Prediction: This Artificial Intelligence (AI) Stock Is Going to Soar After Nov. 5

Key Points

Lemonade is an insurance technology company that uses AI to deliver a highly convenient customer experience.

Its revenue growth has accelerated for seven straight quarters, and its in-force premium recently crossed the $1 billion milestone.

Lemonade is scheduled to release its third-quarter operating results on Nov. 5, and the report could send its stock soaring.

- 10 stocks we like better than Lemonade ›

Nobody really enjoys dealing with their insurance company, especially when it's time to make a claim. Getting paid often involves several phone calls and a lengthy waiting period, which isn't ideal during an already stressful time. Lemonade (NYSE: LMND) is an insurance technology company on a mission to solve those pain points using artificial intelligence (AI).

Lemonade uses AI-powered chatbots to write quotes and process claims, and it also uses AI algorithms behind the scenes to price premiums more accurately. The company has an ambitious plan to grow its in-force premium -- which is the value of the premiums from all active policies -- tenfold over the next decade, which could translate to significant upside for its shareholders.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Lemonade stock is up 42% in 2025 so far. The company is scheduled to release its operating results for the third quarter (ended Sept. 30) on Nov. 5, and here's why I predict its stock will build on those gains following the report.

Image source: Getty Images.

Customers are loving the Lemonade experience

Lemonade operates in five insurance markets: renters insurance, homeowners insurance, pet insurance, life insurance, and car insurance. The company's Maya chatbot can write a quote in just 90 seconds via the Lemonade website, and AI Jim can process claims in under three minutes with no human intervention. In fact, AI Jim holds the record for the fastest-ever insurance payout, at just two seconds.

Therefore, it's no surprise people are flocking to Lemonade. The insurer had a record 2.7 million policyholders at the close of the second quarter (ended June 30), which was up 24% from the same period last year. That growth rate accelerated from 21% in the first quarter just three months earlier.

Lemonade's in-force premium also topped $1 billion in the second quarter for the first time ever, growing by 29% year over year. It was the seventh-straight quarter in which in-force premium growth accelerated, so the company is carrying some serious momentum. An even faster increase in the third quarter would be very bullish for Lemonade stock, so this is something investors should watch on Nov. 5.

The customer experience is just one area in which Lemonade is using AI to fuel its growth. The company developed a series of lifetime value models that analyze several traditional risk factors, but they also assess the likelihood of a customer making a claim, buying multiple policies, and even switching insurers. This allows Lemonade to charge highly accurate premiums, which not only lowers the company's risk but also saves each customer money.

Lemonade could deliver a strong third-quarter report

A soaring in-force premium is meaningless in isolation because insurers also have to limit their losses. Lemonade targets a gross loss ratio of 75%, which is the proportion of its in-force premium paid out as claims, and it came in at an even better level of 70% in the second quarter.

A growing in-force premium and a declining gross loss ratio equals more revenue. After excluding the premiums Lemonade paid forward to other insurers to reduce risk, its second-quarter revenue came in at $164.1 million, which was up 35% year over year. It comfortably beat management's forecast of $158 million.

In fact, Lemonade's momentum was so strong that management drastically increased its full-year revenue guidance for 2025 from $662 million to $712.5 million.

Wall Street analysts will be looking for third-quarter revenue of $185 million on Nov. 5 (according to Yahoo! Finance), which would represent another year-over-year increase of 35%. If the company beats that number, management might raise its 2025 guidance again, which would be very bullish for Lemonade stock.

Why Lemonade stock could soar after Nov. 5

Lemonade stock jumped 30% the day it reported its second-quarter operating results because of the company's better-than-expected revenue, its increased 2025 outlook, and its accelerating customer and in-force premium growth. If the company delivers a similar performance on Nov. 5, I would expect the stock to build on those gains, especially because it's still trading at a relatively attractive level.

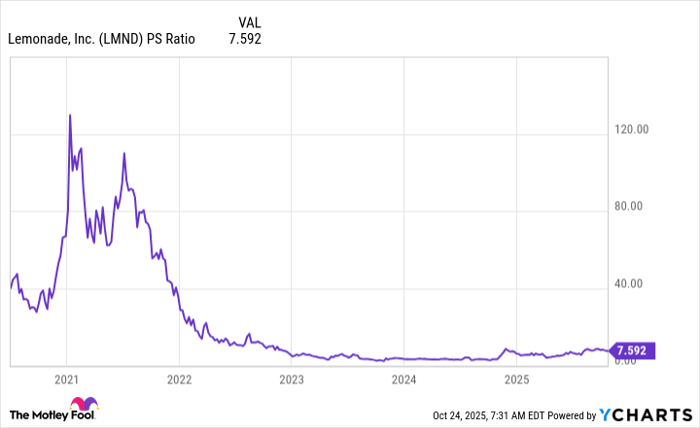

Lemonade stock remains 72% below its 2021 record high of $164, when a frenzy in the tech sector drove its valuation to an unsustainable level. Its price-to-sales (P/S) ratio is now just 7.5, which is a far more reasonable valuation than its peak P/S ratio of over 120 from a few years ago.

LMND PS Ratio data by YCharts

With all of that said, investors who buy Lemonade stock for the long term could reap the biggest rewards. As I touched on earlier, the company believes it can grow its in-force premium tenfold to $10 billion over the next decade or so, driven by its strong brand, exceptional customer experience, and a growing market share in high-value segments like car insurance.

Therefore, while Lemonade stock could certainly rocket higher after Nov. 5, the best returns could come over the next 10 years or so.

Should you invest $1,000 in Lemonade right now?

Before you buy stock in Lemonade, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Lemonade wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $590,357!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,141,748!*

Now, it’s worth noting Stock Advisor’s total average return is 1,033% — a market-crushing outperformance compared to 193% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of October 20, 2025

Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Lemonade. The Motley Fool has a disclosure policy.