Is This the Best Artificial Intelligence (AI) Stock to Buy Right Now?

Key Points

Nvidia is still the primary computing option AI hyperscalers turn to.

Nvidia's stock is far cheaper than some of its peers that haven't produced the strong results Nvidia has already delivered.

- 10 stocks we like better than Nvidia ›

The topic of the "best" artificial intelligence (AI) stock to buy right now is a spirited debate. One may advocate for companies building AI software, while another may be a proponent of rising stars like AMD (NASDAQ: AMD) and Broadcom (NASDAQ: AVGO) after their OpenAI partnership announcement.

There's also a case to be made for a microchip manufacturer like Taiwan Semiconductor Manufacturing (NYSE: TSM). However, the gold standard of AI investing since the AI race began in 2023 has been Nvidia (NASDAQ: NVDA).

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Nvidia is still the dominant player in the artificial intelligence computing realm. But is it still the best AI investment option right now?

Let's take a look, as the answer may surprise you.

Image source: Getty Images.

Nvidia is still far ahead of the competition

Faith in Nvidia has been shaken after OpenAI announced a partnership with rivals AMD and Broadcom. However, Nvidia still controls a large part of the data center computing market, as its graphics processing units (GPUs) are still the most popular option to train and run AI workloads. Although AMD has made improvements to its technology, many companies are already locked into the Nvidia ecosystem, and it could be difficult to switch over, leaving Nvidia as the top pick in this space.

Even if Nvidia loses some market share to its competition, the company will still be fine. Nvidia CEO and co-founder Jensen Huang discussed the massive and growing data center opportunity during the company's Q2 conference call. He claimed that global data center capital expenditures will total $600 billion in 2025, but that figure will rise to between $3 trillion and $4 trillion by 2030. That's monster growth, and if it occurs, there will be plenty of growth to go around between Nvidia, AMD, and Broadcom.

I still expect Nvidia to be dominant moving forward, but maybe not quite as dominant as it once was. This doesn't disrupt my overall investment thesis in the company, and there is still plenty of room for the stock to run.

Nvidia is still a top AI investment option

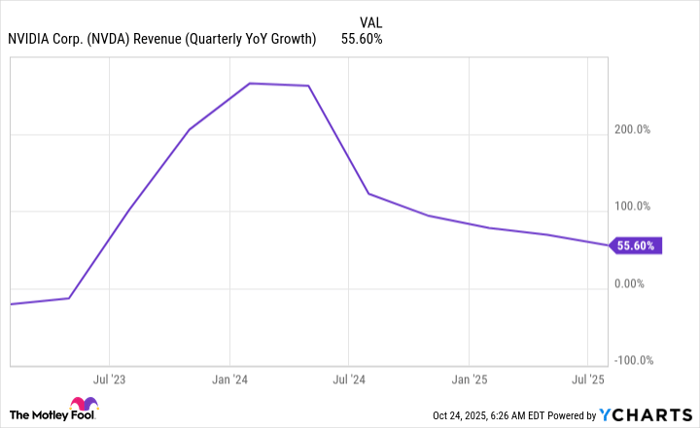

In the second quarter of fiscal year 2026 (ended July 27, 2025), Nvidia posted revenue growth of 56%, which is slower than in previous quarters.

NVDA Revenue (Quarterly YoY Growth) data by YCharts

However, I hesitate to call a 56% growth rate a slow one, even if the rate is slowing. Nvidia's revenue totaled $46.7 billion for the quarter, so this is still an incredible growth rate for its size. It also increased revenue 6% quarter over quarter, showing that demand is still rising.

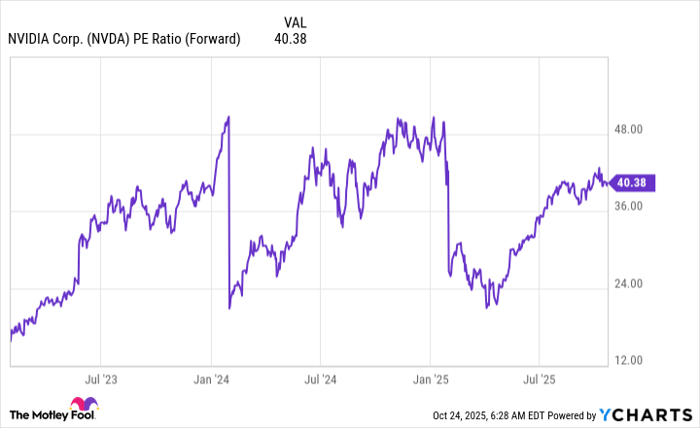

Even with its strong growth rate, Nvidia trades at 40 times forward earnings.

NVDA PE Ratio (Forward) data by YCharts

While I'm never going to claim that 40 times forward earnings is particularly cheap, it isn't a bad price to pay for a company growing as fast as Nvidia is, and which will likely continue that rate for years to come.

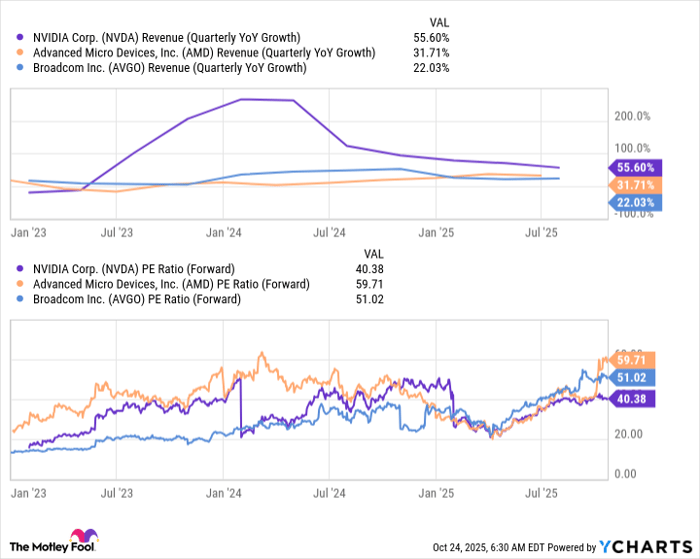

Furthermore, when you compare Nvidia's valuation to its peers, one thing becomes abundantly clear.

NVDA Revenue (Quarterly YoY Growth) data by YCharts

The competition has already baked in a ton of success that hasn't occurred. On the flip side, Nvidia is experiencing the success that the other two can only dream of, yet trades for a much lower multiple. This makes Nvidia's stock far less risky than the other two, giving it the title of the best AI stock to buy right now.

The AI world is filled with great investing opportunities, but sometimes the best idea is the one that has already been a winner. Nvidia still has a ton of room to run if the AI computing capacity buildout projections come true, and it will be a primary beneficiary of this once-in-a-decade opportunity.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $590,287!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,173,807!*

Now, it’s worth noting Stock Advisor’s total average return is 1,047% — a market-crushing outperformance compared to 195% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of October 27, 2025

Keithen Drury has positions in Broadcom, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends Advanced Micro Devices, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.