3 Dividend Stocks to Double Up on Right Now

Key Points

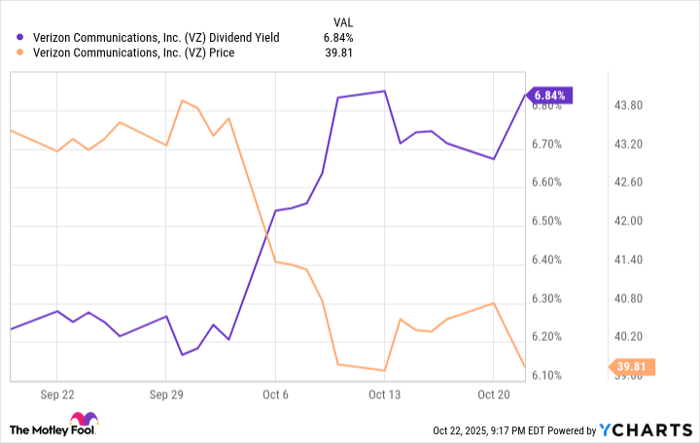

Verizon shares have slipped since a new CEO was announced, pumping up its already juicy dividend yield.

Realty Income is a REIT that takes great pride in its status as “The Monthly Dividend Company.”

Kimberly-Clark is a classic consumer staples stock and a Dividend King.

- 10 stocks we like better than Verizon Communications ›

In a relentless bull market, it can be tempting to overlook the wealth-building power of dividends. When high-flying growth stocks are the life of the party, dividend payers might seem like the equivalent of a cold shower. But history tells a different story.

From 1960 through 2024, reinvested dividends accounted for 85% of the S&P 500's cumulative total returns, according to a Hartford Funds report. Based solely on price appreciation of the benchmark index, a $10,000 investment in 1960 would be worth $982,000 by 2024. Factoring in reinvested dividends, that same investment would have produced total returns of $6.4 million.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

With interest rates headed lower and plenty of high-dividend stocks trading at attractive multiples, this could be a great time to add some income-producing companies to your portfolio -- or to double up on dividend payers you already own. Here are three that merit a closer look.

Image source: Getty Images

1. Verizon

Shares of Verizon Communications (NYSE: VZ) are down 8% since the telecom company announced that Dan Schulman will replace Hans Vestberg as CEO earlier this month. Because a company's stock price and dividend yield have an inverse relationship, the dip in the share price has pushed up Verizon's already juicy yield to just under 7%.

VZ Dividend Yield data by YCharts.

The abrupt C-suite transition has soured short-term investor sentiment, but this could be the perfect time to lock in that dividend rate. The company is coming off a strong second quarter in which revenue increased 5% to $34.5 billion and earnings per share (EPS) jumped 8% to $1.18.

Management also hiked its full-year guidance for adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA); adjusted EPS, and free cash flow. With a price-to-earnings ratio (P/E) of 9.3, the stock is trading at a substantial discount to the S&P 500 (at the time of this writing).

Verizon is a steady generator of free cash flow, with $8.8 billion in the first half of 2025. But consistent revenue and earnings growth has been a challenge in a hypercompetitive telecom market, and the stock has been going sideways for the past two years.

Schulman, the former CEO of PayPal Holdings, could be just what the doctor ordered. During his time at PayPal, the company tripled its revenue and added hundreds of millions of customers to its global payments platform.

2. Realty Income

All in on artificial intelligence (AI)? You might consider adding this monthly dividend payer for some exposure to income-producing commercial real estate.

Realty Income (NYSE: O) is a real estate investment trust (REIT), a special type of entity that invests in real estate and collects income from lease payments or interest. As of June 30, it owned 15,600 commercial properties, mostly in the retail sector, generating steady income from long-term lease agreements with tenants such as 7-Eleven, Dollar General, Tractor Supply, Wynn Resorts, and Walmart.

By law, REITs must distribute at least 90% of their taxable net income to shareholders through dividend payments, and Realty Income had paid nearly $17 billion in dividends since it was founded in 1969. In June, the company hiked its monthly dividend by 3.7% to $0.81 per month, its 111th consecutive quarterly dividend increase. Its yield is 5.3% on an annualized basis, compared to the S&P 500's yield of 1.2%.

Since Realty Income went public in 1994, the self-proclaimed "Monthly Dividend Company" has produced a compound annual return of 13.5%. If you're worried about the economy taking a turn for the worse -- or the AI bubble bursting -- this could be a port in the storm for your portfolio.

3. Kimberly-Clark

Kimberly-Clark (NASDAQ: KMB) might be the quintessential consumer staple stock. The company itself isn't a household name, but you're bound to find at least one of its products in your household -- whether it's Cottonelle toilet paper, Huggies diapers, or Kleenex tissues.

This is a time of transition for Kimberly-Clark. Over the past few years, the company has divested several business units, including the one that produces personal protective equipment in 2024.

Last year, it unveiled a transformation plan meant to accelerate innovation and "improve our growth trajectory, profitability, and returns on investment." During its second-quarter earnings call, CEO Michael Hsu said the company's vision of a "refreshed and refocused Kimberly-Clark" is starting to come to fruition.

One thing that hasn't changed is its status as a Dividend King. In August, it declared a quarterly dividend of $1.26 per share, which equates to a 4.2% yield on an annualized basis. The company has increased its payout for 53 consecutive years.

Shares trade at a P/E of 16.6, compared to the S&P 500 average of 27.9. While it could take some time to recalibrate expectations for the leaner and meaner Kimberly-Clark, the company's durable dividend provides a steady income stream as investors wait for the transformation plan to play out.

Should you invest $1,000 in Verizon Communications right now?

Before you buy stock in Verizon Communications, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Verizon Communications wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $590,357!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,141,748!*

Now, it’s worth noting Stock Advisor’s total average return is 1,033% — a market-crushing outperformance compared to 193% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of October 20, 2025

Josh Cable has positions in Verizon Communications. The Motley Fool has positions in and recommends PayPal, Realty Income, Tractor Supply, and Walmart. The Motley Fool recommends Verizon Communications and recommends the following options: long January 2027 $42.50 calls on PayPal, short December 2025 $75 calls on PayPal, and short October 2025 $60 calls on Tractor Supply. The Motley Fool has a disclosure policy.