Are Bitcoin Treasury Companies Like Strategy a Better Investment Than the Coin Itself?

Key Points

Strategy borrowed $1.4 billion in March 2024 to buy more Bitcoin, sending its stock up 170% while Bitcoin "only" rose by 64%.

Strategy's debt-fueled Bitcoin purchases create both opportunity and risk that direct Bitcoin ownership doesn't have.

- 10 stocks we like better than Strategy ›

There are several ways to invest in Bitcoin these days.

-

You can buy the coin itself, ensuring that your returns always match the cryptocurrency's actual price changes.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

-

You can grab a spot Bitcoin exchange-traded fund (ETF) such as iShares Bitcoin Trust, which does pretty much the same thing but in a more accessible way.

-

Bitcoin mining stocks generally follow the underlying Bitcoin trends, but with an added layer of risk and opportunity. The mining operation isn't cheap, but companies like MARA Holdings and Riot Platforms can accelerate your returns by making active investments in their mining business.

-

Or you can go all out with a dedicated Bitcoin treasury stock, whose management invests pretty much every available dollar in more Bitcoin. The best example of this all-in tactic is Strategy Inc (NASDAQ: MSTR), formerly known as MicroStrategy.

Can a wholehearted Bitcoin treasury stock produce better shareholder returns than Bitcoin itself, though? Let's take a look at a few possible scenarios.

Image source: Getty Images.

Strategy matched Bitcoin for three straight years

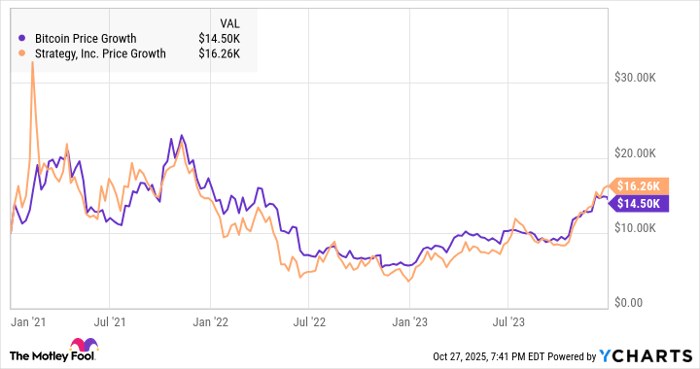

Past performance is no guarantee of future results, and these assets might react differently to future examples of yesteryear's market swings. I would still prefer looking at real-world examples than make up my own hypothetical test data, so let's look back at Strategy's relation to direct Bitcoin investments over the last few years. In the three-year period starting on Jan. 1, 2021, for example, I could barely tell them apart:

Bitcoin Price data by YCharts

Strategy's game-changing bet in 2024

Things changed in the spring of 2024, though. The company took on $1.4 billion of fresh debt in the span of one week, invested all of it in more Bitcoin, and boosted its digital holdings from 190,000 to 214,400 coins. Bitcoin prices were on the upswing at the time, rising 64% in the first three months of the year. Investors lapped it up and sent Strategy's stock 170% higher in the same period.

Another surge followed in November, inspired by the presidential election results. Anything Bitcoin-related soared that month, and leveraged bets like Strategy jumped even higher.

Strategy's stock has been a mixed bag since then, occasionally outracing Bitcoin or giving back some of its outperformance. It all adds up to a comparable pair of price performances -- but at the new, loftier level Strategy reached in 2024.

Making sense of this leveraged Bitcoin play

So Strategy's stock has a history of outperforming Bitcoin under some circumstances, but it didn't amplify the cryptocurrency's volatility in the last crypto winter. If these patterns hold true in the long run, Strategy might be a surprisingly low-risk way to invest in the Bitcoin phenomenon.

However, the debt-leveraged coin buys and political enthusiasm that lifted Strategy this high could also evaporate at some point, removing important support pillars from the stock chart.

In the long run, owning Strategy is a riskier method than simply buying Bitcoin or a spot-price ETF. Be prepared for extreme volatility in future market swings -- both the bullish and bearish types.

Should you invest $1,000 in Strategy right now?

Before you buy stock in Strategy, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Strategy wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $590,287!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,173,807!*

Now, it’s worth noting Stock Advisor’s total average return is 1,047% — a market-crushing outperformance compared to 195% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of October 27, 2025

Anders Bylund has positions in Bitcoin, MARA Holdings, and iShares Bitcoin Trust. The Motley Fool has positions in and recommends Bitcoin and iShares Bitcoin Trust. The Motley Fool has a disclosure policy.