Move Over, IonQ, Rigetti Computing, and D-Wave Quantum -- There's a Much Smarter Way to Invest in the Quantum Computing Revolution

Key Points

Shares of IonQ, Rigetti Computing, D-Wave Quantum, and Quantum Computing Inc. have surged by up to 2,720% over the trailing year.

Though quantum computing pure-play stocks are popular among investors, they're rife with historical red flags.

There's a far more "magnificent" way to gain exposure to the evolution of quantum computing without the outsize risk of pure-play stocks.

- 10 stocks we like better than IonQ ›

Over the last three years, the evolution of artificial intelligence (AI) has fueled the rally on Wall Street. However, AI isn't the only can't-miss trend that has investors eager to open their wallets and press the buy button in their brokerage accounts.

Arguably nothing has been hotter than quantum computing pure-play stocks in 2025. Shares of IonQ (NYSE: IONQ), Rigetti Computing (NASDAQ: RGTI), D-Wave Quantum (NYSE: QBTS), and Quantum Computing Inc. (NASDAQ: QUBT), have respectively skyrocketed higher by 276%, 2,720%, 2,150%, and 1,200% over the trailing 12-month period, as of the closing bell on Oct. 22.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

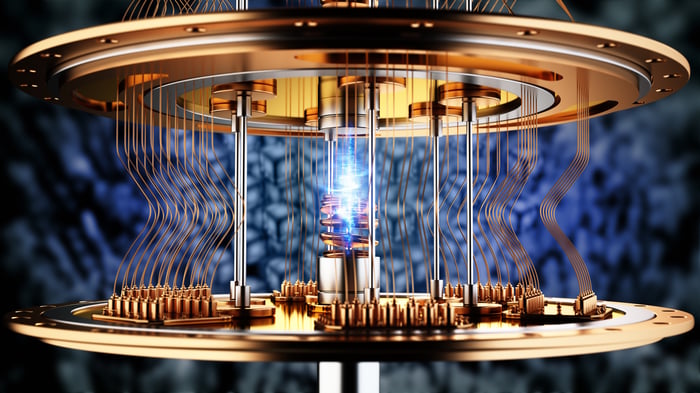

Quantum computing uses specialized computers and the theories of quantum mechanics to solve complex problems that existing computers aren't capable of solving. Quantum computers may have the ability to speed up AI algorithm learning capabilities, and can narrow down best courses of action for drug developers using molecular simulations, to name a few real-world applications.

Image source: Getty Images.

According to online publication The Quantum Insider, this technology could create $1 trillion in global economic value by 2035. A figure this large would support a long list of potential winners.

However, relying on Wall Street's pure-play quantum computing stocks may not be the smartest way to invest in the evolution of this technology. Instead, there's a far more "magnificent" way to gain exposure to quantum computing and safely grow your wealth.

Quantum computing pure-play stocks have well-defined shortcomings

While there have been bright spots for these quantum computing stocks, including IonQ and Rigetti having their respective computers used by Amazon (NASDAQ: AMZN) in its quantum cloud computing service known as Braket, there are far more headwinds than tailwinds for this quartet at the moment.

History might be the biggest hurdle IonQ, Rigetti, D-Wave, and Quantum Computing Inc. would need to overcome.

For more than 30 years, every game-changing technology or hyped innovation has worked its way through an early stage bubble-bursting event. From the internet to hyped innovations like 3D printing, blockchain technology, and the metaverse, investors have persistently overestimated how quickly consumers and/or businesses would adopt, utilize, and optimize a new technology. By overshooting, investors expose themselves -- and the leading stocks involved with these trends -- to eventual disappointment. Nothing suggests that quantum computing stocks will avoid this same fate.

Historical precedent also tells us that quantum computing stocks are richly valued. As of the closing bell on Oct. 22, their respective trailing 12-month (TTM) price-to-sales (P/S) ratios are:

- IonQ: 241

- Rigetti Computing: 1,154

- D-Wave Quantum: 313

- Quantum Computing Inc.: 7,013

For context, companies that led previous game-changing innovative trends often topped out with P/S ratios in the range of 30 to 40. No industry leader has ever been able to sustain a TTM P/S ratio of 30 for any extended period, let alone TTM P/S ratios ranging from 241 to north of 7,000!

With an unfavorable risk-versus-reward profile for IonQ, Rigetti, D-Wave, and Quantum Computing Inc., the smartest way to gain exposure to a coming quantum computing revolution is through the "Magnificent Seven."

Image source: Getty Images.

Ancillary exposure through the Mag 7 is a genius way to wager on quantum computing

Although the applications for quantum computers and quantum hardware are exciting, this is a technology that's a very long way from maturing. Aside from Amazon offering access to IonQ's and Rigetti's quantum computers through Braket on Amazon Web Services (AWS), and Microsoft (NASDAQ: MSFT) offering quantum services on its cloud infrastructure service platform via Azure Quantum, it's not clear if this technology is being adopted on any broad commercial scale.

Furthermore, there's not any clear evidence that quantum computing solutions are being optimized as of yet, or are helping businesses using these solutions generate a recurring profit. In other words, it can't be emphasized enough how early this technology is in the commercialization and evolutionary process.

While quantum computers evolve and become commercialized, IonQ, Rigetti Computing, D-Wave Quantum, and Quantum Computing Inc. are likely to lose money hand over fist. They'll also be issuing common stock and/or debt (if accessible) to bolster their balance sheets amid ongoing investments and operating losses.

In comparison, all members of the Magnificent Seven have established and well-defined competitive advantages -- sometimes in more than one industry. For example, Amazon is the undisputed leader in e-commerce, and the leader in global cloud infrastructure service spending with AWS. All members of the Mag 7 also have sizable piles of cash, cash equivalents, and marketable securities, and most are generating more cash from operations than they know what to do with.

When new technologies and game-changing innovations come along, Magnificent Seven businesses have demonstrated a desire to get their piece of the pie.

For instance, Meta Platforms (NASDAQ: META) has put tens of billions of dollars to work in the metaverse, which is the 3D virtual world where users can interact with each other and their surroundings. Meta CEO Mark Zuckerberg is well aware that these investments may not pay off for multiple years, given that the metaverse needs time to develop and mature. Meta is one of the few publicly traded companies with enough cash and operating cash flow to make these aggressive investments without hurting its bottom line or harming future innovation in other areas.

We've also witnessed Microsoft and Alphabet (NASDAQ: GOOGL)(NASDAQ: GOOG) introduce quantum computing chips. Last week, Alphabet confirmed that its Willow chip ran a quantum algorithm that operated 13,000 times faster than the quickest supercomputers on the planet. Meanwhile, Microsoft's Majorana 1 quantum processing unit was introduced in mid-February.

Though quantum hardware may be years away from generating meaningful revenue, Microsoft and Alphabet (along with other Mag 7 members) have plenty of other operating segments to grow their respective sales and profits in the meantime while investors wait.

Should you invest $1,000 in IonQ right now?

Before you buy stock in IonQ, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and IonQ wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $590,357!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,141,748!*

Now, it’s worth noting Stock Advisor’s total average return is 1,033% — a market-crushing outperformance compared to 193% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of October 20, 2025

Sean Williams has positions in Alphabet, Amazon, and Meta Platforms. The Motley Fool has positions in and recommends Alphabet, Amazon, Meta Platforms, and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.