and 13% market share, respectively.

Image source: Getty Images.

OpenAI and Amazon are deepening their relationship

Following the commercial launch of ChatGPT in November 2022, OpenAI became closely tied to the Microsoft Azure platform through a multi-billion-dollar investment in the company by the Windows developer.

However, Altman has been on a mission throughout 2025 to forge collaborations with alternative cloud providers. Over the summer, OpenAI expanded its reach by partnering with Alphabet's GCP. The company also leverages Oracle's cloud infrastructure services.

The strategic rationale behind these deals is simple: AI developers are seeking to diversify their compute protocols in an effort to reduce reliance on a single capacity provider. One of OpenAI's most direct rivals, Anthropic, is employing a similar playbook. It recently signed a massive contract with Google Cloud, signaling a migration away from AWS.

Earlier this year, some of OpenAI's models onboarded to Amazon Bedrock. Given the success of this deployment, OpenAI is doubling down on its relationship with AWS -- this time committing $38 billion worth of infrastructure spending.

Per the structure of the deal, OpenAI will access hundreds of thousands of clusters of Nvidia GB200 and GB300 chips from AWS. By teaming up with Amazon, OpenAI now has the support of all three major cloud hyperscalers to accelerate its training and inferencing workloads.

Image source: Getty Images.

Is Amazon stock a buy right now?

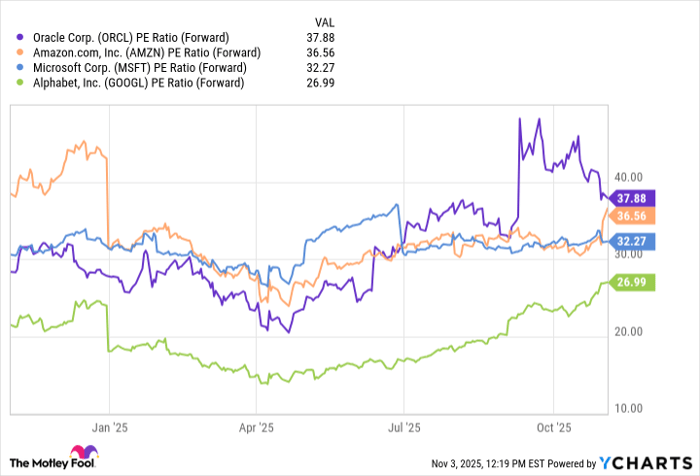

The chart below illustrates the forward price-to-earnings (P/E) ratios among major cloud providers. At first glance, Amazon's forward P/E of 36 might suggest that the stock is trading for a premium. However, a closer look reveals a more nuanced story.

ORCL PE Ratio (Forward) data by YCharts.

During the first few months of the year, Amazon's valuation contracted sharply fueled by concerns over how President Donald Trump's new tariff policies would affect the company's e-commerce business.

During this period, Microsoft boasted the highest multiple in this group. More recently, however, investor sentiment has shifted toward Oracle, Alphabet, and Amazon, driving noticeable valuation expansion across all three. Meanwhile, Microsoft contracted around July and has remained relatively flat ever since.

What is driving these dynamics? In my eyes, it all traces back to Altman and the OpenAI CEO's actions to deepen ties with other hyperscalers and steadily diversify the company's capacity needs beyond Microsoft.

I think the $38 billion deal with OpenAI positions Amazon to strengthen its competitive advantages against the likes of Google Cloud and Azure, potentially fueling accelerated earnings growth amid the AI infrastructure boom.

Amazon's current setup looks compelling as it sits at a unique juncture between growth and value. Investors with a long-term time horizon could use Amazon as a blue chip, buy-and-hold opportunity before the company's AI ambitions kick into full gear.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $593,269!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,268,146!*

Now, it’s worth noting Stock Advisor’s total average return is 1,076% — a market-crushing outperformance compared to 195% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 3, 2025

JPMorgan Chase is an advertising partner of Motley Fool Money. Adam Spatacco has positions in Alphabet, Amazon, Microsoft, Nvidia, and Tesla. The Motley Fool has positions in and recommends Alphabet, Amazon, JPMorgan Chase, Microsoft, Nvidia, Oracle, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.